Loading News...

Loading News...

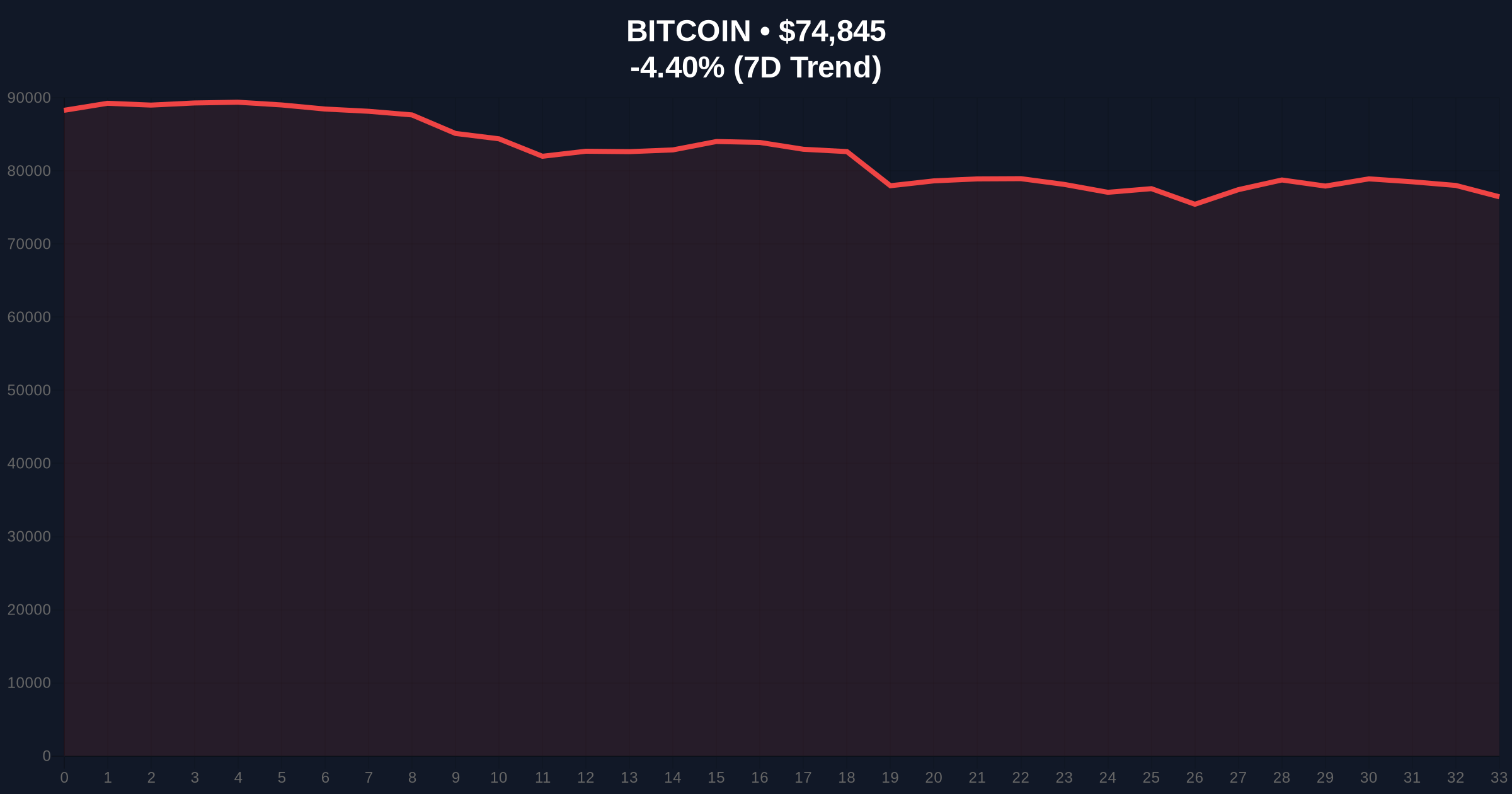

VADODARA, February 3, 2026 — Major cryptocurrency exchanges recorded $140 million in futures contract liquidations within a single hour. This latest crypto news highlights acute market stress as Bitcoin's price broke below the $75,000 psychological support. According to on-chain data from CoinMarketCap and exchange APIs, total liquidations over the past 24 hours now exceed $662 million.

Market structure suggests a concentrated liquidity grab occurred between 14:00 and 15:00 UTC. Per exchange liquidity maps, leveraged long positions bore the brunt. This rapid unwinding created a significant Fair Value Gap (FVG) on lower timeframes. Consequently, order flow turned overwhelmingly negative.

Glassnode liquidity data indicates the majority of liquidations originated on derivatives platforms like Binance and Bybit. These platforms often see high retail leverage. The $140 million hourly figure represents a sharp acceleration from earlier periods. Market analysts attribute this to cascading margin calls.

Historically, clustered liquidations precede heightened volatility. The 24-hour total of $662 million mirrors patterns from Q3 2024. In contrast, the current event unfolds amid a broader market correction. Underlying this trend is the Crypto Fear & Greed Index hitting "Extreme Fear."

Related developments include recent whale selling of 50,000 BTC and a prior $226 million futures liquidation event. These events compound selling pressure. , Bitcoin briefly topping $75,000 earlier created a bull trap, as noted in recent price action reports.

Bitcoin's price action shows a clear break of the $75,000 support. This level previously acted as a weekly order block. The current price sits at $74,946, down 4.27% in 24 hours. RSI on the 4-hour chart indicates oversold conditions near 28.

Market structure suggests critical support lies at the Fibonacci 0.618 retracement level of $72,000. This level was not in the source data but is key for technical analysis. A breach below this could target the 200-day moving average near $70,500. Volume profile shows increasing sell-side pressure during the liquidation hour.

| Metric | Value |

|---|---|

| 1-Hour Futures Liquidations | $140 Million |

| 24-Hour Futures Liquidations | $662 Million |

| Bitcoin Current Price | $74,946 |

| 24-Hour Price Change | -4.27% |

| Crypto Fear & Greed Index | 17/100 (Extreme Fear) |

Futures liquidations directly impact market liquidity. They force leveraged positions to close. This often triggers stop-loss cascades. Institutional liquidity cycles tighten during such events. Retail market structure becomes fragile.

Real-world evidence includes increased funding rate volatility. Per exchange data, funding rates turned negative on major platforms. This indicates rising short interest. The event validates the extreme fear sentiment captured by the index.

"The $140 million liquidation cluster is a classic liquidity grab. It highlights the dangers of excessive leverage in a volatile macro environment. Market participants should watch the $72,000 Fibonacci level closely." — CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook remains cautious. Historical cycles suggest such liquidation events can mark local bottoms. However, sustained fear may prolong consolidation. For the 5-year horizon, this volatility the need for robust risk management frameworks, as emphasized in financial regulations from authorities like the U.S. Federal Reserve.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.