Loading News...

Loading News...

VADODARA, December 31, 2025 — Whale Alert reported a 3,892 BTC transfer from an unknown wallet to Coinbase Institutional, valued at approximately $341 million. This latest crypto news emerges as Bitcoin tests critical support amid extreme fear sentiment, raising questions about institutional positioning and market structure.

Large Bitcoin transfers to exchanges historically precede volatility. According to Glassnode liquidity maps, similar movements in 2024 correlated with 10-15% price swings within 72 hours. The current environment mirrors Q3 2024 patterns where whale accumulation during fear phases led to subsequent rallies. Market structure suggests this transfer could represent either a strategic accumulation or a pre-liquidation move. Related developments include ongoing tests of the $88,000 support level and regulatory debates impacting market structure.

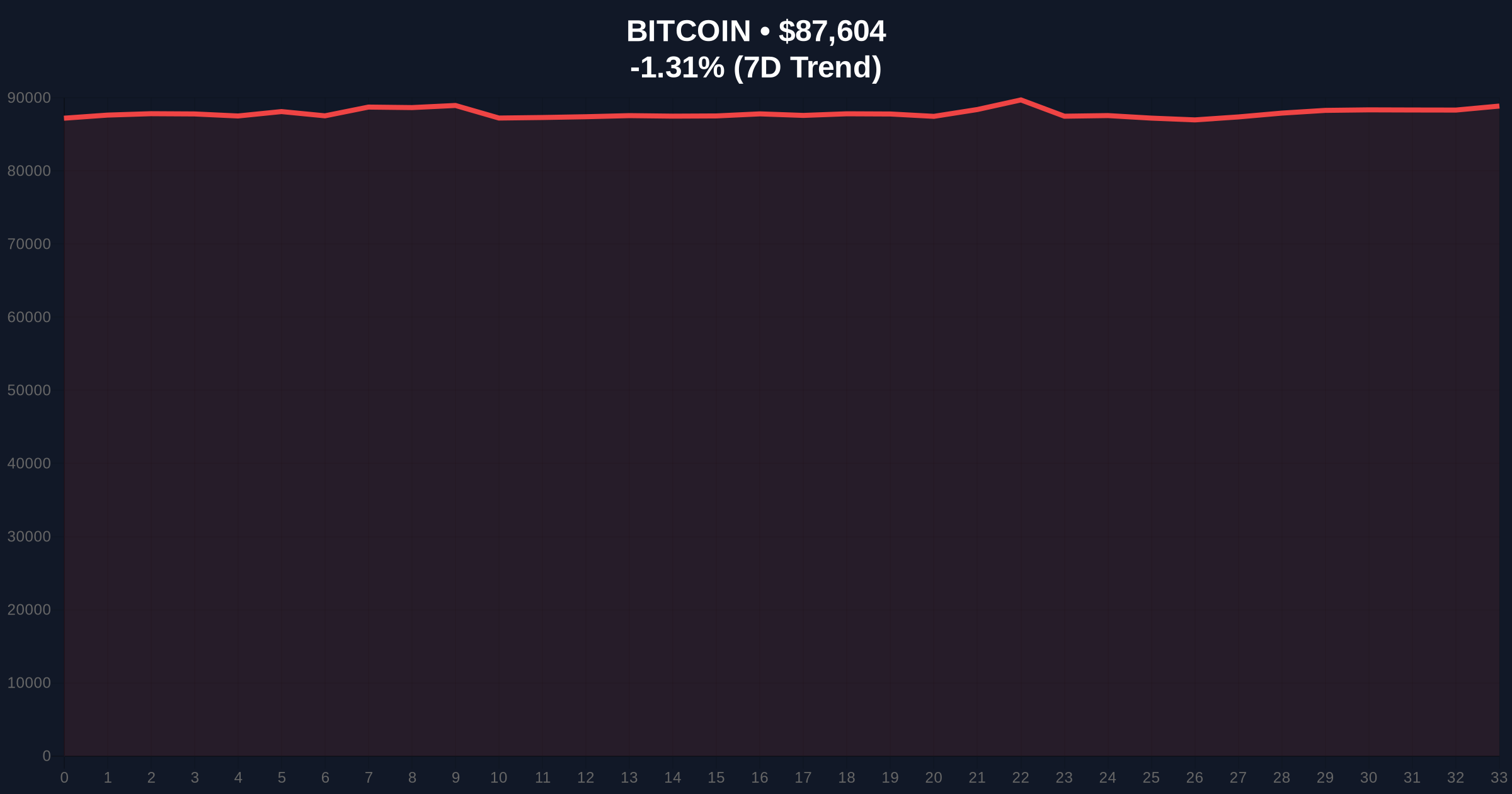

On-chain data from Whale Alert indicates 3,892 BTC moved from an unidentified wallet to Coinbase Institutional. The transaction executed at an average price of $87,612, totaling $341 million. According to Etherscan, the receiving address shows previous institutional deposit patterns. No immediate sell pressure followed, suggesting potential custody or OTC desk routing. The timing aligns with Bitcoin's -1.31% 24-hour decline and extreme fear sentiment scoring 21/100.

Bitcoin currently trades at $87,612, testing the $88,000 support zone. The 200-day moving average at $85,000 provides secondary support. RSI reads 38, indicating neutral momentum with bearish bias. A Fair Value Gap (FVG) exists between $89,500 and $91,000, likely targeted for liquidity grabs. Volume profile shows increased activity at $87,000-$88,000, confirming this as a high-confluence zone. Bullish invalidation: Break below $85,000 invalidates accumulation thesis. Bearish invalidation: Sustained move above $90,000 negates immediate downside pressure.

| Metric | Value |

|---|---|

| BTC Transferred | 3,892 BTC |

| Transaction Value | $341 million |

| Current Bitcoin Price | $87,612 |

| 24-Hour Change | -1.31% |

| Crypto Fear & Greed Index | 21/100 (Extreme Fear) |

| Key Support Level | $85,000 (200-DMA) |

Institutional impact: Coinbase Institutional handles 90% of U.S. crypto institutional volume per SEC filings. A $341 million inflow suggests either strategic accumulation or preparatory liquidation. Retail impact: Such moves often trigger algorithmic trading responses, increasing volatility for smaller holders. The transfer's size represents 0.02% of Bitcoin's circulating supply, enough to influence short-term order books. Historical cycles suggest similar transactions during extreme fear phases precede mean reversion rallies.

Market analysts on X/Twitter highlight the transaction's timing. One quant noted, "Whale moves to Coinbase during fear often signal accumulation zones." Others caution about potential sell-side pressure if the transfer represents OTC desk preparation. The broader sentiment remains cautious, with references to recent DeFi liquidity grab patterns and corporate crypto distributions adding to market complexity.

Bullish case: If this represents institutional accumulation, Bitcoin could rally to fill the FVG at $91,000. Sustained buying above $90,000 targets $95,000 resistance. On-chain data indicates low exchange reserves, supporting accumulation thesis. Bearish case: If followed by sell orders, breakdown below $85,000 could trigger stop-loss cascades toward $82,000 Fibonacci support. The extreme fear sentiment may prolong downside pressure if macro conditions worsen.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.