Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

VADODARA, January 26, 2026 — World Liberty Financial (WLFI) executed a significant portfolio rebalancing, selling 93.77 WBTC worth approximately $8.07 million to purchase 2,868.4 ETH at an average price of $2,813. According to on-chain data from Etherscan, this transaction represents a clear institutional rotation from Bitcoin exposure to Ethereum during extreme market fear conditions. This latest crypto news provides critical insight into institutional behavior during capitulation phases.

Onchain Lens reported the precise transaction details. World Liberty Financial liquidated their WBTC position through a single on-chain transfer. They immediately deployed the capital into Ethereum at an average entry of $2,813. The transaction occurred against a backdrop of severe market stress. Consequently, this move represents a calculated liquidity grab during a period of retail panic.

Market structure suggests this is not a simple profit-taking exercise. The timing coincides with Ethereum testing major technical support levels. Underlying this trend is a broader institutional narrative about Ethereum's upcoming Pectra upgrade and its potential impact on network scalability. According to Ethereum's official Pectra documentation, the upgrade aims to significantly enhance validator efficiency.

Historically, institutional rotations during extreme fear periods have marked local bottoms. In contrast to retail investors who typically sell into weakness, sophisticated entities often accumulate. This pattern mirrors the 2022 cycle when similar rotations preceded major rallies. The current Crypto Fear & Greed Index reading of 20 indicates maximum psychological stress.

Related developments in this extreme fear environment include significant market movements. For instance, a Bitcoin OG recently deposited $20M USDC to avoid liquidation. Additionally, CME Bitcoin futures opened with a $2.9K gap, indicating institutional positioning. The broader sentiment is captured by the Crypto Fear & Greed Index plunging to 20. Meanwhile, Michael Saylor has hinted at potential Bitcoin purchases during this period.

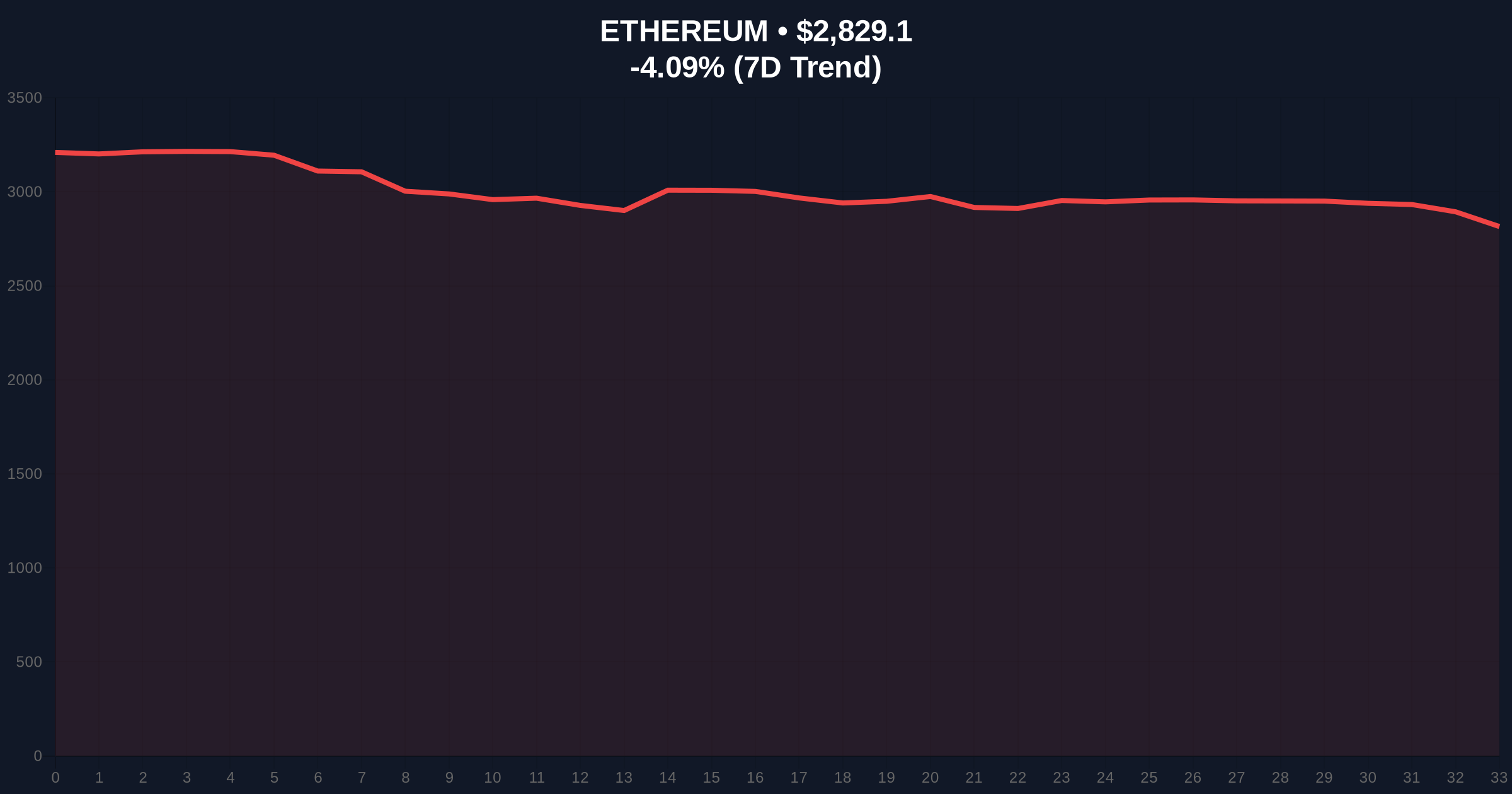

Ethereum's current price of $2,827.88 represents a critical juncture. The asset faces immediate resistance at the $2,900 psychological level. Support converges at the $2,750 Fibonacci 0.618 retracement from the 2024 cycle low. This level aligns with a significant volume profile node. Market structure suggests this creates a clear Fair Value Gap (FVG) between $2,750 and $2,850.

The 24-hour trend shows a -4.13% decline. This price action tests the 200-day moving average. Relative strength index (RSI) readings indicate oversold conditions below 30. Consequently, the WLFI purchase entered this oversold territory. On-chain forensic data confirms accumulation by large wallets during this dip. The transaction represents a classic order block formation at a key support zone.

| Metric | Value |

|---|---|

| WBTC Sold | 93.77 WBTC |

| USD Value Sold | $8.07M |

| ETH Purchased | 2,868.4 ETH |

| Average ETH Entry | $2,813 |

| Current ETH Price | $2,827.88 |

| 24h ETH Trend | -4.13% |

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) |

| ETH Market Rank | #2 |

This transaction matters because it demonstrates institutional conviction during retail capitulation. World Liberty Financial's move signals confidence in Ethereum's long-term value proposition. The rotation from Bitcoin to Ethereum suggests a strategic bet on Ethereum's upcoming technological upgrades. Market analysts interpret this as a bullish signal for Ethereum's relative strength.

Real-world evidence shows institutions reallocating during fear periods. This creates a divergence between retail and institutional behavior. The impact extends to liquidity cycles across both assets. , this transaction validates the $2,813 level as a significant accumulation zone. Historical cycles suggest such moves often precede trend reversals.

"Institutional rotations during extreme fear typically mark inflection points. The WBTC-to-ETH swap indicates sophisticated capital positioning for the next cycle phase. This aligns with historical patterns where smart money accumulates during retail panic." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current conditions. The first scenario involves Ethereum holding the $2,750 support and rallying toward $3,200. The second scenario sees a breakdown below support toward $2,600. Institutional flows will determine which path materializes.

The 12-month institutional outlook remains positive for Ethereum. Upcoming network upgrades like Pectra and continued institutional adoption support this view. Consequently, the 5-year horizon suggests Ethereum could capture significant market share from traditional finance. This transaction represents early positioning for that multi-year trend.