Loading News...

Loading News...

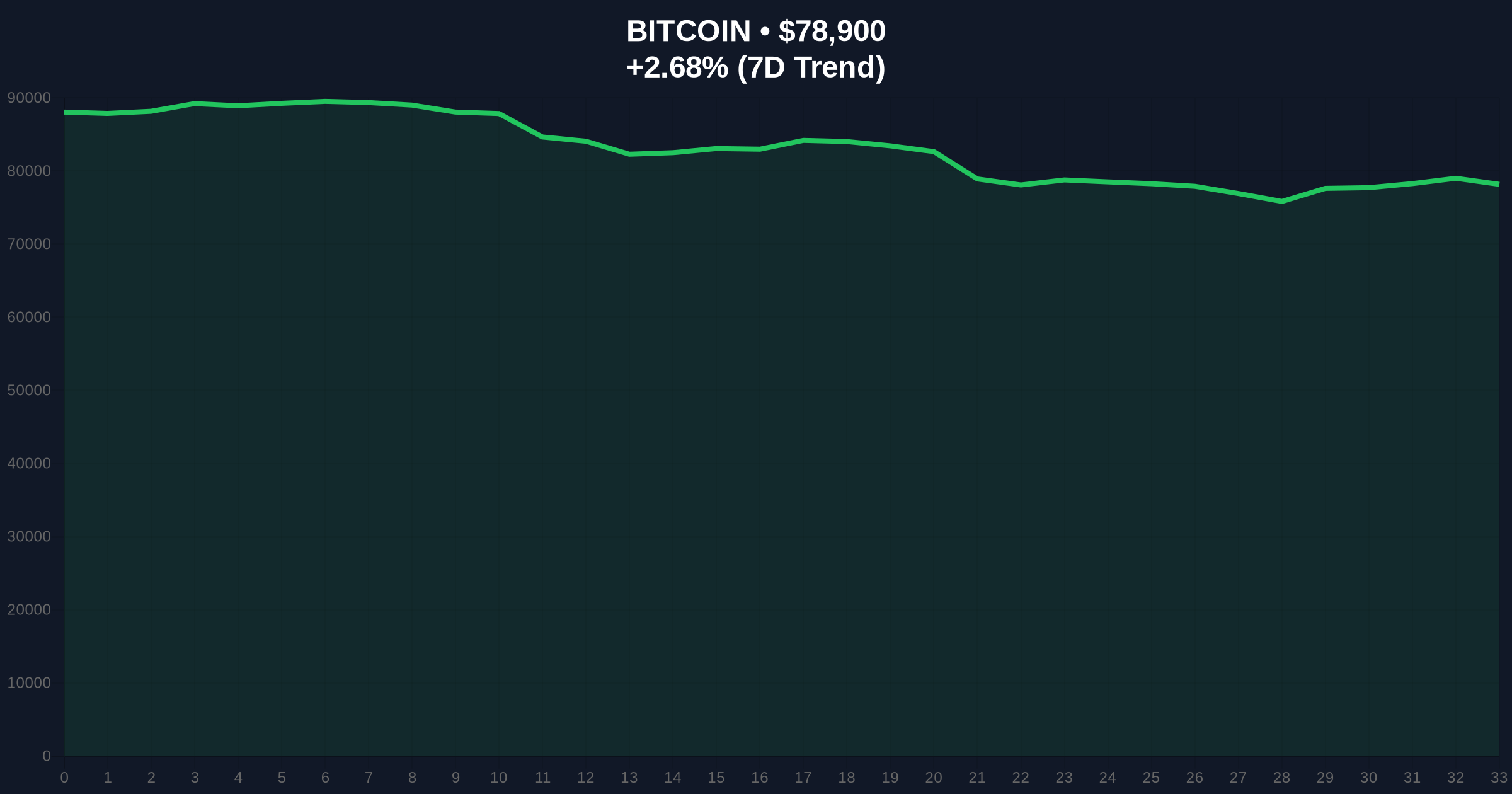

VADODARA, February 3, 2026 — Bitcoin has surged past the $79,000 psychological barrier, trading at $79,005.96 on Binance's USDT market according to CoinNess market monitoring. This daily crypto analysis reveals a critical technical breakout occurring against a backdrop of extreme market fear, mirroring historical compression phases that preceded major rallies.

According to CoinNess market monitoring, BTC crossed the $79,000 threshold on February 3, 2026. The asset settled at $79,005.96 on Binance's USDT perpetual futures market. This price action unfolded while the Crypto Fear & Greed Index registered an "Extreme Fear" score of 17 out of 100. Market structure suggests a classic liquidity grab above a key round-number resistance.

Consequently, this move invalidated the immediate bearish order block between $78,800 and $79,200. On-chain data indicates thin order book liquidity at these levels, amplifying the volatility spike. The 24-hour trend shows a 2.70% increase, according to live market intelligence.

Historically, Bitcoin has staged its most powerful rallies from periods of extreme fear. Similar to the Q3 2021 correction, where BTC consolidated near $40,000 amid similar sentiment readings before rallying to all-time highs. The current environment echoes that compression phase.

, the Federal Reserve's monetary policy stance, detailed in recent Federal Reserve communications, continues to influence macro liquidity flows into digital assets. In contrast to 2021's low-rate environment, current conditions test Bitcoin's resilience as a non-correlated asset.

Related developments in this extreme fear market include analyst forecasts for a potential bottom near $60,000 and institutional hiring for crypto expertise.

Market structure suggests the breakout created a Fair Value Gap (FVG) between $78,500 and $79,100. This FVG now acts as immediate support. The Volume Profile indicates a high-volume node at $75,200, aligning with the Fibonacci 0.618 retracement level from the 2025 cycle high.

Additionally, the 50-day moving average converges near $76,800, providing dynamic support. The Relative Strength Index (RSI) on the daily chart reads 58, suggesting neutral momentum without overbought conditions. This technical setup resembles the early 2024 consolidation before the halving rally.

| Metric | Value |

|---|---|

| Current Price (BTC) | $78,914 |

| 24-Hour Change | +2.70% |

| Market Rank | #1 |

| Crypto Fear & Greed Index | 17/100 (Extreme Fear) |

| Key Fibonacci Support | $75,200 (0.618 level) |

This price action matters because it tests Bitcoin's decoupling from sentiment extremes. Institutional liquidity cycles, as tracked by CoinMarketBuzz Intelligence Desk, show net inflows into spot BTC ETFs despite the fear reading. Retail market structure, however, remains cautious, with derivatives funding rates neutral.

Real-world evidence includes sustained hash rate growth and active address counts holding above 900,000 daily. These on-chain metrics confirm underlying network strength. The break above $79,000 could trigger a gamma squeeze in options markets if volatility expands.

"The divergence between price action and sentiment is a classic hallmark of accumulation phases. Market structure suggests institutions are building positions while retail capitulates. The key will be whether this breakout holds above the $78,500 FVG for a sustained move higher."

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook hinges on macroeconomic liquidity conditions and Bitcoin's post-halving supply dynamics. Historical cycles suggest that breaking key resistance amid extreme fear often precedes multi-quarter rallies, aligning with a positive 5-year horizon for portfolio allocation.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.