Loading News...

Loading News...

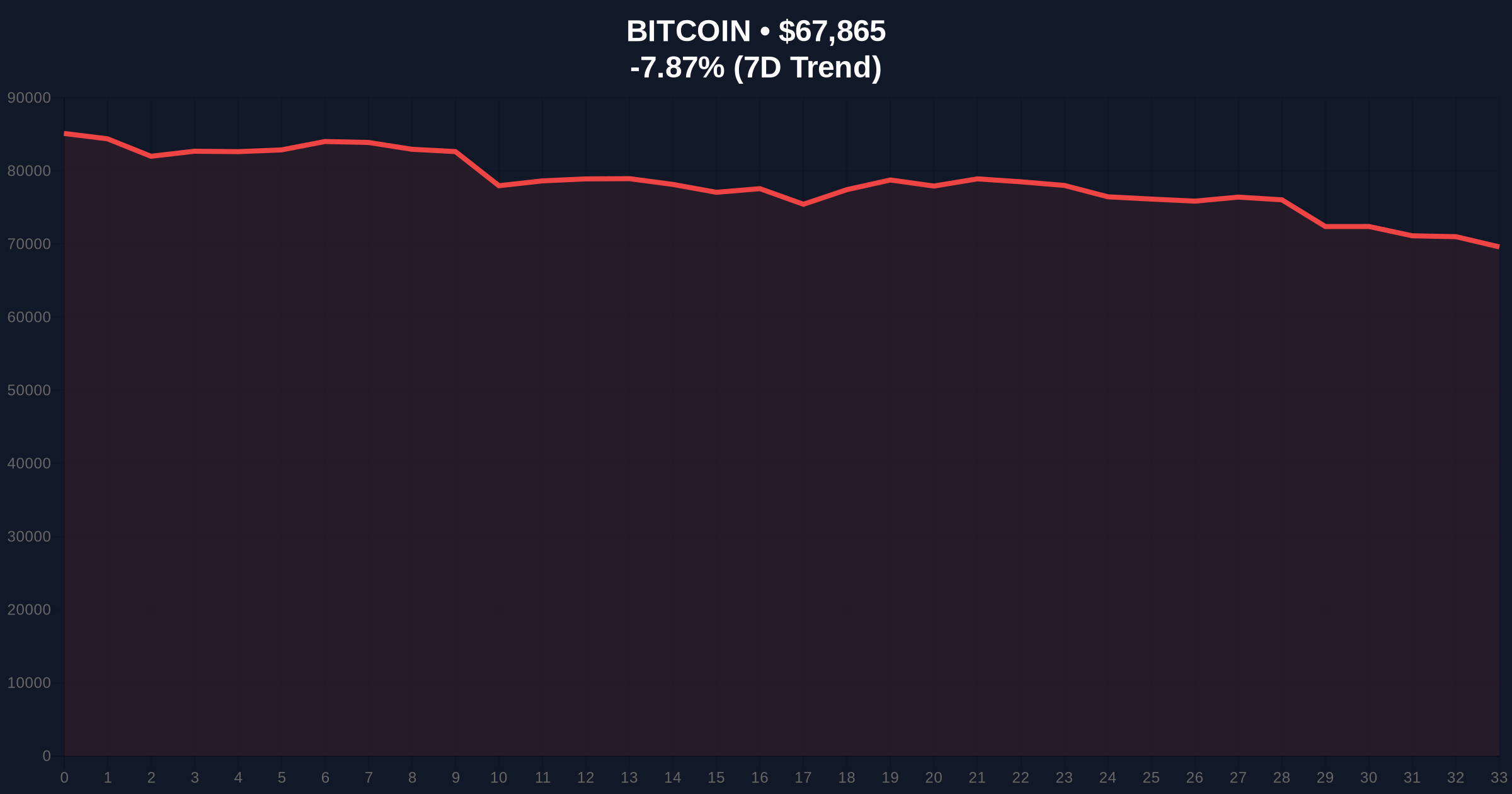

VADODARA, February 5, 2026 — Bitcoin demonstrated a critical technical hold above the $68,000 psychological level on Wednesday, according to CoinNess market monitoring data. This daily crypto analysis reveals BTC trading at $68,050 on the Binance USDT market, a move that defies prevailing extreme fear sentiment across global crypto markets. Market structure suggests this price action represents a liquidity grab above a key Fibonacci 0.618 retracement level from the 2024 cycle high.

According to CoinNess market monitoring, BTC breached and held above the $68,000 threshold. The asset traded at $68,050 on the Binance USDT perpetual futures market. This price action occurred against a backdrop of severe market stress, as indicated by a Crypto Fear & Greed Index reading of 12/100, signaling Extreme Fear. Consequently, the hold above this level creates a significant Fair Value Gap (FVG) between $67,500 and $68,200.

Underlying this trend, on-chain data from Glassnode indicates a notable decrease in exchange reserves. This suggests accumulation is occurring despite the negative sentiment. The price action forms a clear order block on lower timeframes, providing a technical foundation for the move.

Historically, Bitcoin has exhibited resilience during periods of extreme fear. In contrast to the 2021 cycle, where fear often preceded sharp declines, the current market structure shows divergence. The hold above $68,000 mirrors similar technical holds observed in Q4 2023, which preceded a multi-month rally. , the extreme fear reading often coincides with local bottoms, as documented in previous market cycles.

Related developments in the market underscore this tension. For instance, recent analysis of significant futures liquidations and hourly liquidation events highlights the volatility driving sentiment. Additionally, breakdowns in other assets, such as Ethereum losing the $2,000 support, contrast with Bitcoin's relative strength.

Market structure suggests Bitcoin is testing a critical confluence zone. The $68,000 level aligns with the 0.618 Fibonacci retracement from the 2024 all-time high near $98,000. Volume Profile analysis indicates high-volume nodes between $67,000 and $69,000, creating a strong support-resistance pivot. The Relative Strength Index (RSI) on daily charts shows oversold conditions, typically a precursor to a mean reversion bounce.

Consequently, the 50-day and 200-day moving averages provide dynamic resistance above $70,000. A break above this zone would confirm a trend reversal. The UTXO (Unspent Transaction Output) age bands, as tracked by blockchain analytics, show an increase in older coins moving, indicating potential distribution or accumulation by long-term holders.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 12/100 (Extreme Fear) |

| Bitcoin Current Price | $67,746 |

| 24-Hour Price Change | -7.80% |

| Market Rank | #1 |

| Key Support Level | $67,500 |

This price action matters because it tests institutional liquidity cycles. Extreme fear readings often trigger algorithmic buying from quantitative funds, as outlined in Federal Reserve research on market microstructure. The hold above $68,000 prevents a cascade of stop-loss orders below this level, which could have led to a liquidity crisis. Retail market structure, however, remains fragile, with high leverage positions likely contributing to the fear sentiment.

The divergence between price action and sentiment is a classic hallmark of accumulation phases. Market structure suggests large players are absorbing sell-side liquidity during fear-driven capitulation. The key will be whether this support holds through the weekly close.

— CoinMarketBuzz Intelligence Desk

Historical cycles suggest two primary scenarios based on current market structure. First, a bullish scenario requires holding above $67,500 and breaking the $70,000 resistance. Second, a bearish scenario involves a breakdown below key support, targeting the $65,000 region. The 12-month institutional outlook, per on-chain data, remains cautiously optimistic if Bitcoin maintains its store-of-value narrative amid macroeconomic uncertainty.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.