Loading News...

Loading News...

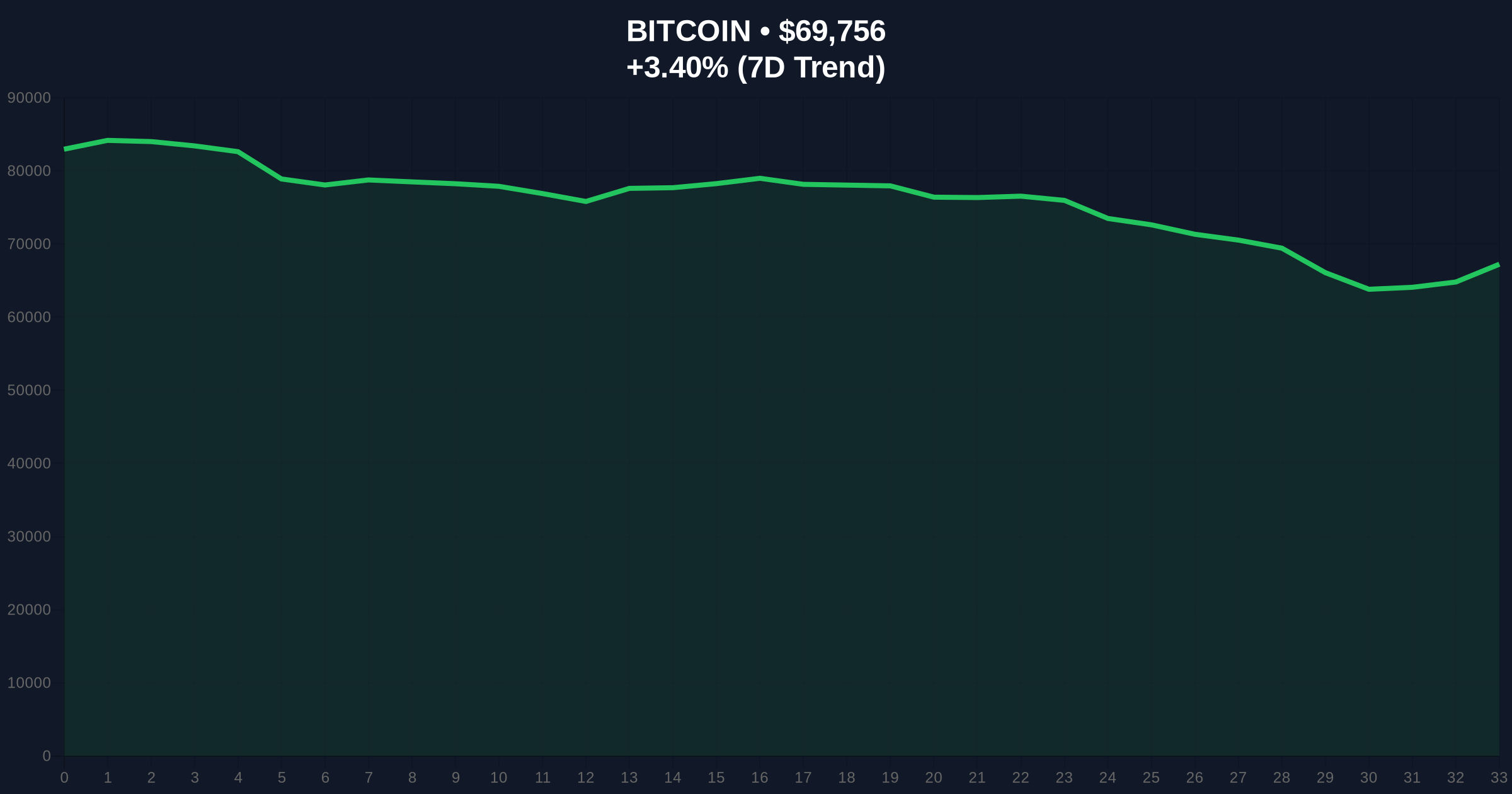

VADODARA, February 6, 2026 — Bitcoin plunged to $60,062 this week, marking a 52% collapse from its October 2025 all-time high of $126,000. This Bitcoin price analysis reveals a market in extreme fear, with institutional outflows exceeding $12 billion since November 2025. According to CNBC data, the daily Relative Strength Index (RSI) hit 18, signaling severely oversold conditions. Market structure suggests a fundamental reassessment of Bitcoin's utility as digital gold.

Bitcoin fell 15% in a single session on Thursday, February 5, 2026. This drop pushed it to its lowest level since October 11, 2024. Spot Bitcoin ETFs recorded outflows of $3 billion in January 2026 alone. Deutsche Bank analysts noted thinning liquidity due to large institutional outflows. Simultaneously, Ethereum and Solana fell 24% and 26% respectively. Anthony Scaramucci of SkyBridge called the crash unexplained, fueling market fear.

Market analysts attribute the sell-off to macro-driven deleveraging. Jasper De Maere of Wintermute stated this differs from past structural blowups. It ties to risk appetite and positioning shifts. The crash followed a period where Bitcoin underperformed gold by 100 percentage points over 12 months. This undermines its safe-haven narrative.

Historically, Bitcoin corrections of 50%+ are not uncommon. The 2021 cycle saw a 53% drawdown from April to July. However, this crash lacks a clear catalyst like the Luna collapse or FTX failure. In contrast, it mirrors the 2018 bear market's slow bleed. Underlying this trend is a narrative shift. Bitcoin's correlation with risk-on assets like the S&P 500 has increased.

Following Trump's April 2025 tariff announcement, Bitcoin fell 10% while the S&P 500 dropped 4%. This challenges its digital gold thesis. , payment adoption initiatives have stalled. Ryan Rasmussen of Bitwise noted stablecoins now dominate payments. Bitcoin's evolution from currency to store of value faces skepticism.

Related developments include recent market structure shifts, such as the $19 billion October liquidation event that altered liquidity profiles. Additionally, whale activity, like a 250 million USDC transfer to Binance, signals potential liquidity grabs amid extreme fear.

Bitcoin's price action shows a clear breakdown below the 200-day moving average. The RSI at 18 indicates extreme oversold conditions, similar to March 2020 lows. Market structure suggests a Fair Value Gap (FVG) between $60,000 and $70,000. This gap represents a liquidity void that price may retest.

On-chain data from Glassnode reveals increased UTXO age bands moving to exchanges, signaling distribution. The Fibonacci 0.618 retracement level from the 2024 low to the 2025 high sits at $82,000. This level acts as a major Order Block. A failure to reclaim it would confirm bearish continuation. Volume profile analysis shows high volume nodes at $60,000, indicating strong support.

| Metric | Value | Source |

|---|---|---|

| Bitcoin Current Price | $69,771 | Live Market Data |

| 24-Hour Change | +3.42% | Live Market Data |

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) | Live Market Data |

| Weekly ETF Outflows (Jan 2026) | $3 billion | Deutsche Bank Analysis |

| RSI Level (Thursday Low) | 18 (Oversold) | CNBC Data |

This crash matters for institutional adoption cycles. According to the SEC.gov filings, spot Bitcoin ETFs were a major catalyst. Their reversal threatens long-term inflows. Retail market structure is also at risk. The extreme fear sentiment could trigger a gamma squeeze if options markets become unbalanced.

, Bitcoin's network security faces emerging threats. Quantum computing risks are gaining investor attention. Bitwise has allocated funds to mitigate this. This adds a layer of systemic risk not present in traditional assets.

"This time is markedly different from other bear markets. It's a fundamentally macro-driven deleveraging tied to positioning and narratives rather than systemic failures within crypto itself," said Jasper De Maere, desk strategist at Wintermute, in a statement to CNBC.

CoinMarketBuzz Intelligence Desk synthesizes: "The market is repricing Bitcoin's utility. Historical cycles suggest such repricing leads to prolonged consolidation phases."

Market structure suggests two primary scenarios. The bullish case requires reclaiming key resistance levels. The bearish case involves further liquidation below support.

The 12-month institutional outlook hinges on ETF flow reversals. If outflows persist, Bitcoin may underperform gold further. Over a 5-year horizon, adoption by treasury firms and governments remains critical. Current skepticism could delay this timeline.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.