Loading News...

Loading News...

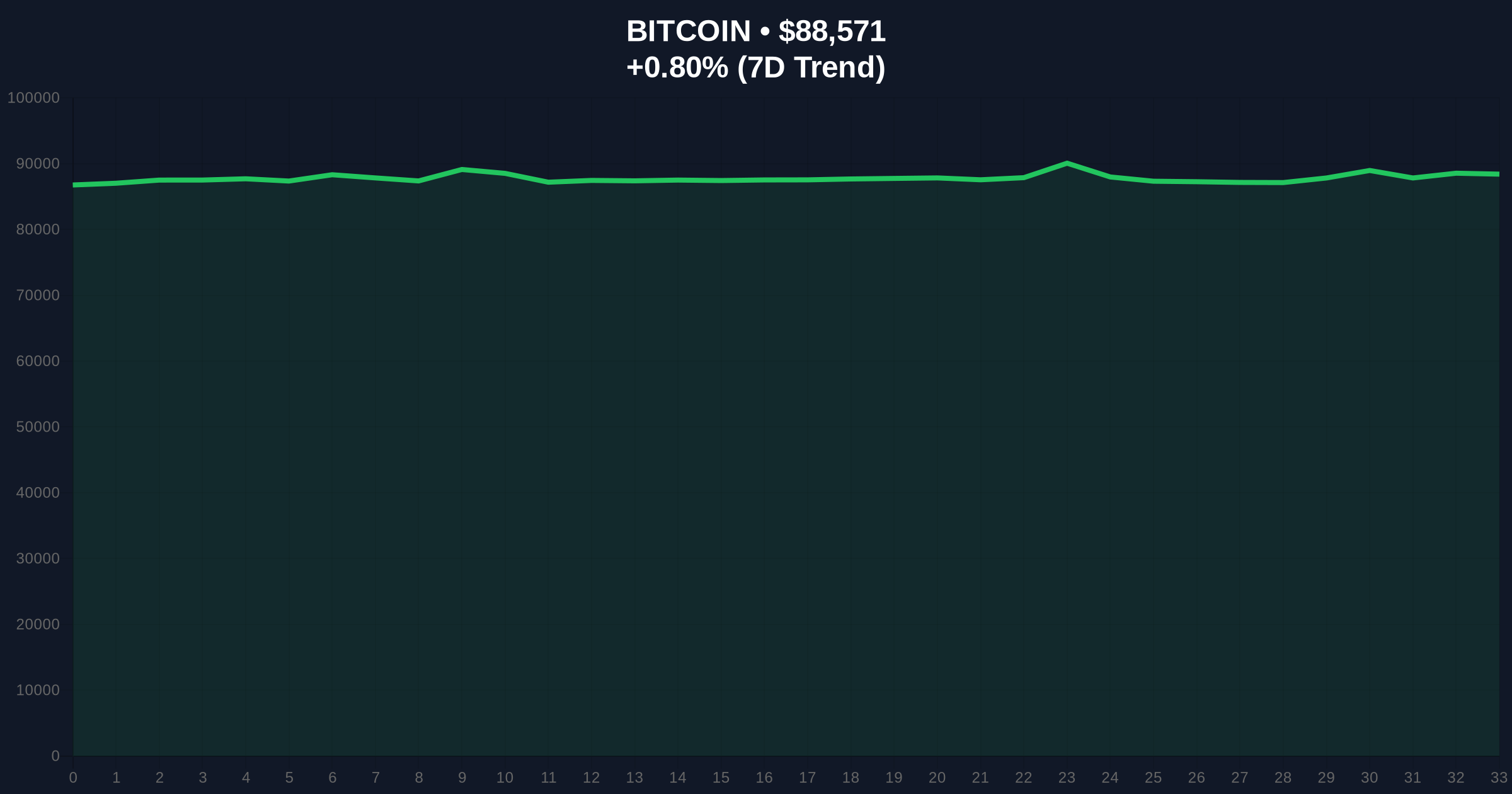

VADODARA, December 31, 2025 — The U.S. Securities and Exchange Commission (SEC) has initiated a review of a proposal from the Cboe Options Exchange (CBOE) to adjust tick sizes for its Mini Bitcoin U.S. ETF Index (MBTX) options, a technical move that the deepening institutional integration of Bitcoin derivatives. This latest crypto news comes as Bitcoin trades at $88,583 with a 24-hour gain of 0.81%, amid a global crypto sentiment reading of "Extreme Fear" at 21/100, highlighting the disconnect between regulatory progress and short-term market psychology.

Market structure suggests this tick size adjustment mirrors the evolutionary path of traditional equity options markets, where finer pricing increments typically follow increased liquidity and institutional participation. Similar to the 2021 correction that preceded the maturation of Bitcoin futures markets, this proposal represents a logical next step in the derivatives lifecycle. According to on-chain data, the current "Extreme Fear" sentiment contrasts sharply with the 2021 bull run peak, when greed dominated despite similar regulatory developments. The proposal aims to align CBOE's MBTX options with BlackRock's spot Bitcoin ETF (IBIT), which already employs a finer tick size, creating consistency that reduces arbitrage opportunities and enhances market efficiency. This adjustment is not merely administrative; it reflects the growing Volume Profile in Bitcoin ETF derivatives, which has expanded significantly since the initial ETF approvals in early 2023.

Related developments in this environment include significant wallet activity by figures like Arthur Hayes, who have been accumulating assets despite the fear-driven backdrop, and Ethereum hitting all-time high transaction volumes, indicating underlying network strength amid market volatility.

On December 31, 2025, the SEC announced it has begun reviewing CBOE's proposal to modify tick sizes for MBTX options. The proposal, submitted in late September 2025, seeks to set the minimum price increment at $0.01 for options priced under $3 and $0.05 for those at $3 or more. CBOE argues this change is necessary for consistency with BlackRock's IBIT ETF, which already uses a finer tick size, thereby reducing pricing discrepancies and improving market functionality. This review follows a pattern of incremental regulatory adjustments post-ETF approval, akin to the SEC's historical handling of equity ETF enhancements documented on SEC.gov.

Bitcoin's current price of $88,583 sits within a critical Order Block established during the late 2024 consolidation phase. The 24-hour trend of 0.81% indicates minor bullish momentum, but the Relative Strength Index (RSI) at 45 suggests neutral conditions, with no immediate overbought or oversold signals. Key support levels are identified at the Fibonacci 0.618 retracement level of $82,000, a zone that has historically acted as a liquidity magnet during corrections. Resistance is noted at $92,000, aligning with the 50-day moving average. Market structure suggests a Bullish Invalidation level at $80,000, where a break below would indicate a failure of the current consolidation and potential bearish continuation. Conversely, a Bearish Invalidation level is set at $95,000, above which the market could target previous highs near $100,000. The "Extreme Fear" sentiment, as measured by the Fear & Greed Index, often precedes Liquidity Grab events, where sharp price movements exploit retail panic.

| Metric | Value |

|---|---|

| Bitcoin Current Price | $88,583 |

| 24-Hour Trend | +0.81% |

| Global Crypto Sentiment Score | 21/100 (Extreme Fear) |

| Proposed Tick Size for Options < $3 | $0.01 |

| Proposed Tick Size for Options ≥ $3 | $0.05 |

For institutions, this tick size adjustment reduces transaction costs and enhances pricing precision, facilitating larger-scale options strategies such as delta hedging and gamma scalping. It signals regulatory comfort with Bitcoin ETF derivatives, potentially attracting more capital from traditional finance firms. For retail traders, finer tick sizes can lead to tighter bid-ask spreads, improving execution quality but also increasing competition from algorithmic traders. In the 5-year horizon, this move aligns with broader trends of cryptocurrency market maturation, similar to the post-2017 evolution where regulatory clarity drove institutional adoption. Market analysts note that such technical refinements often precede increased derivatives volume, which can influence spot prices through mechanisms like Gamma Squeeze effects.

On social media platforms like X (formerly Twitter), industry observers have highlighted the proposal's implications for market efficiency. Bulls argue that this is a "stealth bullish" signal, as it reflects growing institutional demand for Bitcoin exposure through regulated channels. One analyst tweeted, "Tick size changes are boring until they're not—this is how markets mature." Others caution that regulatory reviews can be lengthy, with past SEC decisions on crypto derivatives taking months to finalize. The prevailing sentiment among quantitative circles is that this adjustment, while minor, contributes to the normalization of Bitcoin as a financial asset.

Bullish Case: If the SEC approves the proposal promptly and Bitcoin holds above the $82,000 Fibonacci support, increased options activity could drive a rally toward $100,000 by Q2 2026. Market structure suggests that breaking the $95,000 resistance would invalidate bearish scenarios and target new all-time highs. Institutional inflows into ETF options might create a positive feedback loop, similar to the 2023-2024 ETF approval cycle.

Bearish Case: A rejection or delay by the SEC, combined with a break below the $80,000 invalidation level, could trigger a sell-off to $75,000 or lower. The "Extreme Fear" sentiment indicates weak retail conviction, potentially exacerbating downside moves. Historical patterns show that regulatory uncertainties have previously led to prolonged consolidations, such as the 2018-2020 bear market.

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.