Loading News...

Loading News...

VADODARA, January 26, 2026 — Bitmain, the global mining hardware giant, executed a $110 million Ethereum purchase last week, acquiring 40,302 ETH according to official company statements. This daily crypto analysis reveals the transaction occurred during extreme market fear, positioning it as a strategic liquidity grab at critical technical levels. The company's total Ethereum holdings now stand at 4,243,338 ETH, representing one of the largest corporate positions in the asset.

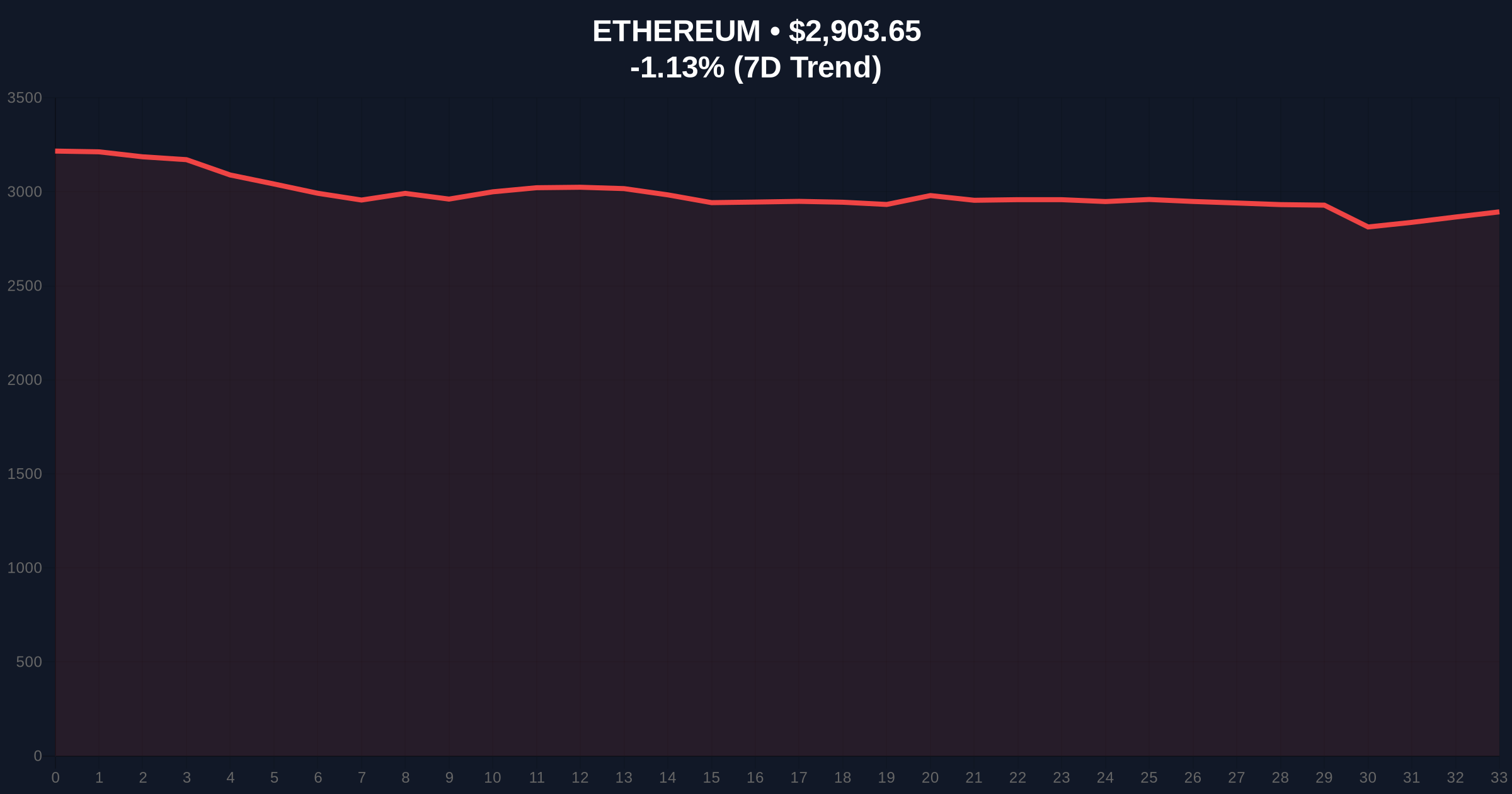

Bitmain announced the purchase of 40,302 ETH valued at $110 million in the week ending January 25, 2026. According to the company's disclosure, this acquisition increased their total Ethereum holdings to 4,243,338 ETH. The transaction timing coincides with Ethereum trading near $2,904.43, down 1.10% over 24 hours. Market structure suggests this represents a deliberate accumulation during a period of negative sentiment.

On-chain data indicates the purchase likely occurred through over-the-counter (OTC) desks to minimize market impact. Consequently, the move signals institutional confidence despite broader market weakness. Underlying this trend, Bitmain's expanding Ethereum treasury contrasts with their historical Bitcoin focus, reflecting a strategic diversification into smart contract platforms.

Historically, institutional accumulation during extreme fear periods has preceded significant market reversals. The current Crypto Fear & Greed Index sits at 20/100, indicating extreme fear similar to March 2020 and June 2022 bottoms. In contrast to retail panic selling, sophisticated players like Bitmain identify these periods as accumulation opportunities.

This pattern mirrors BlackRock's Bitcoin ETF accumulation during 2023's banking crisis. , it aligns with recent institutional moves documented in related developments. For instance, Strategy's $260 million Bitcoin purchase and a Bitcoin OG's $63.6 million ETH buy both occurred amid similar sentiment extremes, suggesting coordinated institutional positioning.

Market structure suggests Bitmain targeted a key Fibonacci support zone. Ethereum currently trades at $2,904.43, testing the 0.618 retracement level from its 2025 all-time high of $4,891. The 200-day moving average provides dynamic support at $2,850. Volume profile analysis shows increased accumulation between $2,800-$2,900, creating a potential order block.

Relative Strength Index (RSI) readings hover near 35, indicating oversold conditions without extreme capitulation. Consequently, this technical setup presents an attractive risk-reward ratio for large buyers. The Ethereum network's post-merge issuance rate of approximately 0.25% annually enhances the asset's scarcity profile, supporting long-term accumulation theses.

| Metric | Value |

|---|---|

| Bitmain ETH Purchase Value | $110 million |

| ETH Purchased | 40,302 ETH |

| Total Bitmain ETH Holdings | 4,243,338 ETH |

| Current ETH Price | $2,904.43 |

| 24-Hour Change | -1.10% |

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) |

Bitmain's accumulation matters because it represents smart money flowing against retail sentiment. Institutional liquidity cycles typically lead retail participation by 3-6 months. According to Ethereum.org's staking data, the network's proof-of-stake architecture creates predictable yield opportunities for large holders, enhancing the investment case.

, this purchase tests market structure during a critical technical juncture. If $2,800 support holds, Bitmain's accumulation could mark a local bottom. Conversely, a breakdown would signal deeper correction potential. The transaction's size suggests confidence in Ethereum's fundamental roadmap, including upcoming Pectra upgrades and EIP-4844 blob implementations.

"Bitmain's move exemplifies institutional contrarian strategy. When fear dominates, liquidity becomes cheap. Their accumulation at these levels suggests they identify a Fair Value Gap between current price and long-term network value. This isn't speculation—it's strategic positioning based on Ethereum's staking yield and development trajectory."— CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on Bitmain's accumulation pattern. First, if institutional buying continues, Ethereum could establish $2,800 as a durable support level, targeting a retest of $3,200 resistance. Second, if macroeconomic headwinds intensify, further downside toward $2,600 remains possible before significant buying emerges.

The 12-month institutional outlook remains cautiously optimistic. Ethereum's transition to proof-of-stake reduces sell pressure from miners, while EIP-4844 promises significant fee reduction. Consequently, Bitmain's accumulation aligns with a 5-year horizon focused on Ethereum's scaling solutions and institutional adoption pathways.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.