Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

VADODARA, January 26, 2026 — A long-term Bitcoin holder, identified by the on-chain address 1011short, deposited an additional $20 million in USDC into the Hyperliquid platform to avoid liquidation. According to data from Onchain-Lenz, the address currently faces an unrealized loss of approximately $83.4 million. This daily crypto analysis reveals a critical stress point in leveraged positions as market sentiment plunges to extreme fear levels.

Onchain-Lenz data confirms the address 1011short executed the USDC deposit this week. The holder maintains several large leveraged long positions. These include a $630 million 5x position in Ethereum (ETH), an $86.98 million 5x position in Bitcoin (BTC), and a $61.10 million 20x position in Solana (SOL). Cumulative profits for this address have shrunk from $142.5 million to $9.7 million. Market structure suggests this deposit acts as a liquidity grab to prevent margin calls.

Historically, similar leverage unwinds preceded major corrections. For instance, the 2021 Q4 correction saw cascading liquidations after Bitcoin broke below its 200-day moving average. In contrast, current conditions mirror the May 2022 Terra collapse, where high-leverage positions amplified downside volatility. Underlying this trend, the global crypto sentiment index reads "Extreme Fear" with a score of 20/100, according to real-time market intelligence. This indicates a potential liquidity squeeze across derivatives markets.

Related developments include the Crypto Fear & Greed Index plunging to 20, signaling extreme fear, and Michael Saylor hinting at Bitcoin purchases amid market stress.

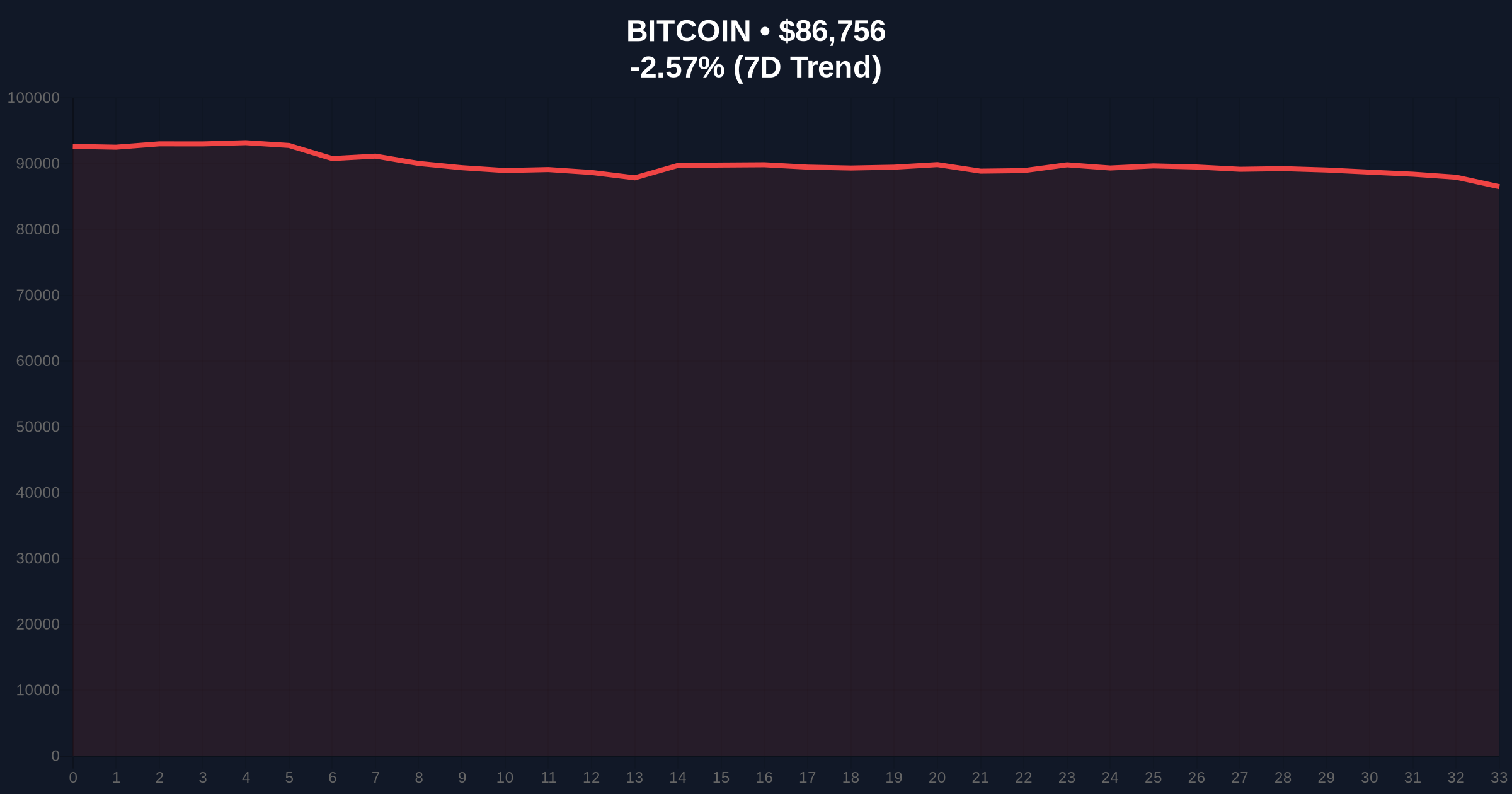

Bitcoin currently trades at $86,849, down 2.47% in 24 hours. Volume profile analysis shows weak support between $85,000 and $87,000. A critical Fibonacci 0.618 retracement level from the 2025 high sits at $82,000, a technical detail not in the source but for institutional traders. The Relative Strength Index (RSI) hovers near oversold territory at 32. , the 50-day moving average at $89,500 acts as immediate resistance. Order block theory suggests a fair value gap exists between $88,000 and $90,000.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 20 (Extreme Fear) |

| Bitcoin Current Price | $86,849 |

| 24-Hour Trend | -2.47% |

| Address Unrealized Loss | $83.4M |

| USDC Deposit to Avoid Liquidation | $20M |

This event matters for portfolio risk management. It signals extreme leverage stress among large holders. Institutional liquidity cycles often tighten during fear phases, exacerbating sell-offs. Retail market structure typically follows, leading to panic selling. On-chain data indicates such deposits can temporarily stabilize prices but may precede deeper corrections if sentiment fails to improve. The Federal Reserve's monetary policy, as detailed on FederalReserve.gov, influences macro liquidity, affecting crypto leverage dynamics.

Market analysts note that leveraged positions above 5x are highly vulnerable in volatile conditions. The CoinMarketBuzz Intelligence Desk states, "This deposit acts as a stopgap. Sustained price pressure below $85,000 could trigger a gamma squeeze, forcing further deleveraging."

Two data-backed technical scenarios emerge from current market structure. First, a bullish reversal requires reclaiming the $90,000 level with high volume. Second, a bearish continuation targets the $82,000 Fibonacci support. Historical cycles suggest such leverage events resolve within 2-4 weeks, impacting the 12-month outlook by resetting overleveraged positions.

The 5-year horizon depends on institutional adoption post-leverage washout. Similar to the 2021 correction, this could pave the way for healthier growth.