Loading News...

Loading News...

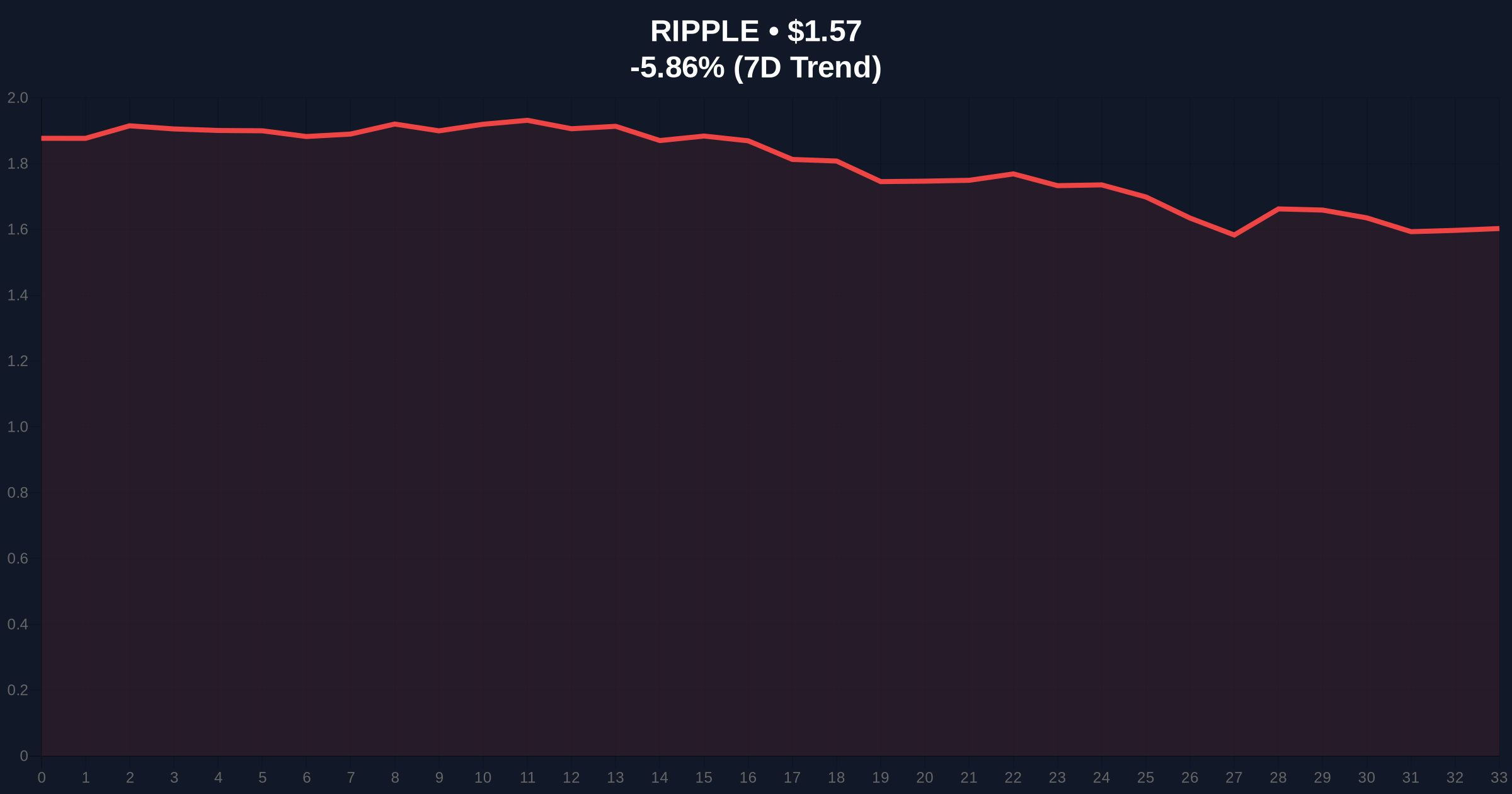

VADODARA, February 2, 2026 — Whale Alert, the blockchain tracking service, reported a single transaction locking 400 million XRP into Ripple's escrow system. This daily crypto analysis reveals a market structure anomaly: the theoretically supply-constraining event coincides with XRP's price dropping 5.86% to $1.57 and the broader Crypto Fear & Greed Index hitting 14/100 (Extreme Fear).

According to Whale Alert's on-chain data, Ripple executed a 400 million XRP transfer into a programmed escrow contract. This represents approximately 0.4% of XRP's total circulating supply. The transaction occurred against a backdrop of severe market stress. Market structure suggests this is a routine quarterly escrow replenishment from Ripple's treasury, not a novel bullish signal. The official Ripple escrow mechanism, documented on XRPL.org, automatically releases 1 billion XRP monthly, with unused portions returning to escrow.

Historically, Ripple's escrow locks have provided temporary supply-side support. In contrast, today's event failed to prevent a sell-off. This mirrors the 2021 cycle where similar escrow activity preceded sideways consolidation. Underlying this trend is a critical contradiction: supply reduction typically supports price, yet XRP faces intense selling pressure. The Extreme Fear sentiment, scoring 14/100, indicates pervasive panic that overrides fundamental mechanics. Related developments show this fear is systemic, as seen in recent $144M liquidation events and Bitcoin breaking 9-month lows.

XRP currently trades at $1.57, down 5.86% in 24 hours. Volume profile analysis shows weak buying at this level. The 50-day moving average at $1.63 acts as dynamic resistance. A critical Fibonacci retracement level from the 2024 high sits at $1.48 (0.618). This level represents a major order block. If broken, it would invalidate the current market structure. The RSI reads 38, indicating neither oversold nor overbought conditions. This technical neutrality amidst extreme fear creates a Fair Value Gap (FVG) between price and sentiment.

| Metric | Value |

|---|---|

| XRP Escrow Lockup | 400 Million |

| Current XRP Price | $1.57 |

| 24-Hour Change | -5.86% |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

| XRP Market Rank | #5 |

This event matters because it tests the efficiency of tokenomics in a fear-dominated market. Ripple's escrow system aims to manage supply inflation. On-chain data indicates that 400 million XRP represents standard quarterly operations. However, its failure to stabilize price reveals deeper issues. Institutional liquidity cycles are currently in a risk-off phase. Retail market structure shows capitulation, as evidenced by the Extreme Fear reading. The lockup may prevent further supply dumping, but demand destruction appears to be the dominant force.

Market structure suggests escrow events are now priced-in mechanics, not catalysts. The real signal is the divergence between supply management and price action. This indicates either a liquidity grab by larger players or a fundamental shift in XRP's valuation model. We are watching the $1.48 Fibonacci level closely.

— CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook hinges on whether this escrow lockup marks a supply floor or merely delays a larger sell-off. Historical cycles suggest that extreme fear periods often precede consolidation, but require a catalyst for reversal. The 5-year horizon depends on Ripple's ability to demonstrate utility beyond treasury management, particularly in cross-border settlements and CBDC integrations.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.