Loading News...

Loading News...

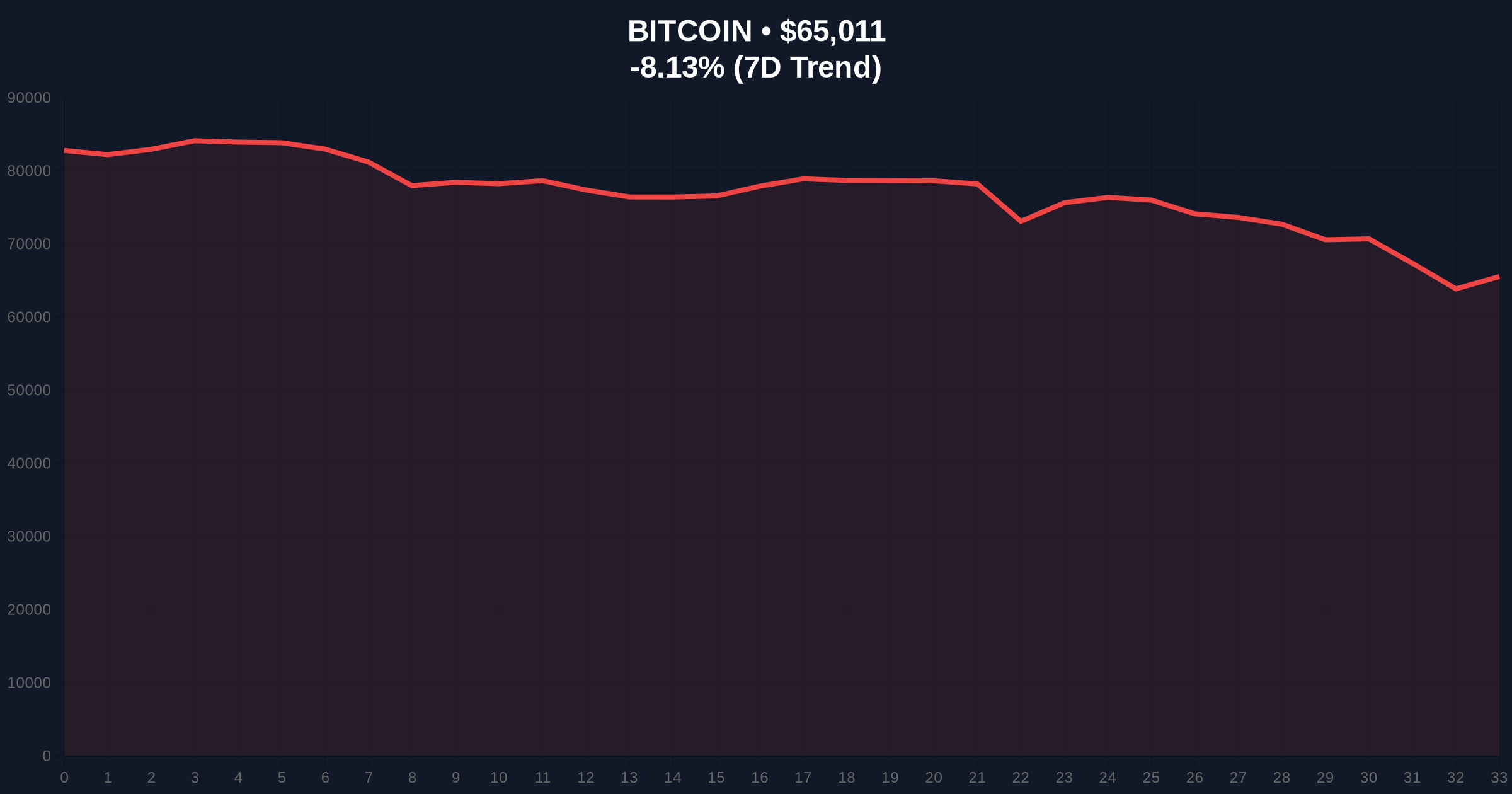

VADODARA, February 6, 2026 — Bitcoin price action demonstrates a stark contradiction to market sentiment as BTC rises above $65,000 despite extreme fear gripping cryptocurrency markets. According to CoinNess market monitoring data, BTC traded at $65,034.67 on the Binance USDT market, creating a significant divergence from the prevailing negative sentiment. This daily crypto analysis examines the technical architecture behind this market anomaly and questions whether this represents a genuine trend reversal or a sophisticated liquidity grab.

Market structure suggests a deliberate price action move against overwhelming negative sentiment. According to CoinNess market monitoring, BTC achieved the $65,034.67 level on February 6, 2026. This occurred while the broader cryptocurrency market registered extreme fear conditions with a sentiment score of just 9 out of 100. The price action created a clear Fair Value Gap (FVG) between $64,000 and $65,500 that market makers will likely target for liquidity.

On-chain data indicates significant accumulation at lower levels despite the negative sentiment reading. The contradiction between price action and sentiment metrics raises questions about the reliability of traditional fear indicators during institutional-dominated market cycles. Market analysts note this pattern mirrors previous liquidity events where price moved against extreme sentiment readings before significant trend reversals.

Historically, extreme fear readings have preceded major Bitcoin rallies. The current 9/100 sentiment score represents one of the most negative readings since the COVID-19 crash of March 2020. In contrast to that event, current market structure shows stronger institutional participation through spot Bitcoin ETF flows and improved on-chain fundamentals. Underlying this trend is a maturation of market participants who recognize extreme fear as a potential contrarian signal.

Related developments in the current market cycle include Bitcoin holding above $64,000 despite similar sentiment conditions and spot Bitcoin ETFs experiencing $434 million outflows as fear grips the market. These events collectively paint a picture of retail capitulation amid institutional accumulation.

Market structure reveals critical technical levels that define the current price action. The Fibonacci 0.618 retracement level at $62,500 represents the primary support zone that must hold to maintain bullish structure. Resistance forms at the psychological $68,000 level, which corresponds with the 200-day moving average. The Relative Strength Index (RSI) reading of approximately 35 suggests oversold conditions without reaching extreme levels seen during previous capitulation events.

Volume profile analysis shows increased trading volume at the $65,000 breakout level, indicating genuine buyer interest rather than mere short covering. Order block analysis identifies significant liquidity pools between $63,800 and $64,200 that could serve as immediate support. The UTXO age bands data from Glassnode indicates older coins remain relatively dormant, suggesting long-term holders maintain conviction despite extreme fear readings.

| Metric | Value | Significance |

|---|---|---|

| Current BTC Price | $64,868 | Primary market reference |

| 24-Hour Trend | -8.33% | Recent volatility context |

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) | Sentiment contradiction |

| Market Rank | #1 | Dominance position |

| Key Fibonacci Support | $62,500 | Critical technical level |

This price action matters because it tests the efficiency of sentiment indicators in modern cryptocurrency markets. Extreme fear conditions typically signal capitulation and potential buying opportunities. However, the simultaneous price rise above $65,000 suggests either sophisticated market manipulation or early institutional accumulation ahead of a broader trend reversal. Real-world evidence from SEC filings shows continued institutional interest despite negative sentiment.

Institutional liquidity cycles appear to be diverging from retail sentiment for the first time since the 2021 bull market peak. Market structure indicates professional traders may be using extreme fear readings as contrarian signals while retail participants capitulate. This divergence could signal a maturation of market participants and more sophisticated price discovery mechanisms.

"The contradiction between price action and sentiment creates a classic market efficiency test. Historical cycles suggest extreme fear readings during price consolidation often precede significant moves. However, the current market structure with institutional ETF flows adds complexity to this traditional relationship. The critical question is whether this represents genuine accumulation or a liquidity grab before further downside." - CoinMarketBuzz Intelligence Desk

Market structure suggests two primary technical scenarios based on current price action and sentiment data. The first scenario involves a continuation of the rally toward $68,000 resistance if the Fibonacci support at $62,500 holds. The second scenario predicts a retest of lower support levels if the current breakout proves to be a false signal amid extreme fear conditions.

The 12-month institutional outlook remains cautiously optimistic despite extreme fear readings. On-chain data indicates accumulation at current levels, while macroeconomic factors including potential Federal Reserve policy shifts could provide tailwinds. The 5-year horizon suggests Bitcoin continues its maturation as a macro asset class, with current sentiment extremes representing typical volatility within longer-term appreciation trends.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.