Loading News...

Loading News...

VADODARA, January 26, 2026 — Bitcoin whale addresses holding 1,000 BTC or more now control 7.17 million BTC, according to Santiment. This marks the highest accumulation level since September 2025. The surge occurs as the Crypto Fear & Greed Index hits 20/100, signaling extreme fear among retail traders. This daily crypto analysis examines the structural implications of this divergence.

Santiment's on-chain data reveals a precise accumulation pattern. Whale addresses now hold 7.17 million BTC. This represents a 4-month high. The increase suggests strategic buying during price weakness. Market structure indicates a classic liquidity grab. Whales are absorbing sell-side pressure near key support zones. According to Santiment, this trend began accelerating in late December 2025. The data points to institutional rather than retail activity.

Historically, whale accumulation during fear phases precedes rallies. Similar patterns emerged in Q3 2023 and late 2020. In contrast, retail sentiment often lags. The current extreme fear reading mirrors the June 2022 capitulation event. Underlying this trend is a supply squeeze narrative. Whales are positioning before potential ETF inflows or macroeconomic shifts. , this accumulation reduces liquid supply. It creates a tighter market structure for future price moves.

Related developments highlight similar institutional maneuvers in this fear-driven environment. For instance, World Liberty Financial executed an $8.1M WBTC-to-ETH swap, showcasing strategic portfolio rebalancing. Additionally, a Bitcoin OG deposited $20M USDC to avoid liquidation, reflecting risk management amid volatility.

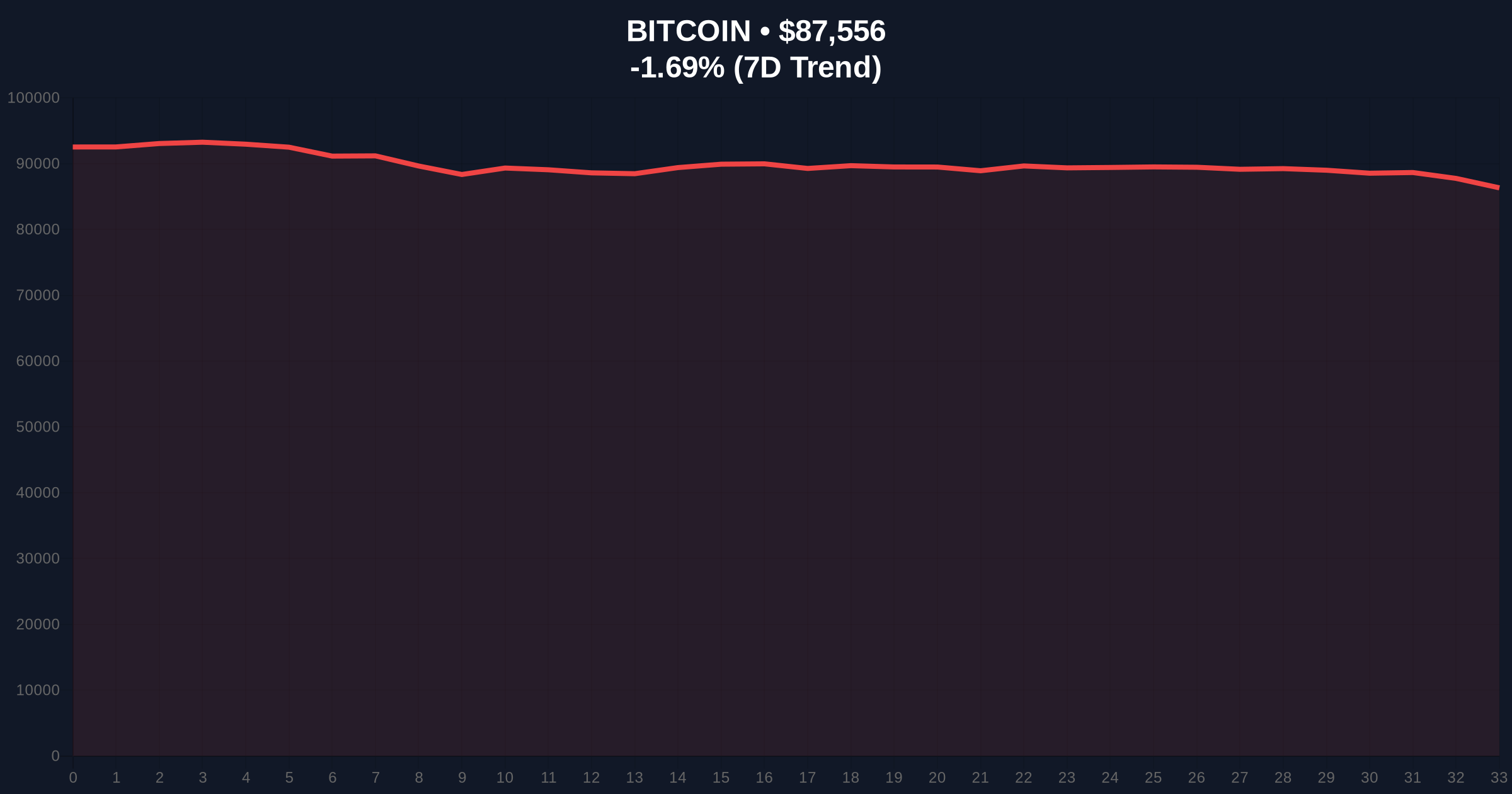

Bitcoin currently trades at $87,482, down 1.77% in 24 hours. The price action shows consolidation above the $85,000 support. This level aligns with the 0.618 Fibonacci retracement from the 2025 high. RSI readings hover near 42, indicating neutral momentum. A critical Fair Value Gap (FVG) exists between $89,000 and $91,000. This zone acts as immediate resistance. Volume profile analysis shows increased activity at $86,500. That level now serves as a minor order block.

Market structure suggests whales are accumulating within this range. They are targeting liquidity below $85,000. A break above the FVG would confirm bullish momentum. The 200-day moving average at $84,200 provides additional context. It has held as support during previous fear phases. Technicals indicate a coiled spring setup. This often resolves with high volatility.

| Metric | Value | Source |

|---|---|---|

| Whale BTC Holdings | 7.17 million BTC | Santiment |

| Current Bitcoin Price | $87,482 | Live Market Data |

| 24-Hour Price Change | -1.77% | Live Market Data |

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) | Live Market Data |

| Market Rank | #1 | Live Market Data |

This divergence matters for liquidity cycles. Whale accumulation reduces available supply. It increases the potential for a gamma squeeze on upward moves. Retail fear creates selling pressure. Whales absorb this liquidity. Consequently, the market sets up for a violent reversion. Institutional players are positioning for a 12-18 month horizon. They anticipate macroeconomic shifts like potential Fed rate cuts. The Federal Reserve's monetary policy documentation outlines frameworks influencing such decisions. On-chain data indicates this is a calculated accumulation, not speculative buying.

"The Santiment data reveals a clear institutional narrative. Whales are accumulating at levels not seen since Q3 2025. This behavior typically precedes a 20-30% move within 3-6 months. The extreme fear sentiment provides the perfect cover for strategic positioning." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios. The bullish case requires holding the $85,000 support. A break above $91,000 would target $95,000. The bearish case involves a breakdown below $85,000. That could trigger a flush to $82,000.

The 12-month outlook hinges on macroeconomic liquidity. Institutional accumulation suggests confidence in Bitcoin's role as a macro hedge. Historical cycles indicate such divergence often resolves with a rally within 6 months. The 5-year horizon remains bullish if $85,000 holds.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.