Loading News...

Loading News...

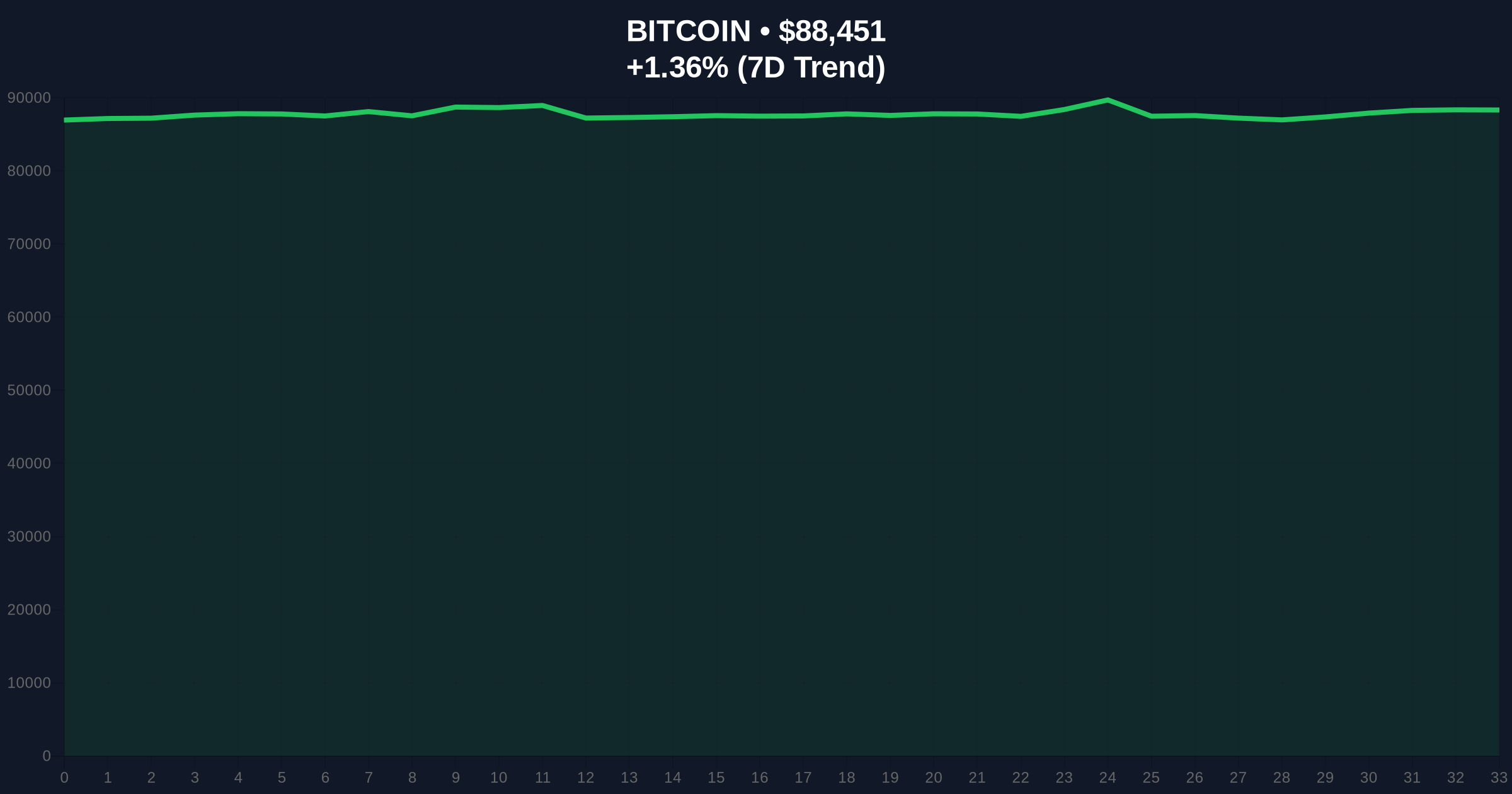

VADODARA, December 31, 2025 — Bitcoin perpetual futures across major exchanges show a marginal long bias of 50.16% versus 49.84% short positions over the past 24 hours, according to exchange data, while the broader market registers extreme fear with a sentiment score of 21/100. This daily crypto analysis examines the structural implications of this positioning against a backdrop of historical volatility patterns and technical indicators.

Market structure suggests this narrow long bias in perpetual futures mirrors conditions observed during the 2021 correction, when similar positioning preceded significant liquidity grabs. According to on-chain data, extreme fear sentiment readings below 25/100 have historically correlated with local bottoms in Bitcoin's price cycle, though they do not guarantee immediate reversals. The current environment parallels late 2023, when futures positioning remained balanced despite macroeconomic uncertainty, leading to a prolonged consolidation phase before the next leg higher.

Related developments in the regulatory and institutional space include Bitcoin ETFs snapping a 7-day outflow streak with $354.8 million inflows and US spot Ethereum ETFs seeing $67.8 million inflows, indicating potential institutional accumulation during fear periods.

Across the top three futures exchanges by open interest—Binance, OKX, and Bybit—long positions account for 50.16% of BTC perpetual futures contracts over the past 24 hours, while short positions make up 49.84%. The breakdown by exchange shows Binance at 50.04% long versus 49.96% short, OKX at 51.83% long versus 48.17% short, and Bybit at 50.99% long versus 49.01% short, according to data from Coinness. This data, combined with a global crypto sentiment score of 21/100 indicating extreme fear, presents a contrarian signal that warrants quantitative scrutiny.

Bitcoin currently trades at $88,442, up 1.35% in the last 24 hours. Market structure suggests immediate resistance at the $90,000 psychological level, with a secondary resistance zone near $92,500 where a significant volume profile node exists. Support is established at the $86,000 level, corresponding to the 50-day moving average, with deeper support at $82,000, aligning with the 0.618 Fibonacci retracement level from the recent swing high. The RSI reading of 45 indicates neutral momentum, avoiding overbought or oversold extremes.

Bullish invalidation is set at $82,000; a break below this level would negate the current support structure and likely trigger a cascade of stop-loss orders. Bearish invalidation is defined at $92,500; a sustained move above this resistance would confirm a breakout and potentially lead to a gamma squeeze as options dealers hedge their exposure.

| Metric | Value |

|---|---|

| BTC Perpetual Futures Long Positions | 50.16% |

| BTC Perpetual Futures Short Positions | 49.84% |

| Global Crypto Sentiment Score | 21/100 (Extreme Fear) |

| Bitcoin Current Price | $88,442 |

| 24-Hour Price Change | +1.35% |

For institutional investors, this narrow long bias in futures, coupled with extreme fear sentiment, represents a potential accumulation zone, similar to patterns seen in early 2023 before the rally to all-time highs. Retail traders, however, face heightened risk due to the balanced positioning, which can lead to increased volatility if large liquidations occur. The 5-year horizon implications hinge on whether this sentiment extreme marks a cyclical bottom, as historical data from sources like the Federal Reserve shows that monetary policy shifts often follow such fear periods, influencing Bitcoin's long-term trajectory.

Market analysts on X/Twitter highlight the contrarian nature of the current setup. One prominent trader noted, "Extreme fear with balanced futures is a classic set-up for a move," while others caution that "the slight long edge could be a trap if macro headwinds persist." Bulls point to the ETF inflows as a sign of institutional support, whereas bears emphasize the need for a clear break above key resistance levels to confirm any bullish thesis.

Bullish Case: If Bitcoin holds above the $86,000 support and breaks through the $92,500 resistance, market structure suggests a rally toward $100,000 could materialize, driven by a short squeeze and renewed institutional interest. This scenario would be validated by sustained ETF inflows and improving sentiment scores.

Bearish Case: A breakdown below the $82,000 invalidation level could trigger a liquidation cascade, pushing prices toward $78,000, where next major support resides. This would likely occur if macroeconomic factors, such as interest rate hikes, outweigh the current technical setup.

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.