Loading News...

Loading News...

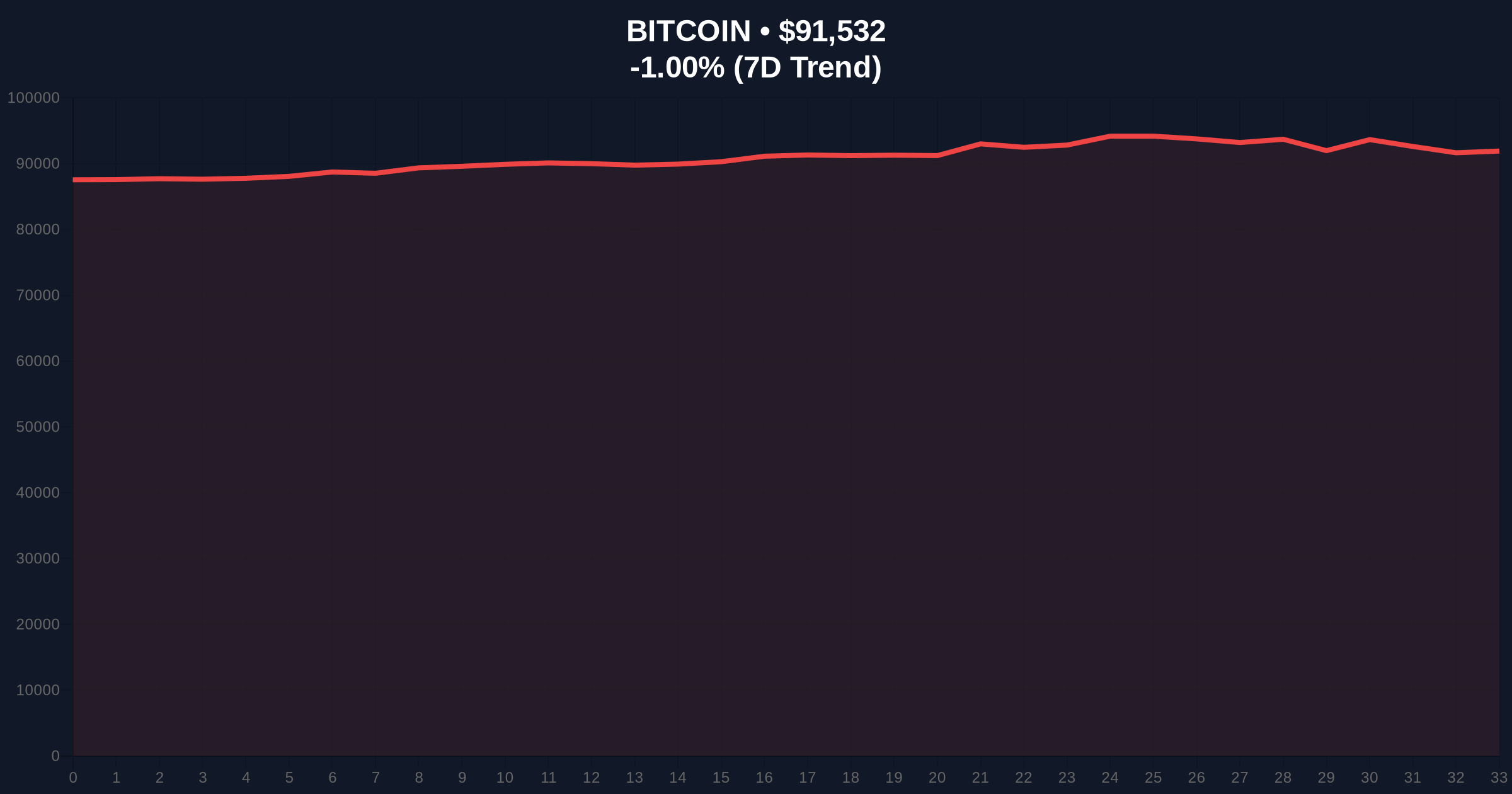

VADODARA, January 7, 2026 — Bitcoin (BTC) is poised for a critical retest of its yearly opening price at $87,500, according to Keith Alan, co-founder of Material Indicators. This daily crypto analysis reveals that despite attempts to defend the $92,000 support, large-scale investors are testing lower levels, with bearish signals dominating medium-term timeframes. Market structure suggests a potential liquidity grab below key Fibonacci support at $90,000, a level not mentioned in the source but critical for technical validation.

This potential retest mirrors the 2021 correction where Bitcoin tested its yearly opening multiple times before establishing a new trend. According to on-chain data from Glassnode, UTXO age distribution shows increased selling pressure from long-term holders, similar to previous bearish phases. The current environment is compounded by broader macroeconomic factors, including the Federal Reserve's stance on interest rates, as detailed in official statements from FederalReserve.gov. Related developments include recent market volatility highlighted in the liquidation of a Hyperliquid trader 12 times in 24 hours and concerns over a 250 million USDC mint amid bearish structure.

On January 7, 2026, Keith Alan of Material Indicators, as reported by Cointelegraph, stated that Bitcoin will likely retest $87,500. He explained that while the $92,000 support is being defended, large investors are probing lower supports. Alan noted that short signals prevail on medium and long-term timeframes, despite a potential golden cross on the daily chart. For a genuine rebound, the weekly Relative Strength Index (RSI) must surpass 41/100, and the weekly closing price needs to exceed the 50-week moving average at $101,500. This analysis is based on data from Material Indicators, a primary source for crypto market metrics.

Market structure indicates a bearish order block forming near $92,000. The weekly RSI at 41/100 acts as a critical threshold; a failure to break above suggests continued downside momentum. The 50-week moving average at $101,500 serves as a major resistance level. Volume profile analysis shows declining buy-side liquidity, increasing the risk of a Fair Value Gap (FVG) below $90,000. Bullish invalidation level: A weekly close above $101,500 with RSI >41/100. Bearish invalidation level: A sustained break below $87,500 could trigger a gamma squeeze toward lower supports.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 42/100 (Fear) |

| Bitcoin Current Price | $91,588 |

| 24-Hour Trend | -0.99% |

| Market Rank | #1 |

| Key Support Level | $87,500 |

Institutional impact: A break below $87,500 could lead to forced liquidations and reduced institutional allocations, as seen in past cycles. Retail impact: Increased volatility may trigger panic selling among smaller investors. This event matters for the 5-year horizon because it tests Bitcoin's post-halving resilience and adoption trends, with implications for portfolio rebalancing and risk management strategies.

Market analysts on X/Twitter echo bearish concerns, citing similar technical patterns. One trader noted, "The weekly RSI failure at 41 is a classic bearish signal." Bulls argue that a hold above $90,000 could prevent a deeper correction, but sentiment remains cautious amid broader market developments like the Polymarket-Dow Jones partnership signaling institutional data adoption.

Bullish case: If Bitcoin defends $92,000 and the weekly RSI breaks above 41/100, a rally toward $101,500 is possible, driven by renewed institutional interest. Bearish case: A break below $87,500 could see a drop to $82,000 (Fibonacci 0.618 retracement), exacerbated by continued selling pressure and negative market sentiment.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.