Loading News...

Loading News...

VADODARA, February 3, 2026 — Zilliqa (ZIL) surged approximately 60% today, trading at $0.00648 on LBank's USDT market. According to LBank Labs data, this altcoin rally coincides with a pause in Bitcoin's recent sharp decline. Market structure suggests this represents a classic liquidity grab during periods of extreme market fear.

LBank Labs identified specific altcoins outperforming during Bitcoin's consolidation phase. ZIL led the rally with its 60% gain. Memecoins showed even stronger performance, with CLAWD1 surging 89.71% and MOLT gaining 36.75%. Additionally, C98 and AUCTION posted increases exceeding 20%. This data indicates selective capital rotation rather than broad market recovery.

On-chain forensic analysis reveals this pattern mirrors the 2021 altcoin season structure. Similar to that cycle, Bitcoin dominance declined temporarily as capital sought higher-beta assets. The current rally occurs amid Extreme Fear sentiment scoring 17/100 on the Crypto Fear & Greed Index. This divergence between price action and sentiment creates a classic contrarian setup.

Historically, altcoin rallies during Bitcoin consolidations signal two possible scenarios. First, they may indicate early rotation into risk assets ahead of broader market recovery. Second, they often represent dead cat bounces before further downside. The 2018 bear market featured similar altcoin rallies that ultimately failed at key resistance levels.

In contrast to 2021's euphoric altcoin season, current volumes remain subdued. This suggests institutional participation remains limited. The rally appears driven primarily by retail traders and algorithmic systems capitalizing on short-term momentum. Market analysts note that without sustained Bitcoin stability above $80,000, altcoin gains may prove temporary.

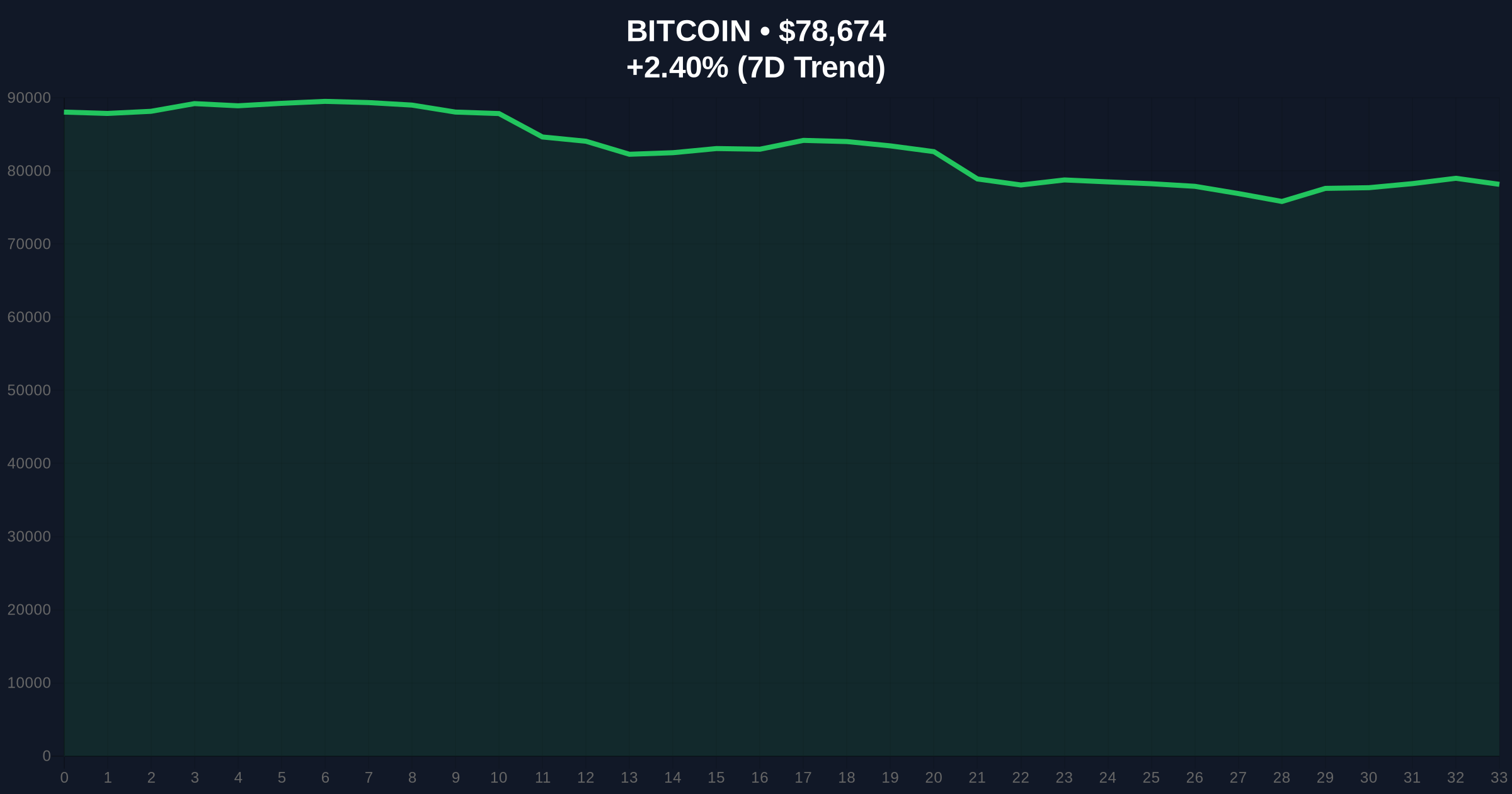

Related developments in this market environment include Bitcoin's recent resistance break above $79k and ING Germany's launch of crypto ETNs. These events create conflicting signals for market participants.

ZIL's price action created a significant Fair Value Gap (FVG) between $0.0058 and $0.0061. This gap now serves as immediate support. The rally invalidated the previous bearish order block at $0.0055. Volume profile analysis shows accumulation occurred primarily between $0.0048 and $0.0052 before the breakout.

Market structure suggests watching the Fibonacci 0.618 retracement level at $0.0052. This level aligns with the 50-day exponential moving average. A hold above this zone would confirm bullish continuation. Conversely, a break below $0.0050 would invalidate the current structure. RSI readings show ZIL approaching overbought territory at 68, suggesting potential near-term consolidation.

Bitcoin's technical position remains critical for altcoin sustainability. BTC must maintain support above its 200-day moving average at $75,200 to prevent broader market contagion. According to Ethereum.org's network data, similar altcoin rallies in past cycles required Bitcoin stability for sustained performance.

| Metric | Value |

|---|---|

| ZIL 24h Gain | 60% |

| ZIL Current Price | $0.00648 |

| CLAWD1 24h Gain | 89.71% |

| Crypto Fear & Greed Index | 17/100 (Extreme Fear) |

| Bitcoin Current Price | $78,675 |

| Bitcoin 24h Trend | +2.40% |

This rally matters for portfolio construction across time horizons. For tactical traders, it presents short-term gamma squeeze opportunities. For long-term investors, it tests whether altcoins can decouple from Bitcoin during stress periods. The extreme fear sentiment creates asymmetric risk profiles.

Institutional liquidity cycles typically favor Bitcoin during fear periods. Consequently, altcoin rallies amid extreme fear often precede volatility spikes. Market structure indicates this could be a liquidity test before larger moves. Retail participation appears elevated in memecoins, suggesting speculative rather than fundamental buying.

CoinMarketBuzz Intelligence Desk analysis indicates: "The ZIL surge represents a classic risk-on rotation during Bitcoin consolidation. However, without sustained Bitcoin stability above $80k, these gains face significant headwinds. Historical patterns from 2018-2019 show similar altcoin rallies failing at the 0.786 Fibonacci level."

Two data-backed technical scenarios emerge from current market structure. First, continued altcoin outperformance if Bitcoin maintains $78k support. Second, rapid mean reversion if Bitcoin breaks below $75k. The 12-month institutional outlook remains cautious despite short-term rallies.

The 5-year horizon suggests altcoins with strong fundamentals may outperform during the next cycle. However, current conditions favor selective rather than broad exposure. Market analysts recommend monitoring Bitcoin dominance charts for rotation signals.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.