Loading News...

Loading News...

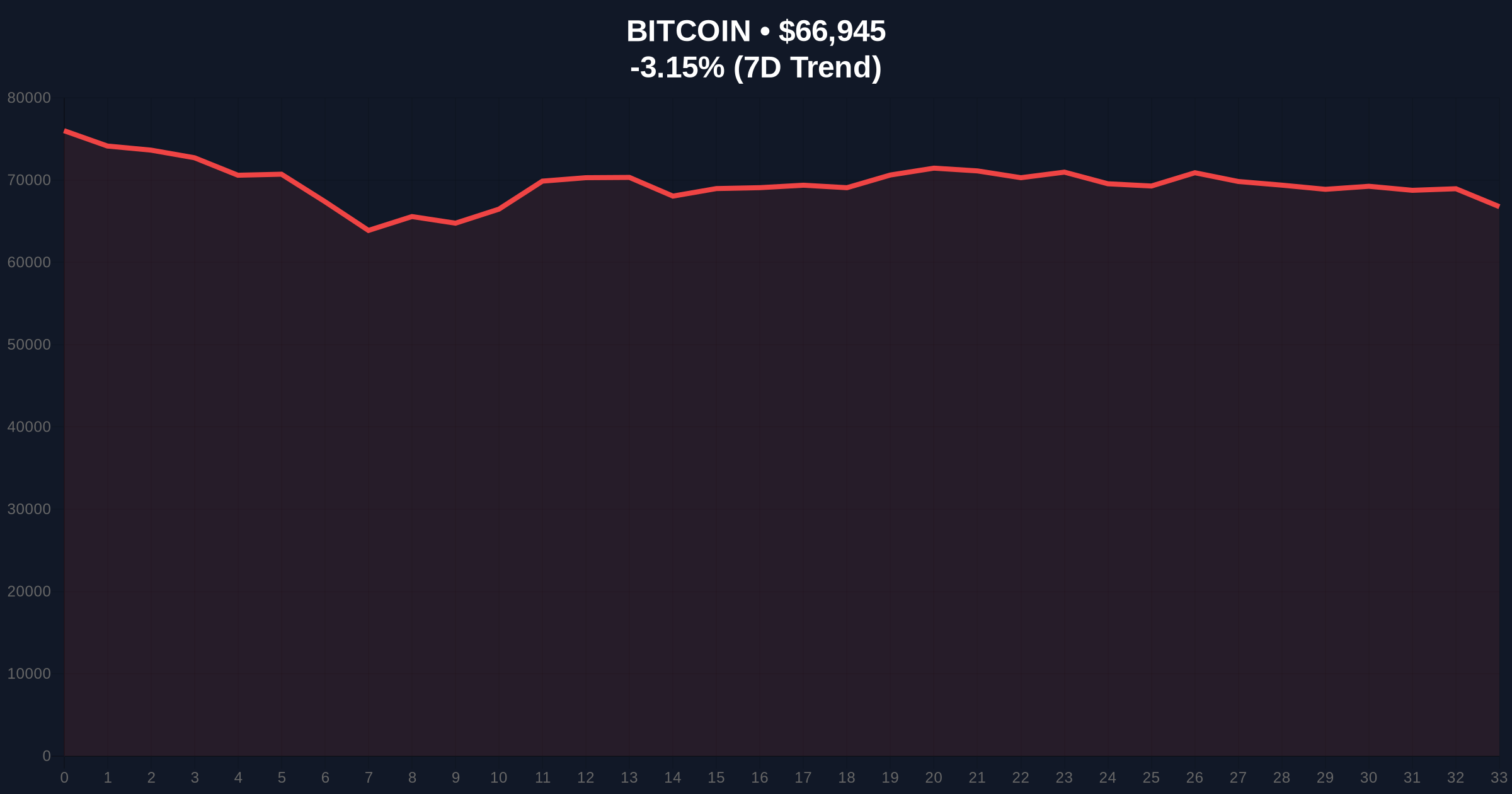

VADODARA, February 11, 2026 — Bitcoin faces a potential structural bear market, not a simple correction. According to a CryptoQuant post by analyst XWIN Research Japan, market participants are ignoring this reality. The $66,938 price reflects a -3.16% 24-hour decline. This daily crypto analysis examines the data behind the warning.

XWIN Research Japan published a critical analysis on CryptoQuant. The post argues Bitcoin entered a "crypto winter." Market structure delays recognition. Supply-demand dynamics define bear markets. Capital flows and sentiment shifts matter more than price alone. The Fear & Greed Index confirms extreme fear. Score: 11/100. Historical cycles show sentiment weakens before major corrections. Participants cling to bull market hopes. Spot ETF introductions and institutional participation create false security. On-chain selling pressure persists. ETF inflows remain unstable. The analyst's data points to a deeper downturn.

Historically, Bitcoin cycles follow predictable patterns. The 2022 bear market saw an 80% drawdown. Current conditions mirror early 2022 sentiment contractions. In contrast, 2021 bull runs featured greed scores above 90. Underlying this trend, institutional adoption changed market dynamics. Spot ETFs added $10 billion in inflows initially. However, capital rotation into altcoins drained Bitcoin liquidity. , regulatory uncertainty pressures global markets. For instance, South Korea's stablecoin bill faces governance clashes amid similar fear. Related developments include Bitwise CIO blaming the 4-year cycle for Bitcoin's slump while defending ETF growth.

Market structure suggests critical support at $65,000. This aligns with the 0.618 Fibonacci retracement from the 2025 high. A break below invalidates the bull market thesis. Resistance forms at $70,000, a previous order block. RSI readings hover near 30, indicating oversold conditions. However, oversold markets can stay oversold in bear trends. The 200-day moving average at $68,500 acts as dynamic resistance. Volume profile shows distribution above $70,000. UTXO age bands indicate long-term holders are not selling en masse yet. This creates a liquidity grab scenario. A gamma squeeze is unlikely without ETF inflow stabilization.

| Metric | Value | Implication |

|---|---|---|

| Bitcoin Price | $66,938 | -3.16% daily, testing key support |

| Fear & Greed Index | 11/100 (Extreme Fear) | Severe sentiment contraction |

| 24-Hour Trend | -3.16% | Bearish momentum acceleration |

| Market Rank | #1 | Dominance holds but liquidity drains |

| Key Support Level | $65,000 | Fibonacci 0.618, bull/bear line |

This analysis matters for portfolio risk management. A structural bear market implies prolonged drawdowns. Institutional liquidity cycles typically last 18-24 months. Retail market structure often breaks during such phases. Real-world evidence includes ETF outflow patterns. According to on-chain data, exchange reserves are rising. This indicates selling pressure. The SEC's official guidance on digital asset classifications could further impact institutional participation. Market participants must adjust expectations. Historical patterns suggest bear markets reset leverage and speculation.

"The data indicates a supply-demand imbalance. ETF inflows are not offsetting miner and long-term holder sales. Until capital flows reverse, the bear thesis holds. Participants are in denial, clinging to improved infrastructure narratives." — CoinMarketBuzz Intelligence Desk

Two data-backed scenarios emerge from current market structure.

The 12-month institutional outlook depends on ETF flows. If inflows stabilize, a range-bound market emerges. Otherwise, a deeper downturn aligns with historical bear cycles. The 5-year horizon still favors Bitcoin due to halving mechanics and adoption trends. However, short-term pain is likely.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.