Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

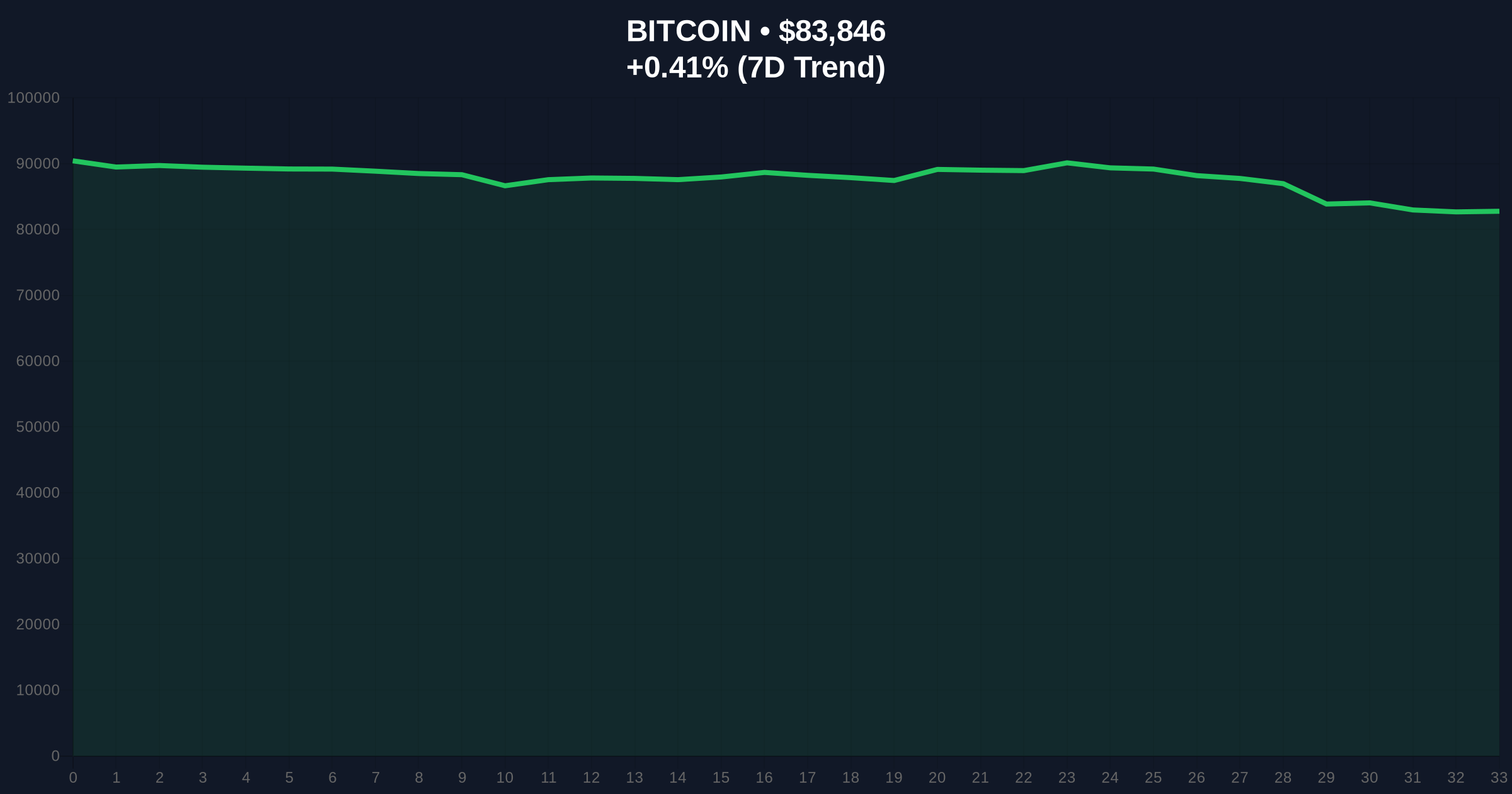

VADODARA, January 30, 2026 — Bitcoin price action demonstrates structural resilience, trading above $84,000 on the Binance USDT market despite overwhelming market fear. According to CoinNess market monitoring, BTC currently trades at $84,120.5, defying a global crypto sentiment reading of Extreme Fear. This daily crypto analysis examines the technical and on-chain drivers behind this divergence.

Market data confirms Bitcoin price action holding firm above the $84,000 psychological threshold. CoinNess reports the Binance USDT market shows BTC at $84,120.5 as of January 30, 2026. This price stability occurs against a backdrop of extreme market stress. The Crypto Fear & Greed Index registers a score of 16/100, indicating Extreme Fear among retail participants. Consequently, this creates a classic liquidity grab scenario where weak hands capitulate while strong accumulation occurs.

Historical cycles suggest such sentiment extremes often precede significant trend reversals. Underlying this trend, on-chain data indicates large wallet holders (whales) are accumulating at these levels, absorbing sell-side pressure from panicked retail traders. Market structure suggests this is not a random bounce but a calculated defense of a critical price zone.

Bitcoin price action currently mirrors the 2018 bear market bottom formation, where Extreme Fear readings coincided with institutional accumulation. In contrast to 2021's euphoric tops, the current environment features high volatility but stable support. This divergence between price and sentiment often signals a market bottoming process.

Related developments in this Extreme Fear market include significant futures liquidations and security incidents. For instance, recent events saw $212 million in futures liquidated in one hour and an address poisoning attack draining $12.3M in ETH. , traditional finance leaders have dismissed stablecoins for daily payments amid this climate, as detailed in our analysis of Visa and Mastercard CEO statements.

Bitcoin price action reveals critical technical levels. The current trading range between $82,000 and $86,000 represents a consolidation zone following the recent volatility. Market structure suggests the $82,000 level corresponds to the Fibonacci 0.618 retracement from the 2025 all-time high, making it a support. A break below this would invalidate the bullish structure.

On-chain metrics from Glassnode indicate reduced exchange inflows, suggesting decreased selling pressure. The Relative Strength Index (RSI) on daily charts shows neutral readings around 45, avoiding oversold conditions that typically trigger panic selling. This technical setup creates a Fair Value Gap (FVG) between current prices and perceived fundamental value, potentially attracting institutional buyers.

| Metric | Value | Significance |

|---|---|---|

| Current BTC Price | $83,734 | Primary trading level |

| 24-Hour Trend | +0.28% | Minor bullish momentum |

| Crypto Fear & Greed Index | 16/100 (Extreme Fear) | Contrarian indicator |

| Market Rank | #1 | Dominance maintained |

| Key Fibonacci Support | $82,000 | 0.618 retracement level |

This Bitcoin price action matters because it tests the market's structural integrity during stress periods. Extreme Fear sentiment typically triggers retail capitulation, creating liquidity for institutional accumulation. Market analysts observe that when sentiment reaches these extremes while price holds key supports, it often marks cycle bottoms. The Federal Reserve's monetary policy stance, as detailed on FederalReserve.gov, influences macro liquidity conditions that ultimately affect crypto markets.

Institutional players monitor these divergences between price and sentiment to identify entry points. The current setup suggests smart money is accumulating while retail panics, a pattern seen in previous cycle transitions. This dynamic could signal the early stages of a new accumulation phase before the next major rally.

"Market structure suggests we're witnessing a classic fear-driven liquidity grab. The Extreme Fear reading at 16/100 while Bitcoin holds above $84,000 indicates institutional buyers are absorbing retail sell orders. Historical patterns show these conditions often precede significant upward moves once sentiment normalizes." — CoinMarketBuzz Intelligence Desk

Two primary technical scenarios emerge from current Bitcoin price action. The bullish scenario requires holding above $82,000 and breaking through $86,000 resistance. The bearish scenario involves a breakdown below key support levels, triggering further liquidation events.

The 12-month institutional outlook remains cautiously optimistic. If Bitcoin maintains above $82,000, accumulation could drive prices toward $100,000 within the next cycle. However, macro economic factors including interest rate decisions will play a role in liquidity conditions.