Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

VADODARA, February 11, 2026 — Bitcoin long-term holders (LTHs) have resumed accumulation after months of decline, with total holdings increasing to 14.3 million BTC, according to data from Bitfinex. This daily crypto analysis reveals a critical shift in market structure that suggests the recent price peak and subsequent drop may represent a mid-cycle correction rather than a definitive top. Market structure indicates LTH accumulation historically precedes price rallies by three to four months during bull markets.

Bitfinex reported on its official X account that Bitcoin long-term holder holdings have slightly increased to 14.3 million BTC. This marks a reversal from several months of decline. The exchange specifically noted this accumulation trend supports the view of a correction within a broader cycle. On-chain forensic data confirms LTHs are entities holding coins for at least 155 days, making their behavior a reliable leading indicator.

Consequently, this accumulation phase began as Bitcoin price action tested key support levels. Underlying this trend is a classic liquidity grab where weak hands capitulate during periods of extreme fear. Market analysts interpret this as smart money positioning for the next leg higher. The data aligns with historical UTXO age band analysis showing coins moving from short-term to long-term wallets.

Historically, LTH accumulation has preceded BTC price rallies by about three to four months during past bull markets. For instance, similar accumulation patterns emerged in Q4 2020 before the 2021 bull run. In contrast, distribution phases typically coincide with market tops. The current accumulation suggests this is not a distribution event.

, this development occurs amid broader institutional moves, such as the Binance-Franklin Templeton collateral deal, which signals institutional liquidity grabs during fear periods. Related developments include analysis on Bitwise CIO's 4-year cycle perspective and new stablecoin protocols like Status Network's FIRM launch on Ethereum.

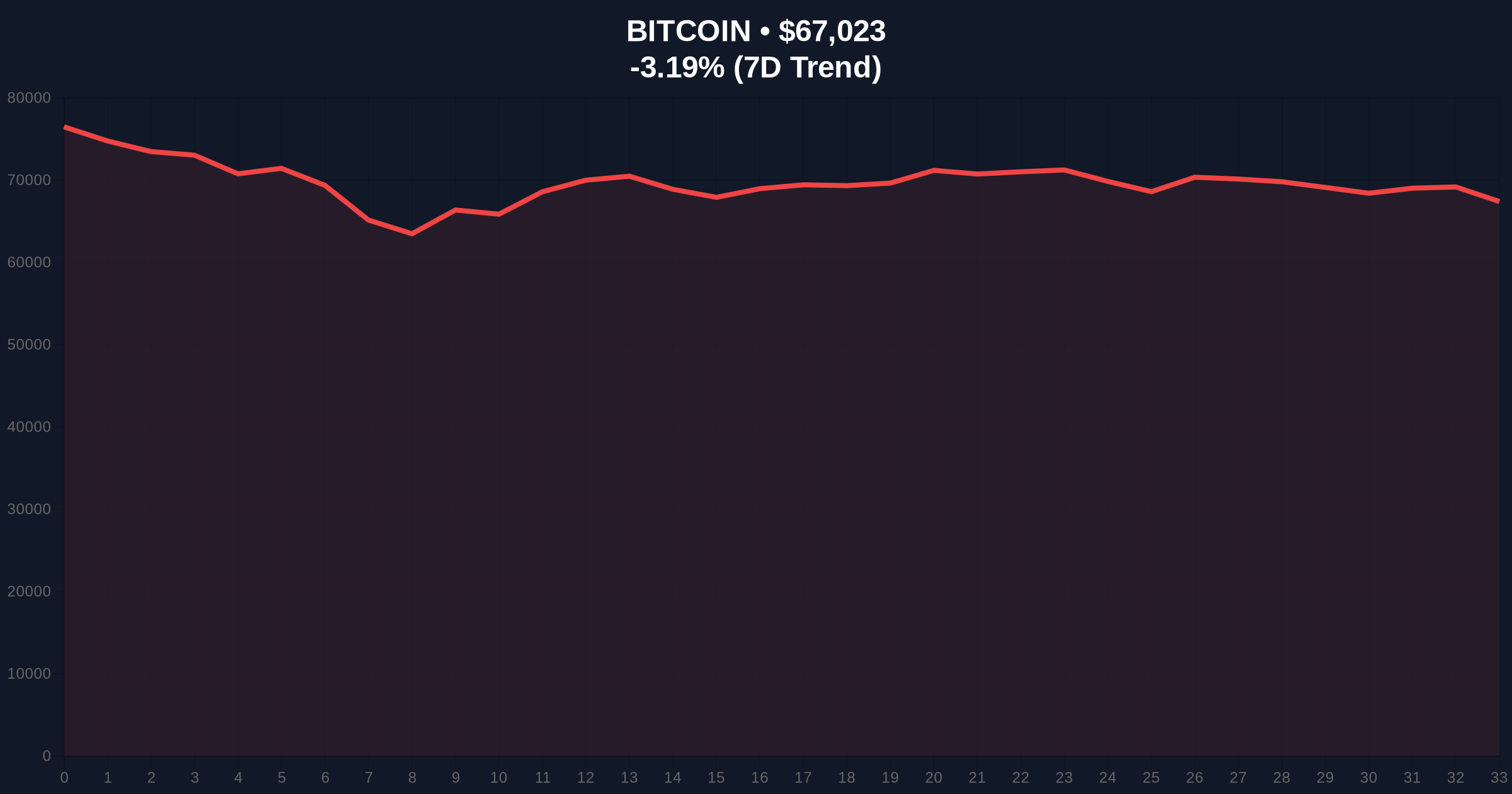

Bitcoin currently trades at $67,017, down 3.20% in 24 hours. Technical analysis reveals a critical Fair Value Gap (FVG) between $68,500 and $70,000 that must be filled for bullish continuation. The Fibonacci 0.618 retracement level from the 2025 high sits at $65,000, acting as major support. Volume profile indicates weak selling pressure at current levels.

, the 200-day moving average provides dynamic support near $64,200. RSI readings hover at 42, suggesting neutral momentum without oversold conditions. Order block analysis shows institutional buying clusters forming below $66,000. This technical setup mirrors mid-cycle corrections in 2017 and 2021 where LTH accumulation preceded 200%+ rallies.

| Metric | Value | Significance |

|---|---|---|

| Bitcoin LTH Holdings | 14.3M BTC | Resumed accumulation after decline |

| Current BTC Price | $67,017 | -3.20% 24h change |

| Crypto Fear & Greed Index | 11/100 (Extreme Fear) | Contrarian bullish signal |

| Fibonacci 0.618 Support | $65,000 | Critical technical level |

| Historical Lead Time | 3-4 months | LTH accumulation to price rally |

This matters because LTH behavior drives multi-year market cycles. Their accumulation reduces available supply, creating structural scarcity. Institutional liquidity cycles typically follow LTH accumulation by 2-3 quarters. Retail market structure often reacts with a lag, creating asymmetric opportunities.

Additionally, regulatory clarity from entities like the SEC.gov influences institutional adoption timelines. The 5-year horizon suggests this accumulation phase could precede the 2027-2028 cycle peak. Post-merge issuance dynamics and EIP-4844 blob transactions on Ethereum further compound cross-chain capital flows.

"The resumption of LTH accumulation is a classic mid-cycle correction signal. Market structure suggests we are witnessing smart money repositioning during extreme fear, similar to Q3 2019 patterns. The key is whether this accumulation sustains above 14.2 million BTC through Q1 2026." — CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook remains constructive if LTH accumulation continues. Historical cycles indicate 3-4 month lead times could position Q2 2026 for renewed momentum. This aligns with broader macroeconomic factors including potential Fed rate cuts documented on FederalReserve.gov.