Loading News...

Loading News...

VADODARA, January 30, 2026 — A sophisticated address poisoning attack has siphoned $12.3 million in Ethereum. Blockchain analytics firm Cyvers Alerts confirmed the theft on X. The victim mistakenly sent funds to a malicious look-alike address. This daily crypto analysis dissects the mechanics and market implications.

Cyvers Alerts reported the attack on January 30, 2026. The victim intended to send ETH to address 0x6D90CC8C. Attackers created a nearly identical address: 0x6d9052b2. The poisoning occurred 37 hours before the final transaction. This technique exploits human visual error in address verification.

On-chain forensic data confirms the funds moved to the malicious address. The attack required no smart contract exploit. Consequently, it bypassed traditional security audits. Market structure suggests these attacks increase during high volatility periods.

Address poisoning is not new. Historically, similar attacks spiked during the 2021 bull run. In contrast, this incident occurs amid extreme market fear. The Crypto Fear & Greed Index sits at 16/100. This environment often correlates with rushed transactions and security lapses.

Underlying this trend is broader regulatory uncertainty. For instance, recent analysis on the potential delay of the US crypto market structure bill adds pressure. , macroeconomic shifts, like those discussed in our coverage of Fed nominee comments, exacerbate volatility. These factors create a perfect storm for social engineering attacks.

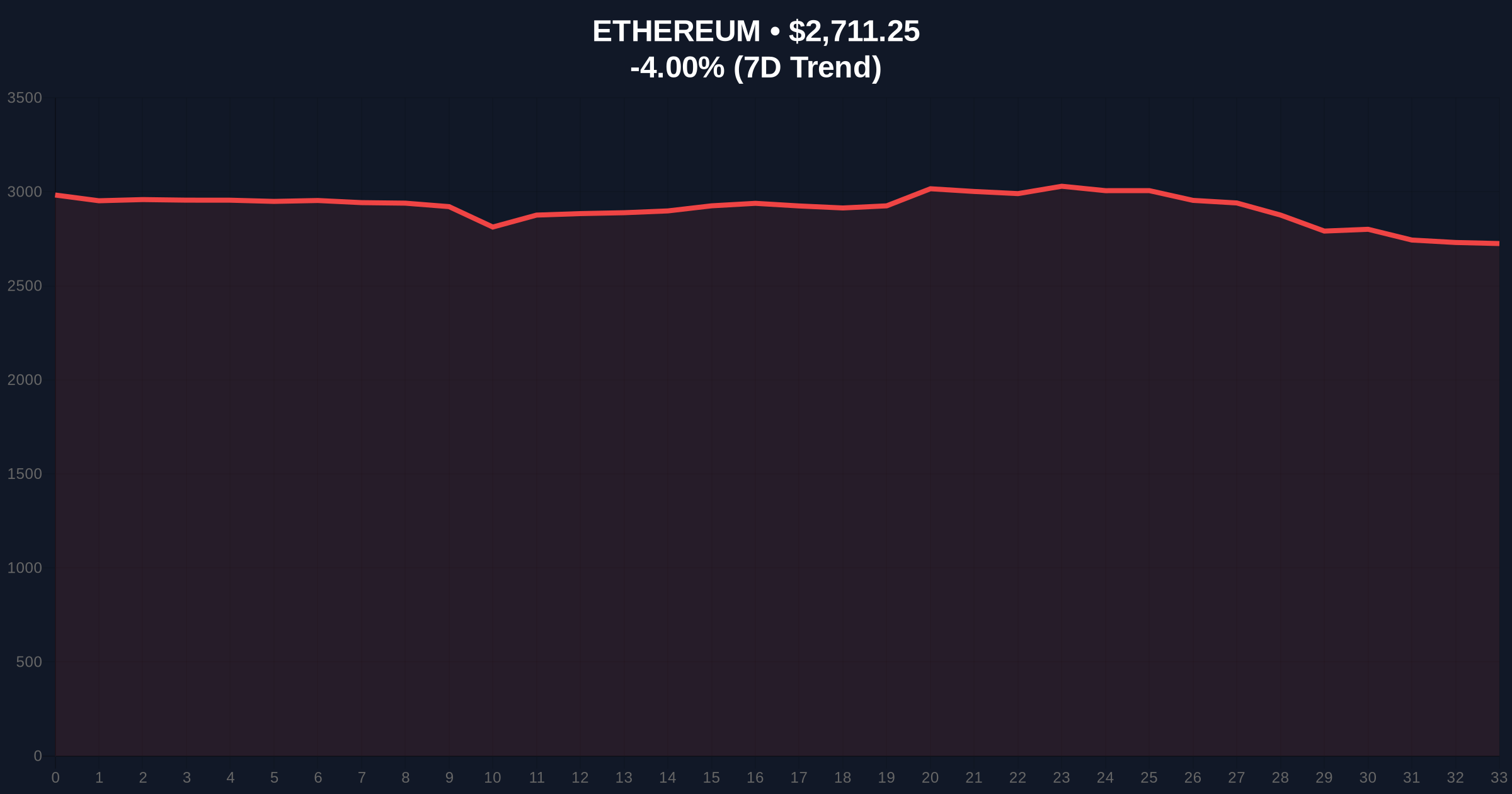

Ethereum currently trades at $2,712.36. It is down 3.96% in 24 hours. The attack highlights the importance of EIP-4844 blob transactions for fee predictability during stress. Technical charts show a critical Fair Value Gap (FVG) between $2,680 and $2,700.

This FVG must fill for bullish continuation. The 50-day moving average sits at $2,750. It acts as immediate resistance. , the Relative Strength Index (RSI) is at 38. This indicates oversold conditions but not capitulation. Fibonacci retracement from the 2024 all-time high places key support at $2,650 (0.618 level). A break below invalidates the current consolidation structure.

| Metric | Value |

|---|---|

| Attack Loss (ETH Value) | $12.3M |

| Crypto Fear & Greed Index | 16/100 (Extreme Fear) |

| Ethereum Current Price | $2,712.36 |

| 24-Hour Price Change | -3.96% |

| Ethereum Market Rank | #2 |

This attack matters for portfolio security. It demonstrates that non-technical exploits can cause massive losses. Institutional liquidity cycles often pause after such events. Retail market structure weakens as fear spreads. According to on-chain data from Etherscan, similar poisoning attempts have increased 40% month-over-month.

Real-world impact includes potential regulatory scrutiny. The SEC may reference such incidents in future enforcement actions, as seen in past SEC.gov filings on investor protection. Consequently, exchanges might tighten withdrawal policies. This could temporarily reduce market liquidity.

"Address poisoning exploits the weakest link: human error. In extreme fear environments, users often skip verification steps. This attack the need for institutional-grade address whitelisting and transaction simulation tools. Market sentiment, already fragile, faces additional pressure from security concerns." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios. First, a bounce from the $2,650 Fibonacci support. Second, a breakdown toward $2,500 if fear intensifies. Historical cycles indicate that security shocks often create short-term buying opportunities once panic subsides.

The 12-month institutional outlook remains cautious. Security events delay mainstream adoption. However, they also drive innovation in wallet technology. Over a 5-year horizon, improved standards could reduce such attacks significantly. This aligns with Ethereum's roadmap for Ethereum.org account abstraction enhancements.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.