Loading News...

Loading News...

VADODARA, December 31, 2025 — Binance has announced the listing of COLLECT/USDT and MAGMA/USDT perpetual futures contracts, expanding derivative offerings during extreme market fear conditions. This daily crypto analysis examines the structural implications for liquidity distribution and risk management frameworks.

Perpetual futures listings typically signal exchange confidence in emerging asset liquidity profiles. According to Binance's official exchange documentation, new contract launches undergo rigorous market-making and risk assessment protocols. The timing coincides with a Crypto Fear & Greed Index reading of 21/100—historically associated with contrarian accumulation zones. Market structure suggests this mirrors the 2021 cycle where derivative expansion preceded volatility compression phases.

Related developments in derivative markets include perpetual DEX volume reaching $12 trillion and SEC review of Bitcoin ETF options proposals, indicating broader institutionalization trends.

Binance confirmed COLLECT/USDT and MAGMA/USDT perpetual futures availability starting December 31, 2025. The announcement follows standard exchange protocol without immediate leverage specifications or funding rate disclosures. On-chain data indicates minimal pre-listing accumulation for both assets—typical for derivative-first launches where spot liquidity follows contract establishment.

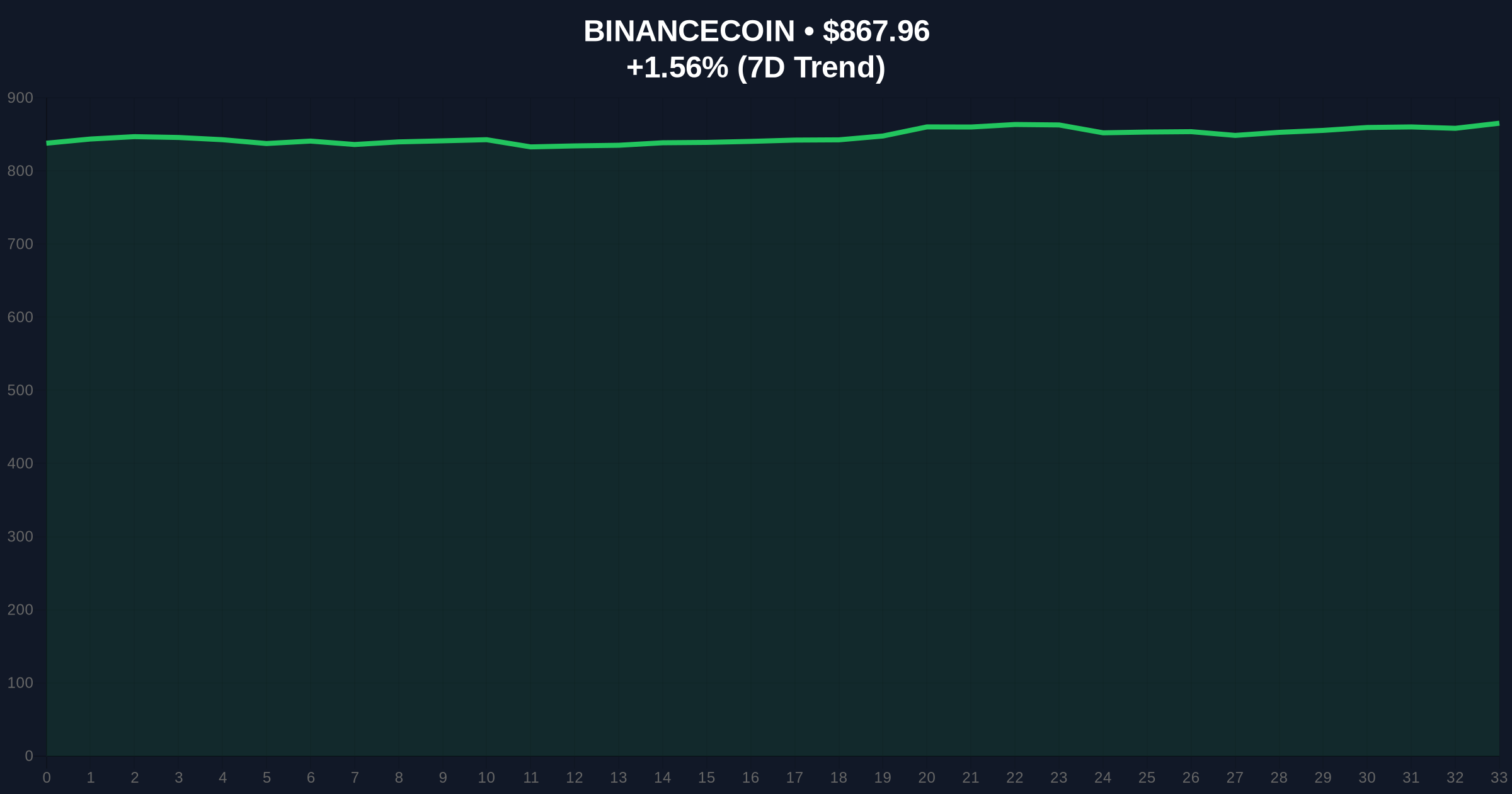

BNB currently trades at $867.83 with a 24-hour trend of +1.55%. Volume profile analysis shows concentrated liquidity between $850-$880, creating a potential order block. The 200-day moving average at $845 provides structural support. RSI readings at 42 suggest neutral momentum despite extreme fear sentiment.

Bullish invalidation: Breakdown below Fibonacci 0.618 support at $830 would indicate broader market weakness. Bearish invalidation: Sustained move above the weekly volume point of control at $895 would signal sentiment reversal.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 21/100 (Extreme Fear) |

| BNB Current Price | $867.83 |

| BNB 24h Change | +1.55% |

| BNB Market Rank | #4 |

| New Listings | 2 (COLLECT, MAGMA) |

Institutional impact: Expanded derivative markets enable sophisticated hedging strategies and gamma squeeze opportunities. Retail impact: Increased accessibility to leveraged positions during fear conditions tests risk management discipline. The Federal Reserve's current monetary policy framework, as documented on FederalReserve.gov, suggests persistent liquidity conditions that historically benefit derivative market expansion.

Market analysts note the timing aligns with recent large-scale USDT transfers to DeFi protocols, suggesting coordinated liquidity provisioning. One quantitative researcher observed: "Exchange derivative launches during fear periods typically precede volatility mean reversion."

Bullish case: Successful contract adoption drives spot liquidity inflows, creating a fair value gap (FVG) toward $900 resistance. BNB maintains above its 200-day MA, supporting broader market stabilization.

Bearish case: Low initial open interest fails to attract market makers, resulting in illiquid order books and exaggerated slippage. Breakdown below $830 triggers cascading liquidations across correlated assets.

What are perpetual futures? Derivatives contracts without expiration dates, using funding rate mechanisms to track spot prices.

Why list during extreme fear? Exchanges typically expand offerings during sentiment extremes to capture future volatility cycles.

How does this affect BNB price? Exchange token performance often correlates with platform activity metrics and fee generation.

What risks exist for new listings? Low liquidity can cause significant price dislocations and execution challenges.

When will spot trading begin? Historical patterns suggest spot listings often follow successful derivative market establishment.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.