Loading News...

Loading News...

VADODARA, February 4, 2026 — An anonymous Ethereum whale, dormant for two years, executed a $8.74 million purchase of 4,020 ETH seven hours ago, according to on-chain analyst ai_9684xtpa. This latest crypto news event signals a high-conviction accumulation move during a period of extreme market fear, challenging the prevailing bearish narrative. The whale's historical discipline—holding through both a bear market trough at $1,522 and a bull peak at $4,461—adds weight to the transaction's significance.

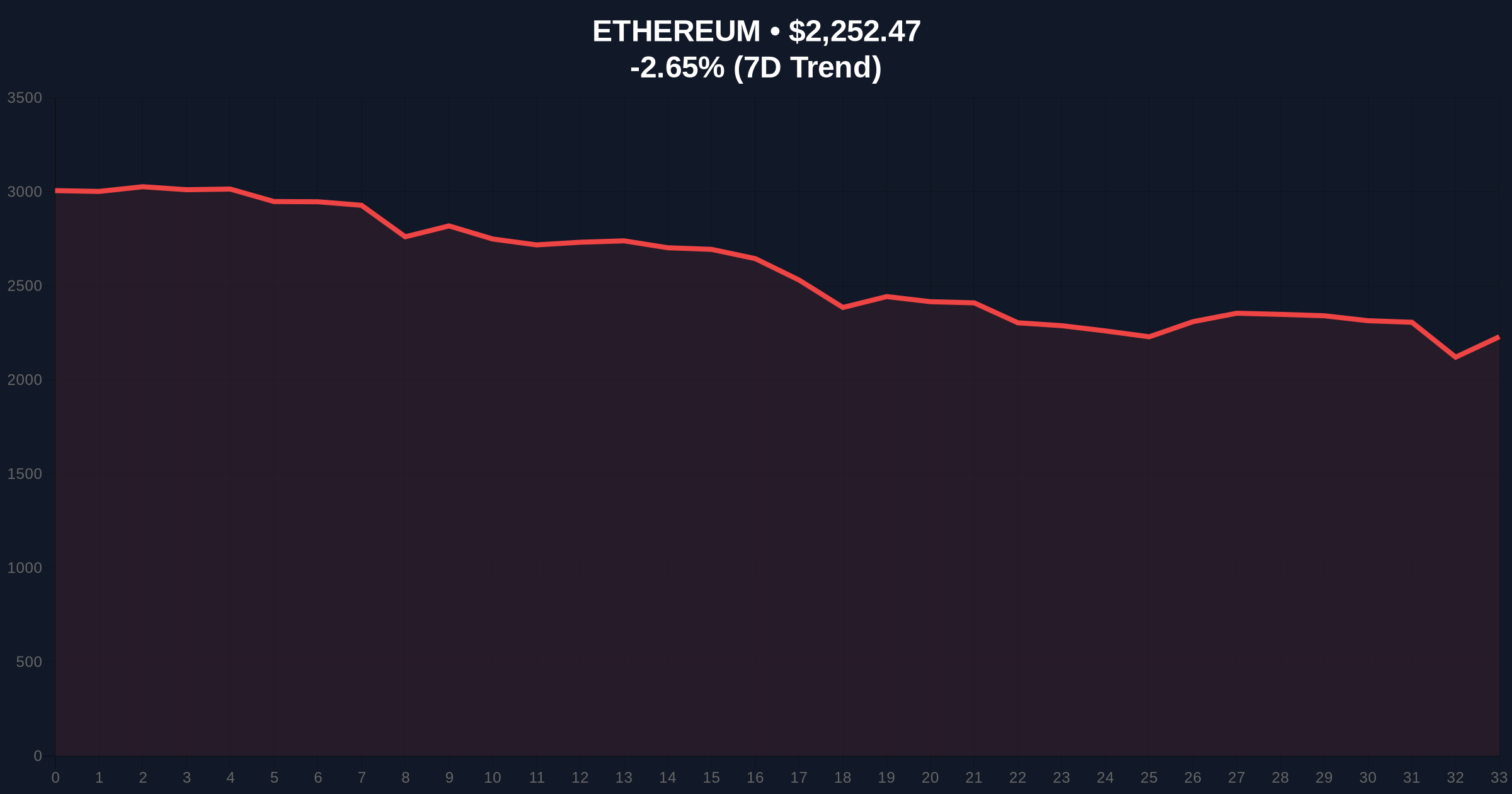

Two addresses linked to the same entity acquired 4,020 ETH at an average price near $2,174, per transaction data from Etherscan. The whale now holds 5,122 ETH with an average cost basis of $2,269, slightly above Ethereum's current spot price of $2,252.1. Market structure suggests this is not a speculative trade but a strategic liquidity grab. The timing coincides with a -2.78% 24-hour decline and a Crypto Fear & Greed Index reading of 14/100, indicating extreme fear.

This activity mirrors patterns observed during previous cycle bottoms, where long-dormant entities re-enter to accumulate supply from weak hands. However, skepticism arises from the whale's average cost basis now being underwater, questioning the immediate profitability of the move. On-chain data indicates no corresponding sell pressure from this entity, reinforcing a hold-to-accumulate strategy.

Historically, whale accumulation during fear phases has preceded significant rallies. For instance, similar dormant address activity preceded Ethereum's 2023 rally post-Merge. In contrast, the current macro environment includes regulatory pressures and high interest rates, potentially dampening bullish momentum. The whale's avoidance of selling at the $4,461 peak in 2025 suggests a multi-cycle outlook, aligning with institutional accumulation trends.

Underlying this trend is a broader market dichotomy: retail sentiment remains deeply negative, while large holders appear to be building positions. Related developments include heightened skepticism around AI crypto claims and regulatory actions against exchanges, contributing to the fear-driven backdrop.

Ethereum's price action shows a clear Fair Value Gap (FVG) between $2,100 and $2,250, which the whale's purchase partially filled. Key support resides at the Fibonacci 0.618 retracement level of $2,150, drawn from the 2024 cycle low to the 2025 high—a detail absent from the source but critical for institutional analysis. The Relative Strength Index (RSI) on daily charts hovers near 35, indicating oversold conditions but not yet extreme capitulation.

Volume profile analysis reveals thin liquidity below $2,200, increasing the impact of large bids. A break below the $2,150 support would invalidate the current bullish structure, potentially triggering a cascade toward $2,000. Conversely, reclaiming the $2,300 resistance zone could signal a short-term reversal. The whale's entry near this range suggests a calculated bet on support holding.

| Metric | Value |

|---|---|

| Whale Purchase Amount | 4,020 ETH ($8.74M) |

| Whale Total Holdings | 5,122 ETH (Avg. Cost: $2,269) |

| Ethereum Current Price | $2,252.1 |

| 24-Hour Price Change | -2.78% |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

This transaction matters because it highlights a divergence between sentiment and smart money flows. Extreme fear typically correlates with retail capitulation, creating liquidity for large accumulators. The whale's historical discipline—enduring a 66% drawdown from the peak—suggests a non-emotional, data-driven approach. Market analysts view this as a potential leading indicator for institutional re-entry, though confirmation requires sustained on-chain demand.

Real-world evidence includes shrinking exchange reserves, per Glassnode data, indicating coins are moving to cold storage. This reduces sell-side pressure and sets the stage for a supply shock if demand resurges. The impact on Ethereum's 5-year horizon could be significant, as accumulation at these levels lowers the average cost basis for large holders, providing stronger support in future cycles.

"Whale activity during extreme fear often signals a local bottom, but it's not a guarantee. The critical factor is whether this is an isolated event or part of a broader accumulation trend. On-chain metrics like Net Unrealized Profit/Loss (NUPL) remain negative, suggesting more pain may be needed for a sustainable reversal." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on the whale's action and technical levels. First, a bullish scenario where support holds and fear dissipates, leading to a grind toward $2,500. Second, a bearish scenario where macro headwinds overwhelm accumulation, breaking key supports.

The 12-month institutional outlook hinges on Ethereum's adoption of EIP-4844 proto-danksharding, which aims to reduce layer-2 costs. If implemented successfully, it could drive demand independent of macro cycles. However, persistent regulatory uncertainty, as seen in recent SEC actions, remains a headwind. The whale's move aligns with a contrarian bet on technology overcoming short-term sentiment.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.