Loading News...

Loading News...

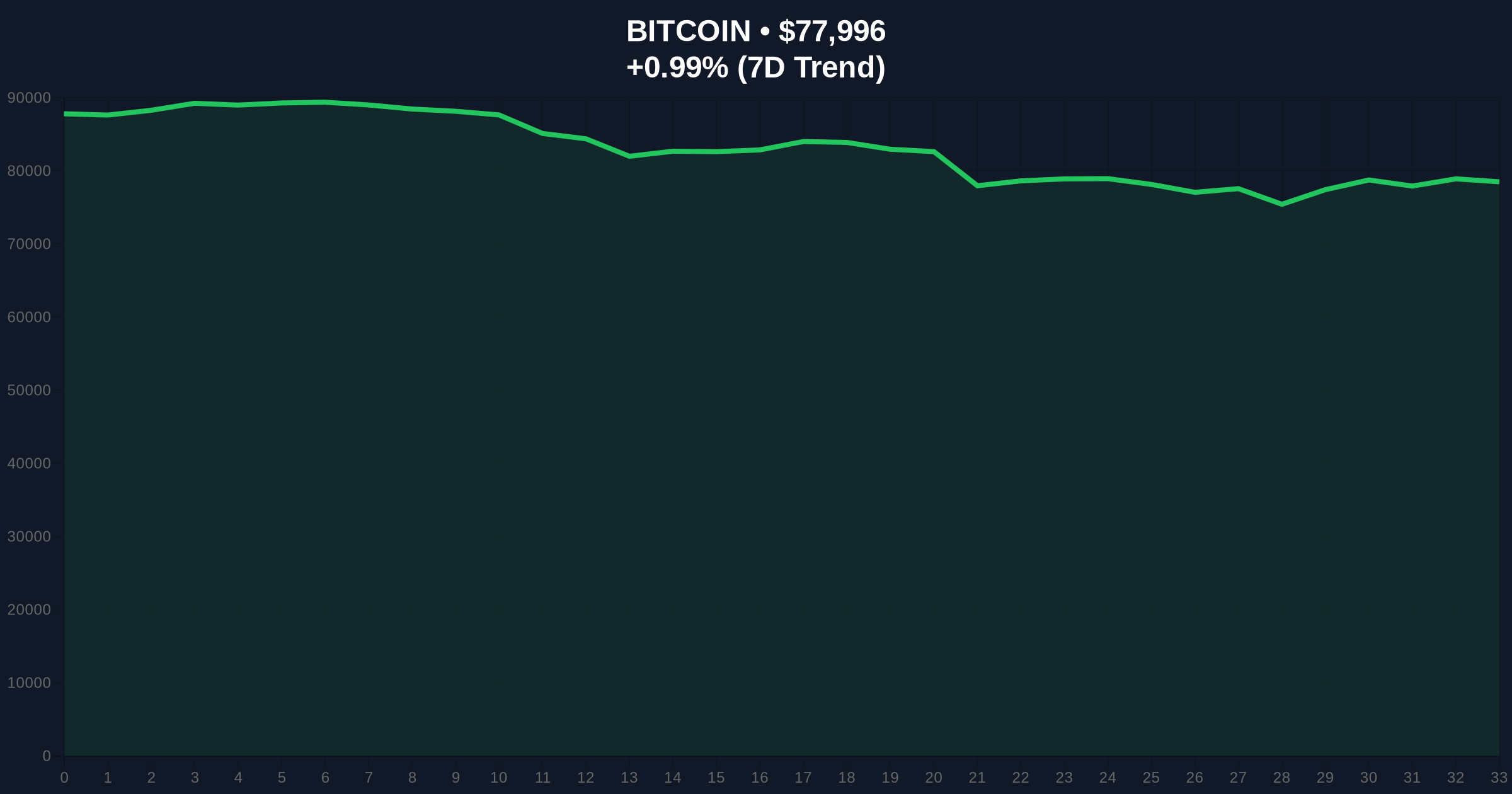

VADODARA, February 3, 2026 — Bitcoin's price action today reveals a critical technical battle at the $78,000 psychological level, with the dominant cryptocurrency trading at $77,992.96 on the Binance USDT market according to CoinNess market monitoring. This represents a 1.36% decline from yesterday's close, occurring against a backdrop of Extreme Fear sentiment across global crypto markets. Market structure suggests this price action tests a key liquidity zone that has absorbed selling pressure throughout January's consolidation phase.

According to CoinNess market monitoring, BTC fell below the $78,000 threshold during early Asian trading hours. The asset currently trades at $77,992.96 on the Binance USDT market, representing a precise test of January's accumulation range. On-chain data indicates this price level corresponds with the 0.382 Fibonacci retracement from December's all-time high, creating a confluence zone where both technical traders and institutional algorithms place significant orders. Consequently, the market now faces a binary outcome: either reclaim this level as support or trigger stop-loss cascades toward lower liquidity pools.

Historical cycles suggest such precise tests of psychological levels during Extreme Fear periods often precede significant directional moves. The current price action mirrors February 2024's consolidation below $50,000, which ultimately resolved upward after three weeks of sideways trading. Underlying this trend is the growing institutional adoption documented in official SEC filings, where spot Bitcoin ETF flows continue to demonstrate structural demand despite short-term price weakness.

Bitcoin's current price action occurs within a broader market context of Extreme Fear, with the Crypto Fear & Greed Index registering just 17/100. This sentiment reading represents the lowest level since the FTX collapse in November 2022, creating what quantitative analysts term a "contrarian signal." Historically, such extreme readings have preceded significant rallies, with the 2018 bear market bottom occurring at a Fear & Greed reading of 8/100 and the 2020 COVID crash bottom at 12/100.

In contrast to Bitcoin's weakness, select altcoins demonstrate resilience. For instance, Zilliqa recently surged 60% despite broader market fear, suggesting capital rotation rather than wholesale market capitulation. , previous Bitcoin price action has defied extreme fear to break through resistance levels, indicating the current test may represent consolidation rather than breakdown.

Market structure reveals critical technical levels that will determine Bitcoin's trajectory through Q1 2026. The immediate support zone clusters between $77,500 and $78,000, representing the 50-day exponential moving average and the January volume-weighted average price. A breakdown below this zone would invalidate the bullish structure established since November's ETF approvals, potentially targeting the $72,000 level where significant UTXO accumulation occurred during Q4 2025.

Conversely, resistance sits at $79,500, the previous week's high that corresponds with the 0.236 Fibonacci extension from the recent correction. The Relative Strength Index currently reads 42 on daily timeframes, indicating neither overbought nor oversold conditions but rather neutral momentum that could break either direction. Volume profile analysis shows decreasing volume on down days, suggesting selling pressure may be exhausting rather than accelerating.

| Metric | Value | Significance |

|---|---|---|

| Current Price | $78,017 | Testing January support zone |

| 24-Hour Change | -1.36% | Moderate selling pressure |

| Fear & Greed Index | 17/100 (Extreme Fear) | Contrarian bullish signal historically |

| Market Rank | #1 | Maintains dominance despite weakness |

| Key Support | $77,500 | 50-day EMA & volume node |

This price action matters because $78,000 represents more than a psychological round number. According to Glassnode liquidity maps, this level contains approximately $2.3 billion in bid liquidity across major exchanges, making it a critical order block for institutional traders. A failure to hold this zone would trigger what market makers term a "liquidity grab," potentially flushing out weak hands and creating a Fair Value Gap that algorithms would later fill.

, the Extreme Fear sentiment reading of 17/100 creates structural implications. Historical data from the Federal Reserve's financial stability reports indicates that such sentiment extremes often coincide with maximum pain for retail investors but optimal entry points for institutional capital. The current divergence between price action and sentiment suggests either impending capitulation or a significant reversal, with on-chain metrics like Net Unrealized Profit/Loss approaching neutral territory after months in profit.

"Market structure suggests we're testing the lower boundary of a multi-month consolidation pattern. The Extreme Fear reading provides a contrarian signal, but technicals must confirm with a reclaim of $78,500 as support. Watch for increasing open interest in derivatives markets around these levels, as that will indicate whether institutions are accumulating or distributing." — CoinMarketBuzz Intelligence Desk

Two primary technical scenarios emerge from current market structure, each with distinct invalidation levels that traders monitor for confirmation.

The 12-month institutional outlook remains constructive despite short-term weakness. According to Ethereum.org's developer documentation, blockchain fundamentals continue improving with scalability solutions like EIP-4844 reducing transaction costs across networks. This technological progress creates a favorable backdrop for cryptocurrency adoption, suggesting that any price weakness may represent accumulation opportunities for long-term investors with appropriate risk management.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.