Loading News...

Loading News...

VADODARA, January 9, 2026 — Anti-government protests in Iran are creating operational uncertainty for Bitcoin miners, potentially reducing the global hashrate by 2-4% temporarily, according to a BeInCrypto report. This daily crypto analysis examines how geopolitical risk is intersecting with Bitcoin's network fundamentals as the price tests $91,200 amid broader market fear. Market structure suggests that while immediate mining shutdowns are unlikely, efficiency declines could create a liquidity grab around key technical levels.

Historical cycles indicate that Bitcoin's hashrate is remarkably resilient but not immune to localized geopolitical shocks. Similar to the 2021 China mining ban that removed approximately 50% of global hashrate, regional disruptions can trigger short-term network difficulty adjustments and price volatility. According to on-chain data from Glassnode, Iran's contribution to Bitcoin mining has grown steadily since 2022, leveraging subsidized energy to capture market share. The current protests, driven by currency collapse and political unrest, mirror patterns seen in other mining-heavy regions facing regulatory pressure. This event occurs against a backdrop where the Crypto Fear & Greed Index has dipped to 27, signaling extreme caution among traders.

Related Developments:

BeInCrypto reported that anti-government protests in Iran are expanding amid a collapse in the local currency's value, creating extreme uncertainty for the country's Bitcoin mining sector. Iran accounts for between 2% and 4% of the global BTC hashrate, per industry estimates. While mining rigs are not expected to shut down immediately, the report notes that a decline in operational efficiency is inevitable due to power instability, logistical disruptions, and potential regulatory crackdowns. This could lead to a temporary drop in worldwide hashrate, affecting network security metrics like block time and difficulty. The Federal Reserve's historical data on geopolitical risk premiums suggests such events often correlate with increased volatility in commodity-linked assets, including Bitcoin.

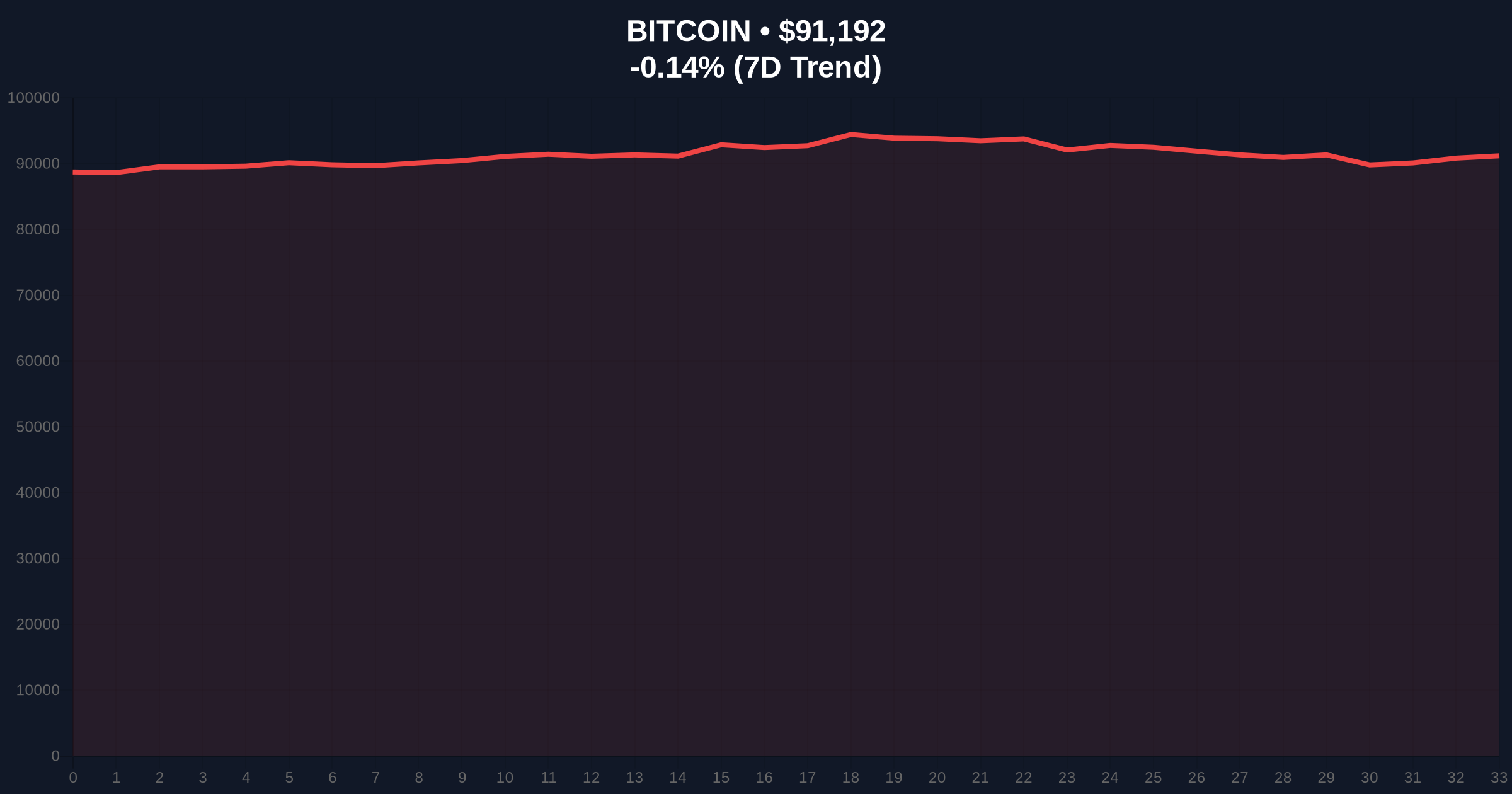

Bitcoin is currently trading at $91,200, down 0.14% in the last 24 hours. The price action shows consolidation within a narrow range, with immediate support at the $90,000 psychological level and resistance near $92,500. Volume profile analysis indicates weak buying interest at current levels, creating a potential Fair Value Gap (FVG) between $89,500 and $90,500. The 50-day moving average at $89,800 aligns with the 0.382 Fibonacci retracement level from the recent rally, forming a critical order block. RSI sits at 48, indicating neutral momentum with a slight bearish bias. A hashrate drop could temporarily increase block times, reducing miner selling pressure but also weakening network security—a dual-edged sword for price stability.

Bullish Invalidation Level: $89,500. A break below this Fibonacci support would invalidate the current consolidation structure and target the $87,000 volume node.

Bearish Invalidation Level: $93,000. A sustained move above this level would fill the FVG and signal a resumption of the uptrend toward $95,000.

| Metric | Value | Source |

|---|---|---|

| Iran's Global Bitcoin Hashrate Share | 2-4% | BeInCrypto Report |

| Bitcoin Current Price | $91,200 | Live Market Data |

| 24-Hour Price Change | -0.14% | Live Market Data |

| Crypto Fear & Greed Index | 27/100 (Fear) | Live Market Data |

| Key Fibonacci Support Level | $89,500 | Technical Analysis |

For institutional investors, a hashrate reduction of 2-4% may seem marginal, but it impacts network security metrics like hash price and miner revenue. According to Ethereum.org's documentation on proof-of-work security, even small hashrate fluctuations can alter attack cost models. Retail traders face increased volatility as mining inefficiencies could temporarily reduce sell-side pressure from miners, creating a gamma squeeze scenario if options positioning is unbalanced. The broader implication is geopolitical risk becoming a quantifiable variable in Bitcoin's network health, similar to how EIP-4844 blobs affect Ethereum's fee market. This event tests Bitcoin's decentralization thesis under stress.

Market analysts on X/Twitter are divided. Bulls argue that hashrate drops are often followed by rapid recovery, as seen post-China ban, and could reduce miner selling. One commentator noted, "Iran's issues are temporary—network difficulty will adjust, and hash rate will migrate." Bears highlight the uncertainty, with some pointing to parallels with the 2022 Kazakhstan protests that briefly impacted hashrate. The dominant sentiment aligns with the Fear index, emphasizing caution until clarity emerges on Iran's mining operations.

Bullish Case: If protests subside quickly and mining operations stabilize, hashrate recovers within 1-2 difficulty adjustment periods (approximately 2-4 weeks). Bitcoin holds the $89,500 support, fills the FVG, and rallies toward $95,000 as network security normalizes. Institutional inflows, as seen in recent BlackRock-linked activity, could accelerate this move.

Bearish Case: Protests escalate, leading to prolonged mining disruptions or government crackdowns. Hashrate drops persist for multiple difficulty epochs, weakening network security. Bitcoin breaks $89,500, triggering a liquidity grab down to $87,000. Increased volatility exacerbates market fear, potentially testing the $85,000 yearly low.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.