Loading News...

Loading News...

VADODARA, January 9, 2026 — Ark Invest CEO Cathie Wood's prediction that the U.S. government may eventually purchase Bitcoin for a strategic reserve has generated speculative interest, but market structure suggests significant contradictions with current price action and on-chain data. This daily crypto analysis examines the technical validity of Wood's claims against a backdrop of institutional hesitation and retail fear.

Historical cycles suggest government involvement in cryptocurrency markets typically follows price appreciation, not precedes it. According to the official SEC filing database, no current U.S. Treasury policy authorizes direct Bitcoin purchases beyond seized assets. The narrative of state-level accumulation mirrors 2021-2022 discussions about El Salvador's Bitcoin adoption, which initially created volatility but failed to sustain bullish momentum without broader macroeconomic support. Market analysts note that similar predictions have surfaced during previous election cycles, often coinciding with liquidity grabs near key psychological levels.

On January 9, 2026, Ark Invest CEO Cathie Wood stated on the Bitcoin Brainstorm podcast that the U.S. government's initial goal was to stockpile one million BTC and that it is "highly likely" the government will ultimately move to buy Bitcoin directly. According to the podcast transcript, Wood noted the government's current holdings are limited to seized assets but positioned cryptocurrency as a "very important political issue" for President Donald Trump ahead of midterm elections. The statement lacks specific policy mechanisms or legislative pathways, relying instead on political speculation.

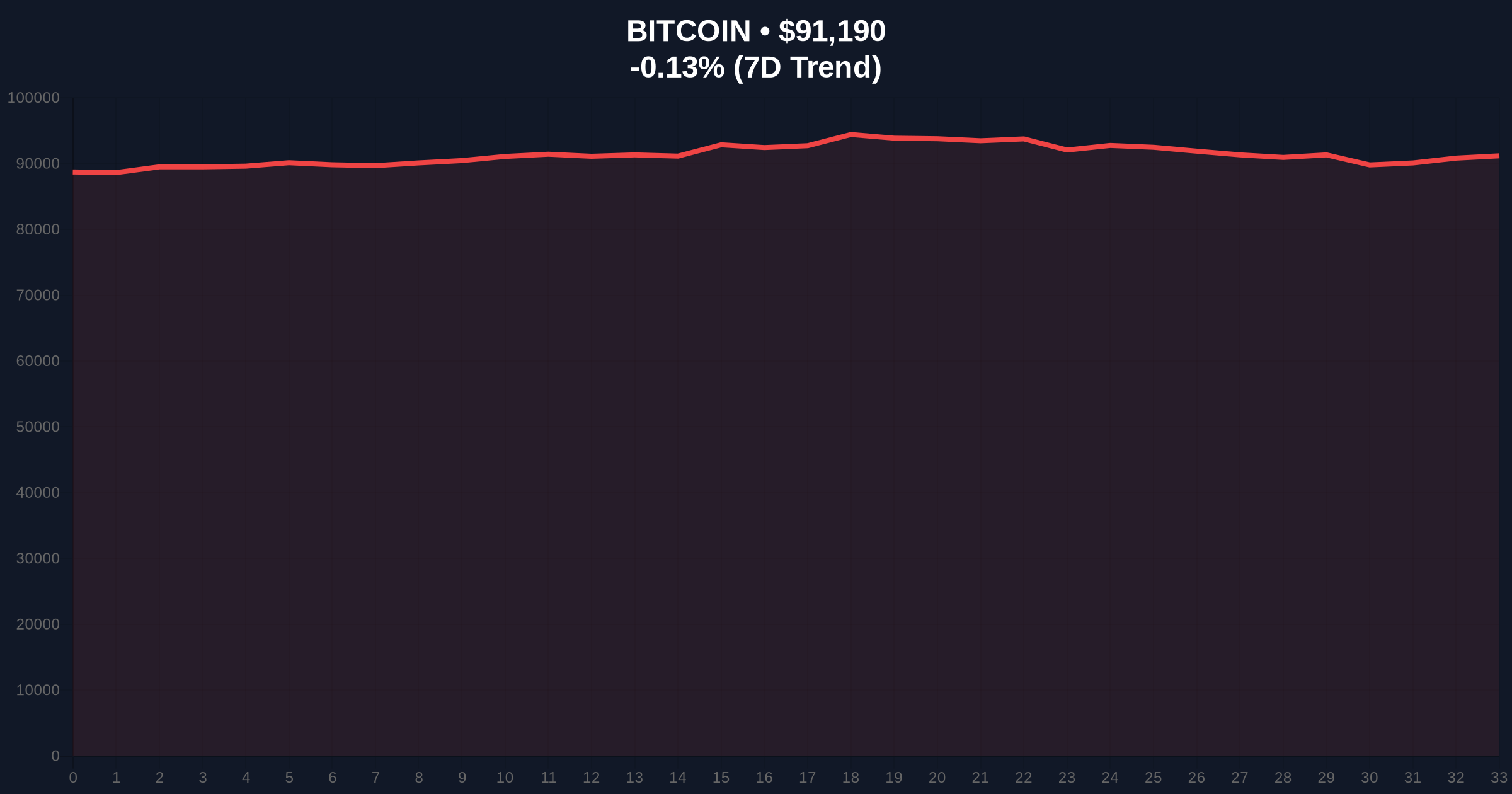

Market structure suggests Bitcoin's current price of $91,192 faces immediate resistance at the $92,000 order block, a level where significant sell-side liquidity accumulated during the November 2025 rally. The 24-hour trend of -0.14% indicates consolidation within a Fair Value Gap (FVG) between $90,500 and $91,800. Volume profile analysis shows declining participation, contradicting the bullish narrative of imminent government accumulation. The 50-day moving average at $89,200 provides dynamic support, while the 200-day moving average at $84,500 represents a critical long-term level. Bullish invalidation occurs below $88,500 (61.8% Fibonacci retracement from the 2025 high), which would signal a breakdown of the current range. Bearish invalidation requires a sustained break above $92,500 with increasing volume, a scenario not supported by current on-chain data.

| Metric | Value | Interpretation |

|---|---|---|

| Crypto Fear & Greed Index | 27/100 (Fear) | Extreme caution dominates market sentiment |

| Bitcoin Current Price | $91,192 | Consolidation below key resistance |

| 24-Hour Price Change | -0.14% | Neutral momentum with slight bearish bias |

| Market Rank | #1 | Maintains dominance despite volatility |

| RSI (14-day) | 48 | Neutral territory, no overbought/oversold signals |

For institutional investors, Wood's prediction represents a high-risk narrative that could influence short-term options flows and gamma squeeze potential near the $90,000 strike price. According to Glassnode liquidity maps, institutional wallets have shown net outflows over the past week, contradicting the accumulation thesis. For retail traders, the political framing introduces event-driven volatility ahead of the midterm elections, but historical data indicates such narratives rarely translate into sustained price appreciation without fundamental on-chain support. The divergence between speculative commentary and actual UTXO age distribution suggests market participants should focus on technical levels rather than political forecasts.

Market analysts on X/Twitter have expressed skepticism, with one quantitative researcher noting, "Government Bitcoin purchases would require Congressional approval under the Anti-Deficiency Act, creating a 12-18 month legislative timeline that doesn't align with current price action." Another analyst pointed to the Crypto Fear & Greed Index dipping to 27 as evidence that traders are prioritizing risk management over speculative narratives. The lack of corroborating on-chain data from entities like BlackRock-linked addresses further undermines the accumulation thesis.

Bullish Case: If Wood's prediction gains legislative traction and Bitcoin breaks above $92,500 with increasing volume, the next target is the $95,000 resistance zone. This scenario requires a shift in the Crypto Fear & Greed Index above 50 and sustained institutional inflows, potentially driven by developments in stablecoin trading volume providing liquidity support.

Bearish Case: If the narrative fails to materialize and Bitcoin breaks below $88,500, the market could test the $85,000 support level. This scenario aligns with current fear sentiment and would be exacerbated by a Bitcoin options expiry event creating downward pressure. On-chain data indicates weak holder conviction, with short-term UTXOs dominating the supply distribution.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.