Loading News...

Loading News...

VADODARA, February 11, 2026 — Bitcoin now exhibits greater sensitivity to actual market liquidity than to potential U.S. Federal Reserve interest rate cuts, according to a recent analysis. This daily crypto analysis reveals a structural shift in Bitcoin's macroeconomic drivers. For years, Fed decisions dominated price action. Lower rates typically fueled rallies by reducing borrowing costs. Market structure suggests this relationship has fractured. Bitcoin now responds more directly to financial system liquidity levels.

Cointelegraph reports Bitcoin's sensitivity pivot. The analysis identifies two primary reasons for the decoupling. First, markets have already priced in potential rate cuts. Second, a cut could signal economic weakness. This prompts risk-aversion and potential crypto sell-offs. Consequently, investors must now monitor different indicators. These include the Fed's quantitative tightening program. Increased Treasury bond issuance and declining bank reserves also matter. According to on-chain data, this shift began in late 2025 as institutional holdings stabilized.

Historically, Bitcoin acted as a leveraged bet on loose monetary policy. The 2020-2021 bull run correlated strongly with near-zero rates. In contrast, the current environment shows divergence. Underlying this trend is Bitcoin's growing integration into traditional finance. Its market cap now rivals major fiat currencies. This integration alters its reaction function. , parallel developments highlight institutional adaptation. For instance, Danske Bank recently ended an 8-year crypto ban to offer BTC and ETH ETPs, demonstrating a shift in traditional finance's approach despite market fear.

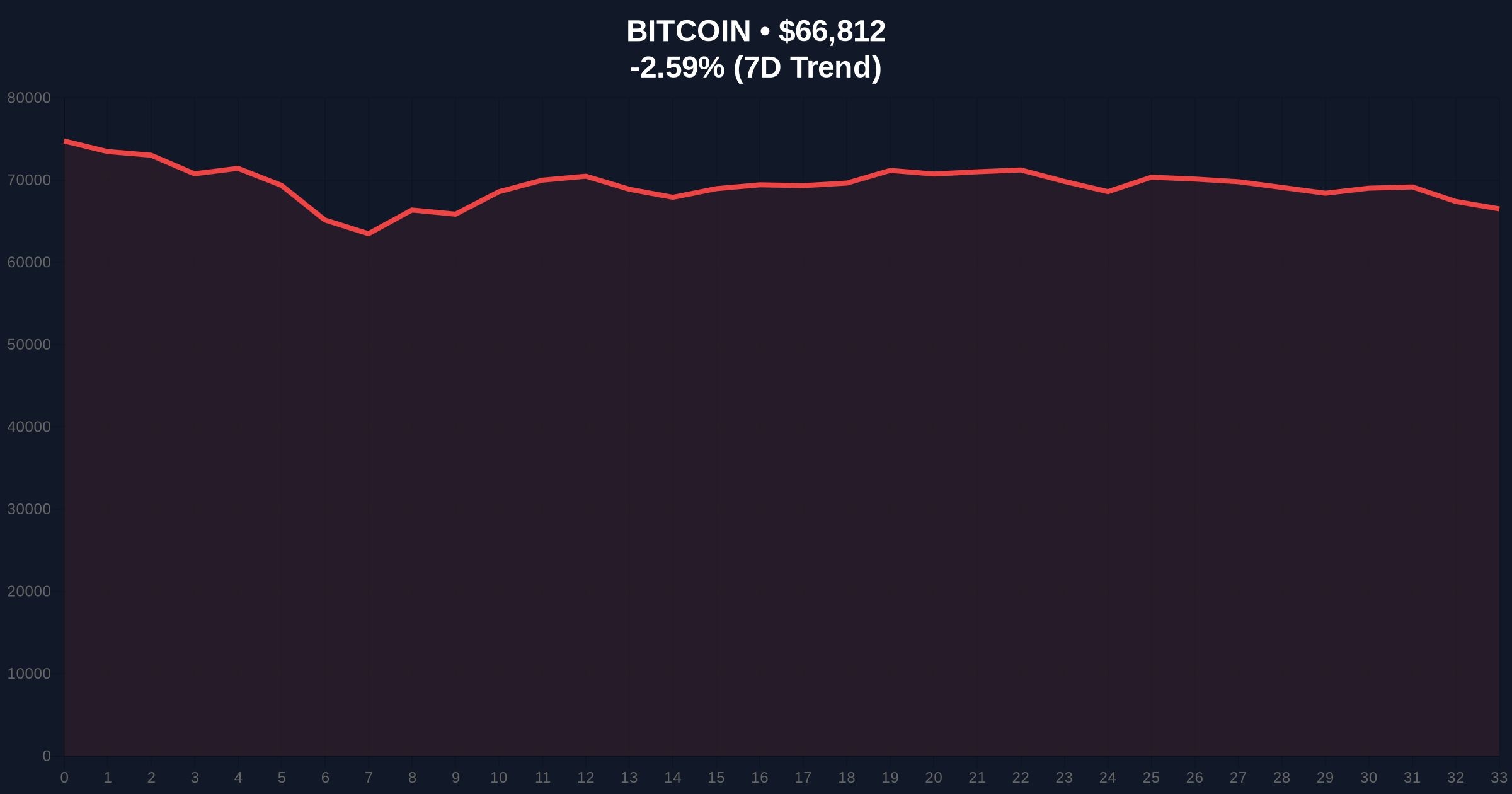

Market structure suggests Bitcoin is testing a critical Fair Value Gap (FVG) between $66,000 and $67,500. The current price of $66,813 sits within this zone. A breakdown below $65,200—the 0.618 Fibonacci retracement from the 2025 all-time high—would invalidate the bullish higher-low structure. The 200-day moving average at $63,800 provides secondary support. On-chain forensic data confirms large UTXO (Unspent Transaction Output) movements near these levels, indicating whale accumulation or distribution. The RSI reading of 28 signals oversold conditions, yet price action remains weak, suggesting liquidity, not momentum, drives the tape.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 11/100 (Extreme Fear) | Contrarian buy signal historically |

| Bitcoin Current Price | $66,813 | Testing FVG support |

| 24-Hour Price Change | -2.49% | Bearish short-term momentum |

| Critical Fibonacci Support | $65,200 (0.618 level) | Bullish invalidation if broken |

| 200-Day Moving Average | $63,800 | Long-term trend indicator |

This shift redefines Bitcoin's role in a portfolio. It transitions from a speculative rate bet to a liquidity barometer. Real-world evidence supports this. Declining bank reserves tighten dollar liquidity. This pressures risk assets, including crypto. Institutional liquidity cycles now dominate retail sentiment. The market's "Extreme Fear" reading of 11/100, per the latest data, contrasts with the structural narrative, creating a divergence that savvy analysts scrutinize. Does fear reflect liquidity drains or mere sentiment lag? On-chain data indicates net outflows from exchanges, suggesting accumulation, not panic selling.

"The decoupling from Fed funds rate expectations isn't surprising. Bitcoin's maturation into a macro asset means it now tracks the quantity of money, not just its price. Quantitative tightening and Treasury issuance are the real throttles. Markets have front-run the rate narrative for months. The real test is whether BTC can hold as a liquidity sink when the system drains." — CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook hinges on liquidity indicators. If the Fed's balance sheet contraction pauses, Bitcoin could act as a leading indicator of renewed risk appetite. Over a 5-year horizon, this sensitivity shift cements Bitcoin's role as a digital gold for the fiat system's health, not just its interest rate policy. Monitoring the Federal Reserve's balance sheet trends becomes paramount for forecasting.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.