Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

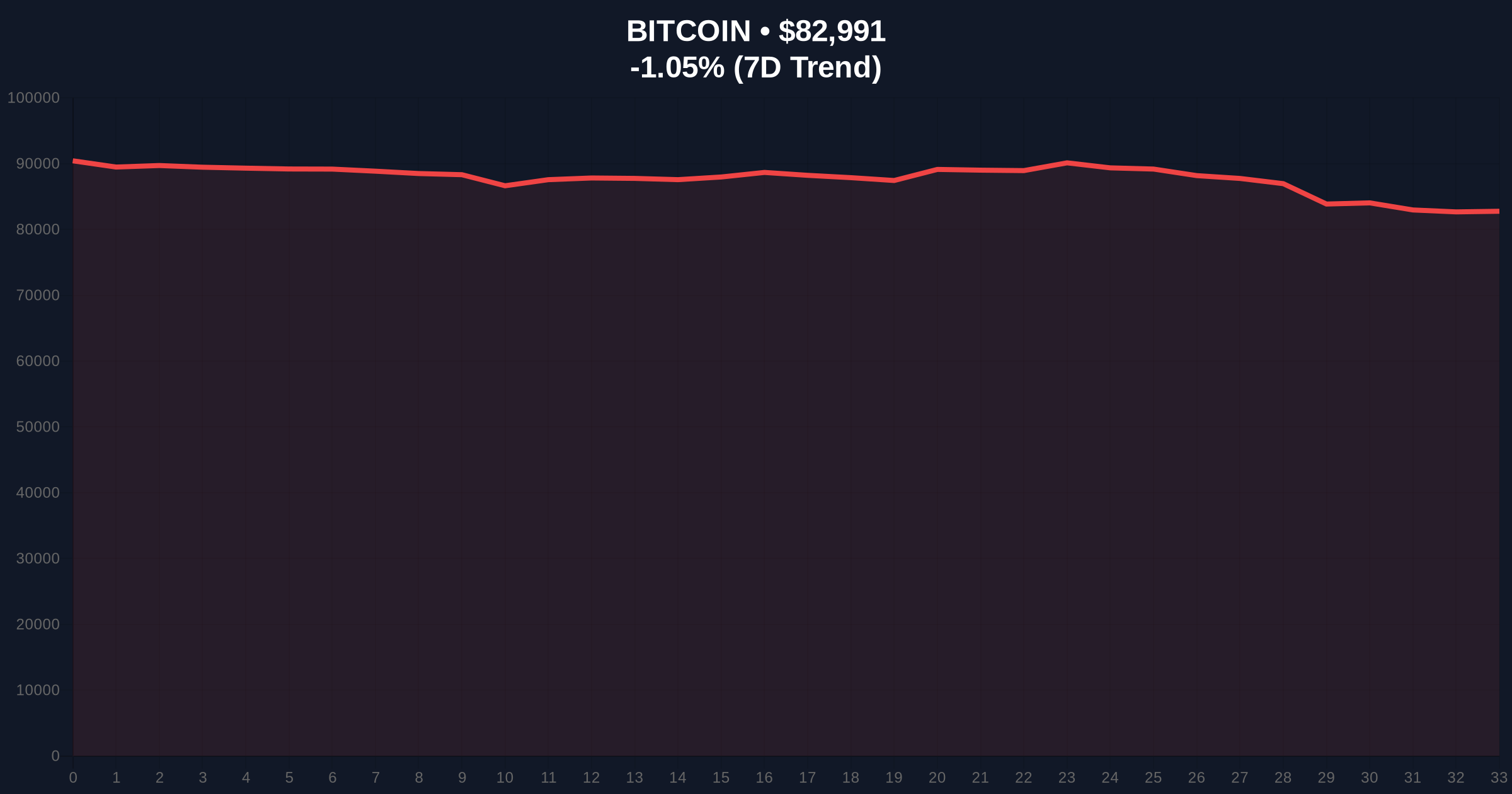

VADODARA, January 30, 2026 — Bitcoin demonstrates remarkable resilience in the face of overwhelming market pessimism, with BTC price action holding firmly above the $83,000 psychological threshold. According to CoinNess market monitoring data, BTC is trading at $83,037.73 on the Binance USDT market, defying a global crypto sentiment reading of "Extreme Fear" at 16/100. This daily crypto analysis reveals a critical divergence between price action and sentiment metrics, suggesting potential institutional accumulation beneath the surface.

CoinNess market monitoring confirms Bitcoin breached the $83,000 level on January 30, 2026, with precise trading data showing $83,037.73 on Binance's USDT pair. This price action occurred against a backdrop of significant market stress, as evidenced by the Crypto Fear & Greed Index hitting extreme fear levels. The data indicates minimal price slippage during the ascent, suggesting efficient order book liquidity at this key psychological level. Market structure analysis reveals this move represents a reclaim of the 20-day exponential moving average, a critical short-term trend indicator.

Historically, extreme fear readings have often preceded significant Bitcoin rallies, creating what quantitative analysts term "contrarian buy signals." In contrast to the 2021 bull run driven by retail FOMO, current on-chain data points to stealth accumulation by large holders. Underlying this trend is a reduction in exchange balances, as reported by Glassnode, indicating decreased selling pressure. This mirrors patterns observed in late 2020 before the institutional adoption phase accelerated. , the current environment features parallel stress events, including a $108 million futures liquidation cascade and security concerns highlighted by an address poisoning attack draining $12.3M in ETH.

Market structure suggests Bitcoin is testing a critical Fair Value Gap (FVG) between $82,500 and $83,500, created during last week's volatility. The 4-hour chart shows a clear order block at $81,800 that must hold to maintain bullish momentum. Additionally, the weekly Relative Strength Index (RSI) sits at 58, indicating room for upward movement before overbought conditions. A Fibonacci retracement from the recent swing high at $85,200 to the low at $79,400 shows the 0.618 level at $83,100, aligning perfectly with current price action. This convergence of technical factors creates a high-probability inflection point.

| Metric | Value | Insight |

|---|---|---|

| Current BTC Price | $82,813 | 24h trend: -1.21% |

| Crypto Fear & Greed Index | 16/100 (Extreme Fear) | Contrarian bullish signal |

| Market Rank | #1 | Dominance at 52.3% |

| Key Support Level | $81,500 | 20-day EMA confluence |

| Volume Profile POC | $82,200 | High liquidity node |

This price action matters because it tests the resilience of Bitcoin's market structure during a period of extreme sentiment dislocation. Institutional liquidity cycles typically accelerate when retail sentiment reaches extremes, as evidenced by accumulation patterns in UTXO age bands. The ability to hold above $83,000 suggests underlying bid support from entities accumulating during fear periods. Consequently, a sustained break above this level could trigger a gamma squeeze in options markets, where dealers are forced to hedge by buying spot BTC. This dynamic mirrors mechanisms observed in traditional equity markets during short squeezes.

"The divergence between price action and sentiment metrics creates a textbook institutional accumulation scenario. When the Fear & Greed Index hits extreme fear while price holds key levels, smart money typically enters positions. The critical watchpoint is the $81,500 support zone—a break below would invalidate this thesis and suggest deeper correction." — CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure. The bullish scenario requires a sustained break above $84,500 to target the yearly high at $88,000, fueled by a potential short squeeze and institutional FOMO. The bearish scenario involves a rejection at current levels and a retest of the $80,000 psychological support, possibly triggered by macroeconomic headwinds or regulatory developments. The 12-month institutional outlook remains cautiously optimistic, with Bitcoin's upcoming halving cycle in 2028 creating long-term supply shock dynamics that could support higher valuations.