Loading News...

Loading News...

VADODARA, February 2, 2026 — On-chain analytics firm Santiment has identified a critical inflection point in Bitcoin price action, reporting that peak levels of Fear, Uncertainty, and Doubt (FUD) on social media platforms historically precede short-term market rebounds. According to social data scraped by Santiment, retail investor sentiment has plunged to its most bearish level since November 21, 2025, coinciding with Bitcoin's 16% decline from its January 28 high. This data-driven signal arrives as the broader market grapples with an Extreme Fear environment, setting the stage for a potential liquidity-driven reversal.

Santiment's analysis, published via its official X account, provides a quantitative framework for the current market psychology. The firm's data indicates a direct correlation between the proliferation of negative social media commentary and subsequent price recoveries. Specifically, the current sentiment trough mirrors conditions observed during previous sharp corrections. Market structure suggests this is not mere coincidence but a reflection of crowd psychology, where maximum pessimism often exhausts selling pressure. Consequently, the data presents a clear, measurable signal: social FUD has reached a statistical extreme.

Underlying this trend is a 16% drawdown in Bitcoin's price since late January. This decline has acted as a catalyst, amplifying negative narratives and creating a self-reinforcing cycle of fear. Santiment's methodology tracks mentions, sentiment polarity, and discussion volume across major platforms, converting qualitative chatter into a quantitative bearishness score. The firm asserts that such peaks in negative public opinion typically resolve with short-term relief rallies, as the market absorbs the last wave of weak-handed sellers.

Historically, sentiment extremes have served as powerful contrarian indicators. The November 21, 2025, sentiment low referenced by Santiment preceded a 12% rally over the following two weeks. Similarly, during the 2022 bear market, multi-year lows in social sentiment often marked local price bottoms before significant bounces. This pattern is rooted in market microstructure; when the last retail seller capitulates, the order book clears, creating a vacuum for buyers to step in at discounted prices.

In contrast, periods of euphoric social sentiment, like those seen near all-time highs, frequently precede corrections. The current setup inverts that dynamic. , this sentiment extreme occurs alongside other market developments, including a surge in physical security threats and strategic moves by major exchanges. For instance, wrench attacks have surged 75%, correlating with high fear environments, while platforms like Coinbase list new perpetual futures to capture volatility. Additionally, entities like Ripple are executing strategic token locks, and traditional finance explores products like a potential Cboe binary options relaunch, all within this high-stress market phase.

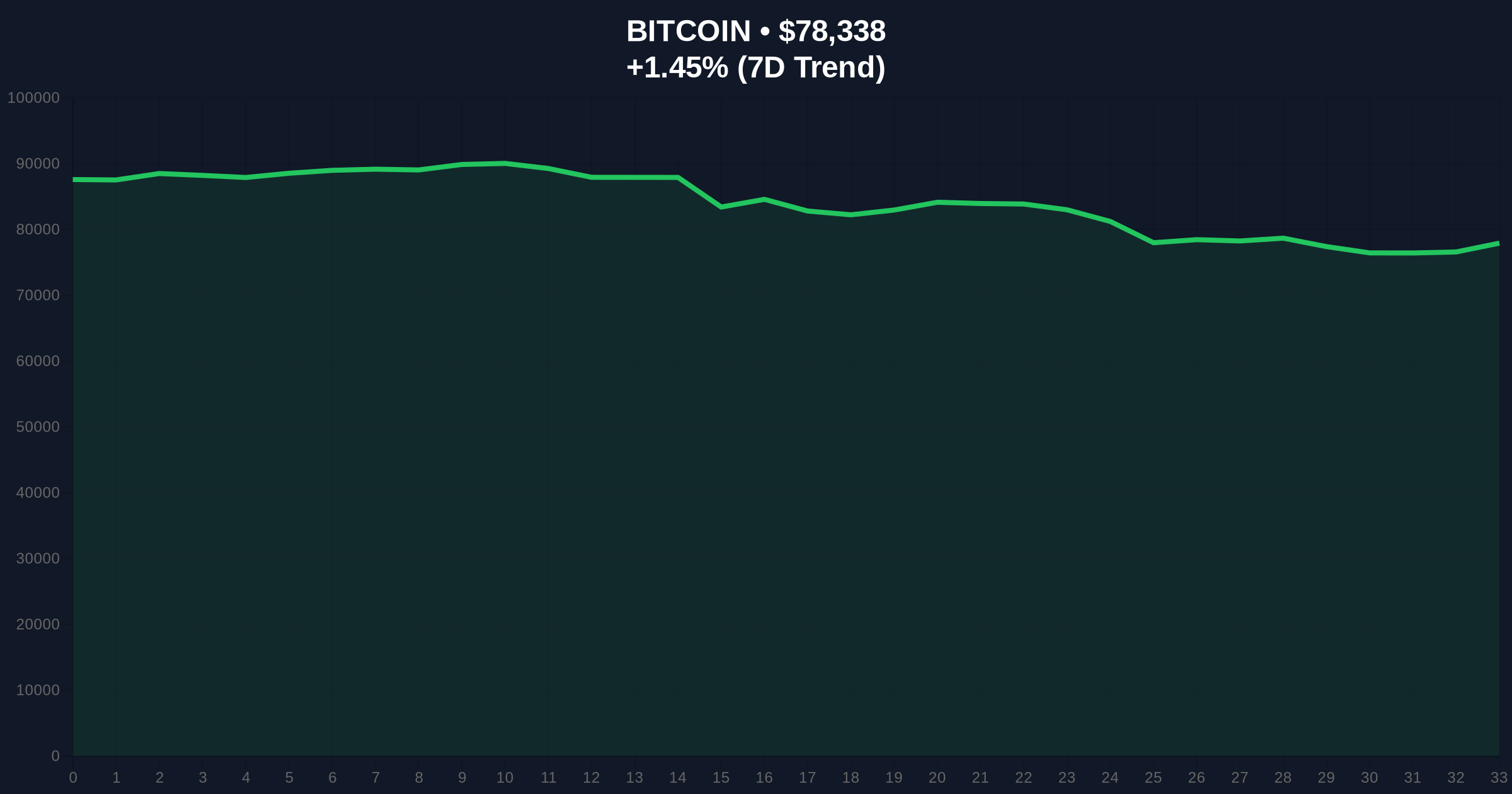

The sentiment data intersects with a precarious technical . Bitcoin currently trades at approximately $78,232, having breached several short-term moving averages. A critical support zone converges around the $75,000 level. This area represents the 200-day simple moving average and the 0.618 Fibonacci retracement level from the October 2025 low to the January 2026 high—a classic technical confluence. A sustained hold above this zone would validate the bullish reversal thesis suggested by sentiment extremes.

Conversely, the immediate resistance forms a Fair Value Gap (FVG) between $81,500 and $83,000, created during the recent sell-off. This FVG will likely act as a magnet for price on any upward move, as the market seeks to fill this liquidity void. The Relative Strength Index (RSI) on the daily chart sits near 35, indicating oversold conditions but not yet at extreme capitulation levels seen at major cycle lows. Volume profile analysis shows significant volume nodes around $77,000, suggesting this is a battleground for bulls and bears.

| Metric | Value | Context |

|---|---|---|

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Primary sentiment gauge; aligns with Santiment data. |

| Bitcoin (BTC) Current Price | $78,232 | Down ~16% from Jan. 28 high. |

| 24-Hour Price Trend | +1.31% | Early signs of potential rebound. |

| Key Fibonacci Support | $75,000 (0.618 level) | Critical technical confluence zone. |

| Social Sentiment Low Date | Nov. 21, 2025 | Previous comparable bearish extreme. |

This development matters because it provides a data-backed framework for navigating high-volatility environments. Retail sentiment, while often wrong at extremes, creates measurable market inefficiencies. Institutional players monitor these signals to time entries into oversold assets. The proliferation of FUD can trigger a gamma squeeze in options markets if a rapid price move forces market makers to hedge dynamically. , understanding these cycles is for long-term portfolio construction, as buying during sentiment extremes has historically generated superior risk-adjusted returns over a 5-year horizon.

"Santiment's data provides a quantifiable measure of crowd psychology. When social media reaches peak negativity, it often indicates that the weak hands have finished selling. This doesn't guarantee an immediate V-shaped recovery, but it statistically increases the probability of a short-term bullish reversal as selling pressure exhausts. The key is to watch for a confirmation in price action, such as a reclaim of the $81,500 level." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on the current data set. The bullish scenario involves Bitcoin holding the $75,000 support, absorbing the remaining sell orders, and rallying to fill the FVG up to $83,000. The bearish scenario involves a breakdown below the key Fibonacci support, potentially triggering a cascade of stop-loss orders and a test of lower support near $70,000.

The 12-month institutional outlook remains cautiously optimistic, contingent on macroeconomic factors like the Federal Reserve's interest rate trajectory. However, the current sentiment setup is a tactical bullish signal within a longer-term consolidation phase. Historical cycles suggest that such sentiment washes are necessary to build a foundation for the next leg higher in the 5-year horizon.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.