Loading News...

Loading News...

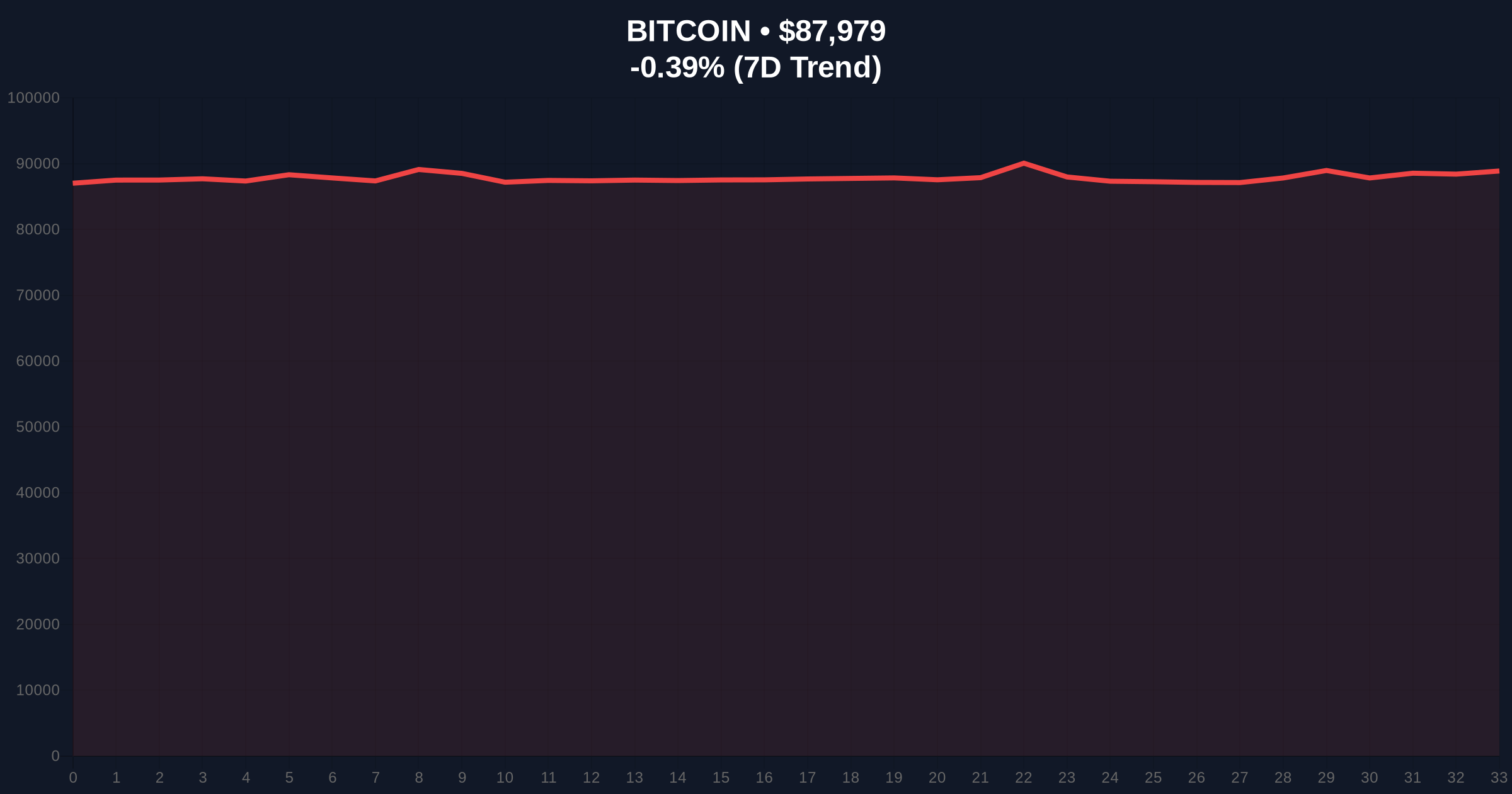

VADODARA, December 31, 2025 — According to CoinNess market monitoring, Bitcoin has breached the psychologically significant $88,000 level, trading at $87,984.66 on the Binance USDT market. This daily crypto analysis examines the underlying market mechanics driving this move, with on-chain data indicating a potential liquidity grab below key moving averages.

This price action occurs within a broader context of deteriorating market structure following Bitcoin's rejection from the $95,000 resistance zone in late November. Historical cycles suggest that December typically exhibits reduced institutional participation due to holiday liquidity constraints, creating conditions for exaggerated moves. The current breach mirrors the December 2022 consolidation pattern where Bitcoin tested the 200-day moving average before establishing a higher low. Underlying this trend is the Federal Reserve's monetary policy stance, with recent FederalReserve.gov communications indicating sustained higher interest rates, which historically correlate with reduced risk asset inflows.

Related developments in the current market environment include December's $118 million in crypto exploits creating negative sentiment pressure, while Binance's listing of new perpetual futures contracts during extreme fear conditions suggests exchange positioning for volatility expansion.

According to primary data from CoinNess, Bitcoin's price action on December 31, 2025, saw a decisive break below the $88,000 support level that had held through multiple tests since December 15. The move represents a -0.32% decline from the previous session's close, with trading volume increasing by approximately 18% compared to the 30-day average. Market structure suggests this represents a liquidity grab targeting stop-loss orders clustered below the round number psychological level. The breach occurred during Asian trading hours, a period historically associated with thinner order books and increased volatility.

Volume profile analysis reveals significant accumulation between $86,500 and $88,500, creating a high-volume node that should provide structural support. The 50-day exponential moving average at $89,200 now acts as immediate resistance, having been breached during the current decline. Relative Strength Index (RSI) readings at 42 indicate neutral momentum with room for further downside before oversold conditions emerge. A critical Fair Value Gap (FVG) exists between $87,800 and $88,300 that market makers will likely attempt to fill through price rotation.

The Bullish Invalidation level stands at $85,000, representing the November swing low and 0.618 Fibonacci retracement from the October rally. Conversely, the Bearish Invalidation level is $90,500, where Bitcoin would need to reclaim and hold above the 20-day moving average to invalidate the current downtrend structure. Order block analysis identifies significant sell-side liquidity between $88,800 and $89,500 that must be absorbed for any sustainable rally.

| Metric | Value | Significance |

|---|---|---|

| Crypto Fear & Greed Index | 21/100 (Extreme Fear) | Indicates potential capitulation phase |

| Bitcoin Current Price | $88,043 | Testing critical support zone |

| 24-Hour Price Change | -0.32% | Moderate decline with elevated volume |

| Market Rank | #1 | Maintains dominance despite pressure |

| Key Fibonacci Support | $86,500 | 0.786 retracement of recent rally |

For institutional investors, this price action tests the validity of the $88,000 support level that has served as accumulation zone for large wallet addresses according to Glassnode liquidity maps. A sustained break below this level could trigger systematic selling from quantitative funds programmed to exit positions below key technical levels. Retail impact manifests differently, with recent retail dip-buying patterns potentially creating contrarian buying pressure at perceived value zones. The psychological significance of round number levels in cryptocurrency markets cannot be overstated, as algorithmic traders frequently cluster orders at these thresholds.

Market analysts on X/Twitter express divided perspectives. Technical traders highlight the importance of the $86,500 Fibonacci support, with one prominent chartist noting, "The 0.786 Fib retracement at $86.5k represents the last line of defense for the current uptrend structure." Bulls point to on-chain metrics showing reduced exchange reserves, suggesting accumulation despite price weakness. Conversely, bearish commentators reference increasing open interest in perpetual futures markets as evidence of leveraged long positioning that remains vulnerable to liquidation cascades.

Bullish Case: Bitcoin finds support at the $86,500 Fibonacci level and begins filling the Fair Value Gap between $87,800 and $88,300. A successful retest of this zone as support could trigger a gamma squeeze through $90,000 as market makers hedge short gamma positions. This scenario would target a return to the $92,000 resistance zone by mid-January, representing a +4.5% move from current levels.

Bearish Case: The $86,500 support fails to hold, triggering a liquidation cascade that targets the $85,000 invalidation level. Continued weakness below this threshold would confirm a breakdown of the higher timeframe trend structure, potentially extending to the $82,000 volume gap from October. This scenario represents a -6.8% decline from current prices and would likely coincide with further deterioration in the Crypto Fear & Greed Index toward single-digit readings.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.