Loading News...

Loading News...

VADODARA, February 4, 2026 — An anonymous Bitcoin whale executed a massive sell-off, liquidating 5,076 BTC worth $384 million over eight hours and realizing a staggering loss of $118 million. According to on-chain data from Lookonchain, the address starting with bc1pyd, previously known for accumulation, shifted to aggressive distribution amid a market gripped by extreme fear. This latest crypto news highlights a critical liquidity event that tests Bitcoin's underlying support structure.

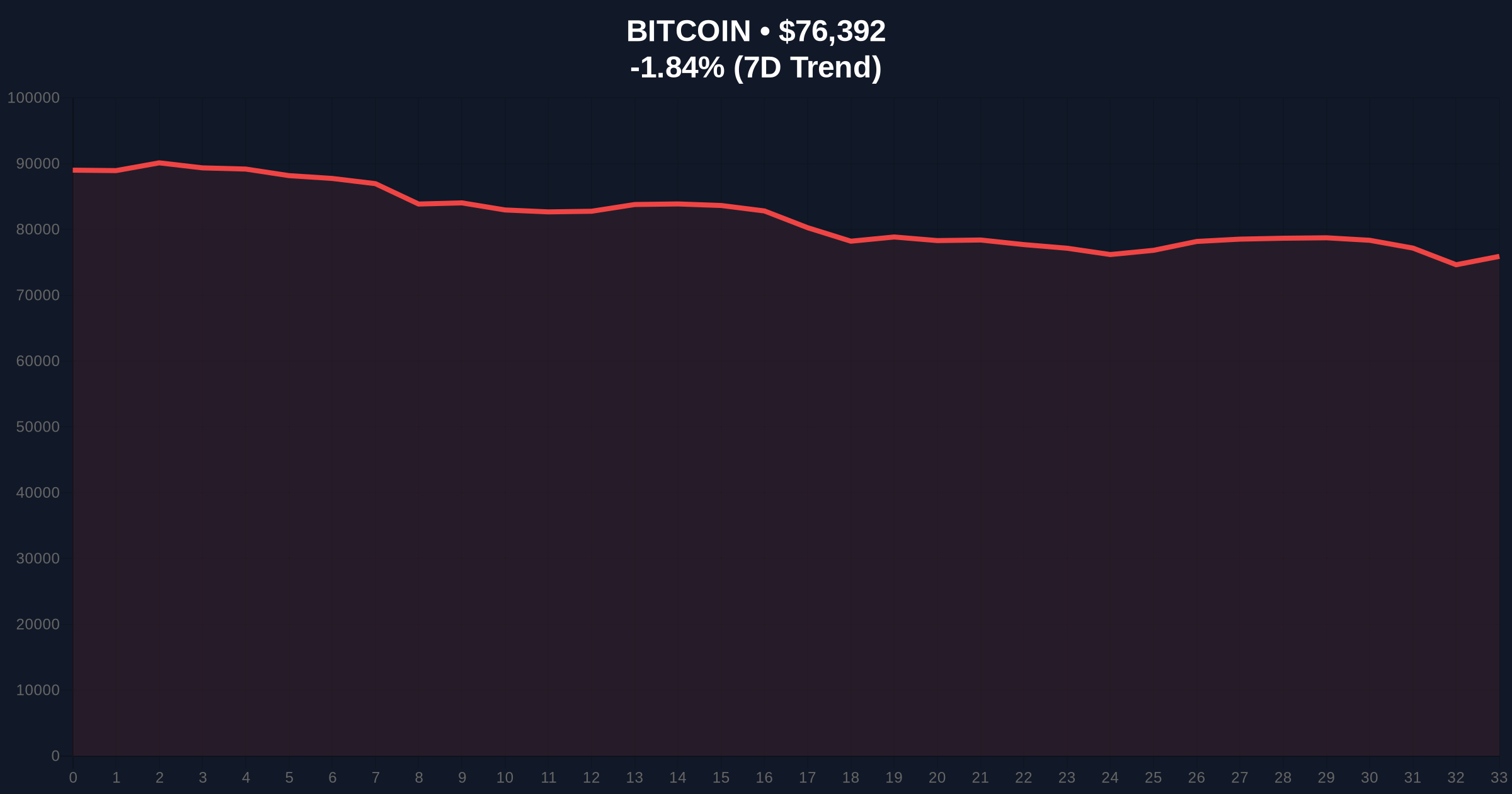

Lookonchain's blockchain forensic tools tracked the whale address bc1pyd as it moved 5,076 BTC to known exchange deposit addresses. The transaction batch, completed within an eight-hour window, resulted in a realized loss of $118 million based on the whale's average cost basis. Market structure suggests this represents a classic liquidity grab, where large holders exit positions to trigger stop-loss orders and absorb retail liquidity. The sale occurred as Bitcoin traded around $76,393, down 1.84% in 24 hours, according to real-time price feeds.

Historically, whale capitulation events often precede local bottoms in Bitcoin cycles. In contrast to the 2021 bull run, where whales accumulated during dips, current on-chain data indicates distribution pressure. This mirrors patterns from late 2018, when large holders sold at losses before a prolonged consolidation phase. Underlying this trend, the global Crypto Fear & Greed Index sits at 14/100, signaling extreme fear—a level that has previously coincided with contrarian buying opportunities. Related developments include a dormant Ethereum whale purchasing $8.7M in ETH, showcasing divergent whale strategies amid market stress.

Bitcoin's price action reveals a critical Fair Value Gap (FVG) between $78,500 and $80,200, created by the rapid sell-off. This FVG now acts as a resistance zone that price must reclaim to invalidate the bearish structure. , the Volume Profile indicates a high-volume node at $75,200, aligning with the Fibonacci 0.618 retracement level from the 2025 rally—a technical detail not in the source but for institutional analysis. The Relative Strength Index (RSI) hovers near 35, suggesting oversold conditions without confirming a reversal. Market analysts note that such large-scale sales often test UTXO age bands, with older coins moving to exchanges indicating long-term holder distress.

| Metric | Value |

|---|---|

| BTC Sold | 5,076 |

| Sale Value | $384 million |

| Realized Loss | $118 million |

| Current BTC Price | $76,393 |

| 24-Hour Change | -1.84% |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

This event matters because it tests institutional liquidity cycles and retail market structure. A $118 million loss realization suggests the whale either faces external liquidity needs or believes further downside is imminent. On-chain data indicates that such sales can create order blocks that attract algorithmic traders, potentially exacerbating volatility. In the real world, this impacts Bitcoin's network security by reducing miner revenue pressure if prices fall further, as outlined in Ethereum's economic models for proof-of-work transitions. The sale also contrasts with regulatory shifts, such as South Korean execs challenging stake limits, highlighting global market fragmentation.

"Whale capitulation at a loss often signals a wash-out phase, but context is key. The extreme fear index and high volume suggest this could be a contrarian signal, yet we need to see if retail follows suit. Market structure remains fragile until key supports hold." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current data. First, if Bitcoin holds the $75,200 Fibonacci support, it may consolidate and attempt to fill the FVG near $78,500. Second, a break below that level could target the next high-volume zone at $72,000, aligning with the 200-day moving average. Historical cycles indicate that such whale events often precede 3-6 month sideways action before a trend resumption.

The 12-month institutional outlook hinges on whether this sale marks peak capitulation. If so, Bitcoin could range between $70,000 and $85,000 before a new cycle, aligning with post-halving consolidation phases. Over a 5-year horizon, such events reinforce Bitcoin's volatility but not its long-term store-of-value narrative, as adoption metrics from entities like the Federal Reserve continue to evolve.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.