Loading News...

Loading News...

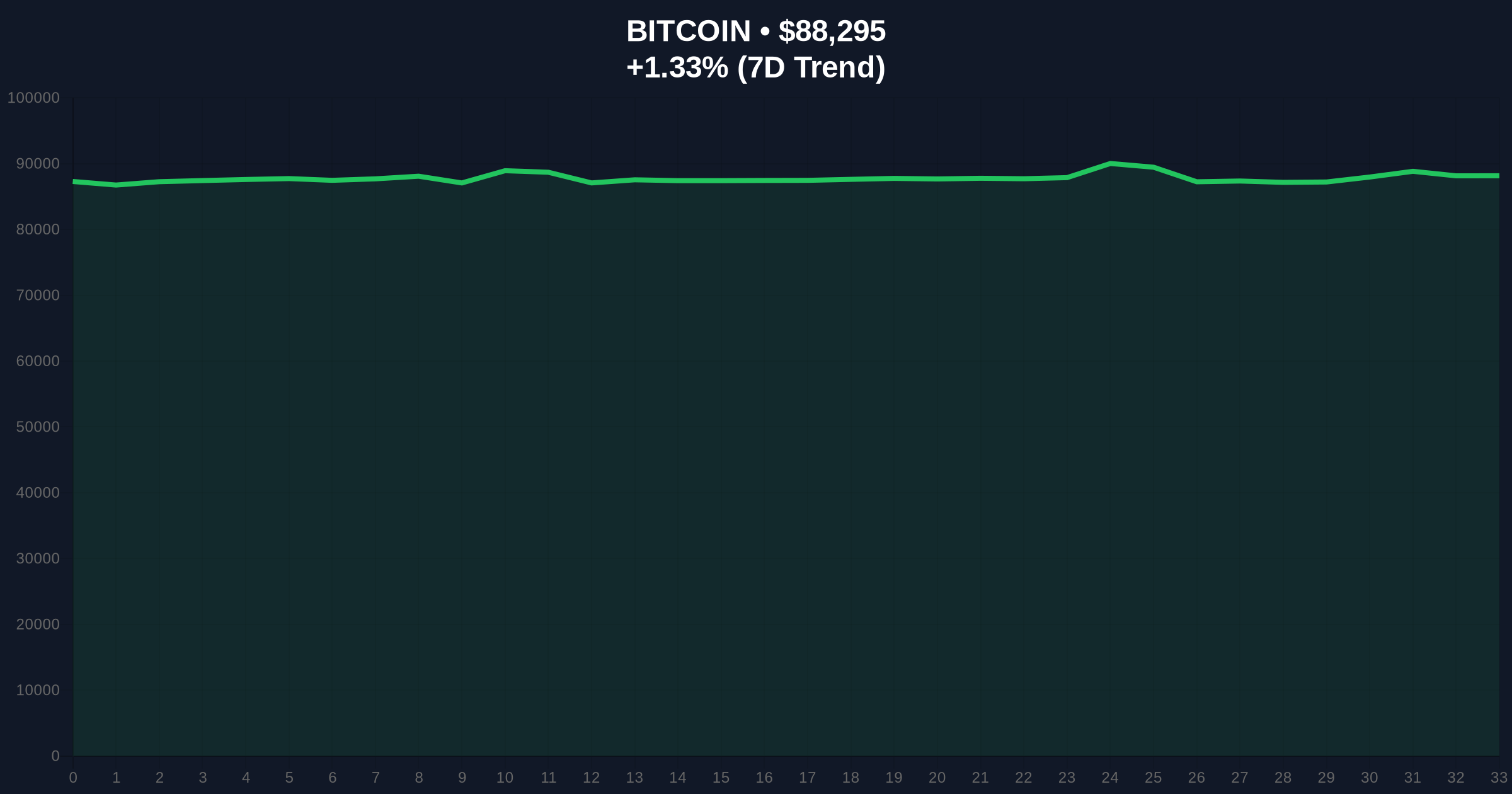

VADODARA, December 31, 2025 — U.S. spot Bitcoin exchange-traded funds (ETFs) recorded total net inflows of $354.77 million on December 30, 2025, snapping a seven-day streak of net outflows, according to data compiled by TraderT. This latest crypto news marks a significant reversal in institutional flow patterns as Bitcoin trades at $88,332, up 1.38% in 24 hours, against a backdrop of extreme market fear. BlackRock's IBIT led the inflows with $143.49 million, followed by Ark Invest's ARKB with $109.56 million and Fidelity's FBTC with $78.59 million.

This inflow event occurs within a broader market structure characterized by persistent outflows and deteriorating sentiment. The seven-day outflow streak preceding December 30 had drained approximately $1.2 billion from U.S. spot Bitcoin ETFs, exacerbating a liquidity vacuum that pressured prices. Underlying this trend is a global crypto sentiment score of 21/100, classified as "Extreme Fear" by market indices, reflecting heightened risk aversion among investors. Historically, such sentiment extremes have often preceded sharp reversals, as seen in the March 2023 banking crisis when Bitcoin rallied from $20,000 to $30,000 amid similar fear levels. The current environment mirrors the 2021 correction where ETF flows turned positive after prolonged outflows, signaling potential capitulation.

Related developments include a short squeeze dominating crypto liquidations as market fear hits extreme levels, and Arthur Hayes' $2M token withdrawal signaling strategic portfolio reallocation.

On December 30, 2025, U.S. spot Bitcoin ETFs collectively attracted $354.77 million in net inflows, breaking a consecutive seven-day outflow streak. According to the data, BlackRock's IBIT was the primary driver, accounting for $143.49 million or approximately 40% of the total inflow. Ark Invest's ARKB contributed $109.56 million, while Fidelity's FBTC added $78.59 million. Other funds with positive flows included Bitwise's BITB ($13.87 million), VanEck's HODL ($4.98 million), and the Grayscale Bitcoin Mini ETF ($4.28 million). This inflow event coincided with Bitcoin's price rising 1.38% to $88,332, suggesting a potential correlation between institutional buying pressure and short-term price appreciation.

Market structure suggests Bitcoin is currently testing a critical Fibonacci support level at $85,000, derived from the 0.618 retracement of the recent rally from $75,000 to $95,000. The Relative Strength Index (RSI) on the daily chart reads 42, indicating neutral momentum with a slight bearish bias, while the 50-day moving average sits at $86,500, providing dynamic support. Volume profile analysis shows increased accumulation near the $88,000 level, potentially forming an order block that could catalyze a move higher. A Fair Value Gap (FVG) exists between $90,000 and $92,000, which may act as immediate resistance if bullish momentum sustains. The Bullish Invalidation level is set at $85,000; a break below this Fibonacci support would invalidate the current inflow-driven optimism and likely trigger further outflows. Conversely, the Bearish Invalidation level is $92,000; a close above this resistance could confirm a trend reversal and attract additional institutional capital.

| Metric | Value |

|---|---|

| Total ETF Net Inflows (Dec 30) | $354.77 million |

| BlackRock IBIT Inflows | $143.49 million |

| Bitcoin Current Price | $88,332 |

| 24-Hour Price Change | +1.38% |

| Global Crypto Sentiment Score | 21/100 (Extreme Fear) |

This inflow reversal holds significant implications for both institutional and retail participants. For institutions, the resumption of positive ETF flows indicates renewed confidence among large asset managers like BlackRock and Fidelity, potentially signaling a bottom in the short-term outflow cycle. According to the U.S. Securities and Exchange Commission, ETF flows are a key indicator of institutional sentiment, and sustained inflows could support Bitcoin's valuation by adding billions in buying pressure over time. For retail investors, this development may alleviate some fear-driven selling, as ETF inflows often correlate with reduced volatility and improved market liquidity. Consequently, a continuation of this trend could help stabilize prices above critical support levels, reducing the risk of a deeper correction.

Market analysts on X/Twitter have reacted with cautious optimism. One quant trader noted, "The ETF inflow spike amid extreme fear is classic contrarian signal—smart money buying when others are fearful." Another analyst highlighted, "BlackRock's $143M inflow suggests institutional accumulation at these levels, which could set up a gamma squeeze if options activity picks up." Bulls argue that this flow reversal mirrors historical patterns where ETF inflows preceded major rallies, while bears caution that a single day of inflows does not confirm a trend change, pointing to ongoing macroeconomic headwinds like potential Federal Reserve rate hikes.

Bullish Case: If ETF inflows persist and Bitcoin holds above the $85,000 support, market structure suggests a rally toward the $95,000 resistance zone. A break above $92,000 could trigger a short squeeze, pushing prices to test the all-time high near $100,000. This scenario assumes improving sentiment and sustained institutional demand, potentially fueled by developments like Ethereum's EIP-4844 upgrade enhancing blockchain efficiency.

Bearish Case: If inflows prove temporary and Bitcoin breaks below $85,000, on-chain data indicates a drop to the next support at $80,000. Prolonged outflows coupled with extreme fear could lead to a liquidity grab, driving prices toward $75,000. This scenario would likely involve continued macroeconomic pressures, such as rising interest rates impacting risk assets.

Data source: Read Original Report

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.