Loading News...

Loading News...

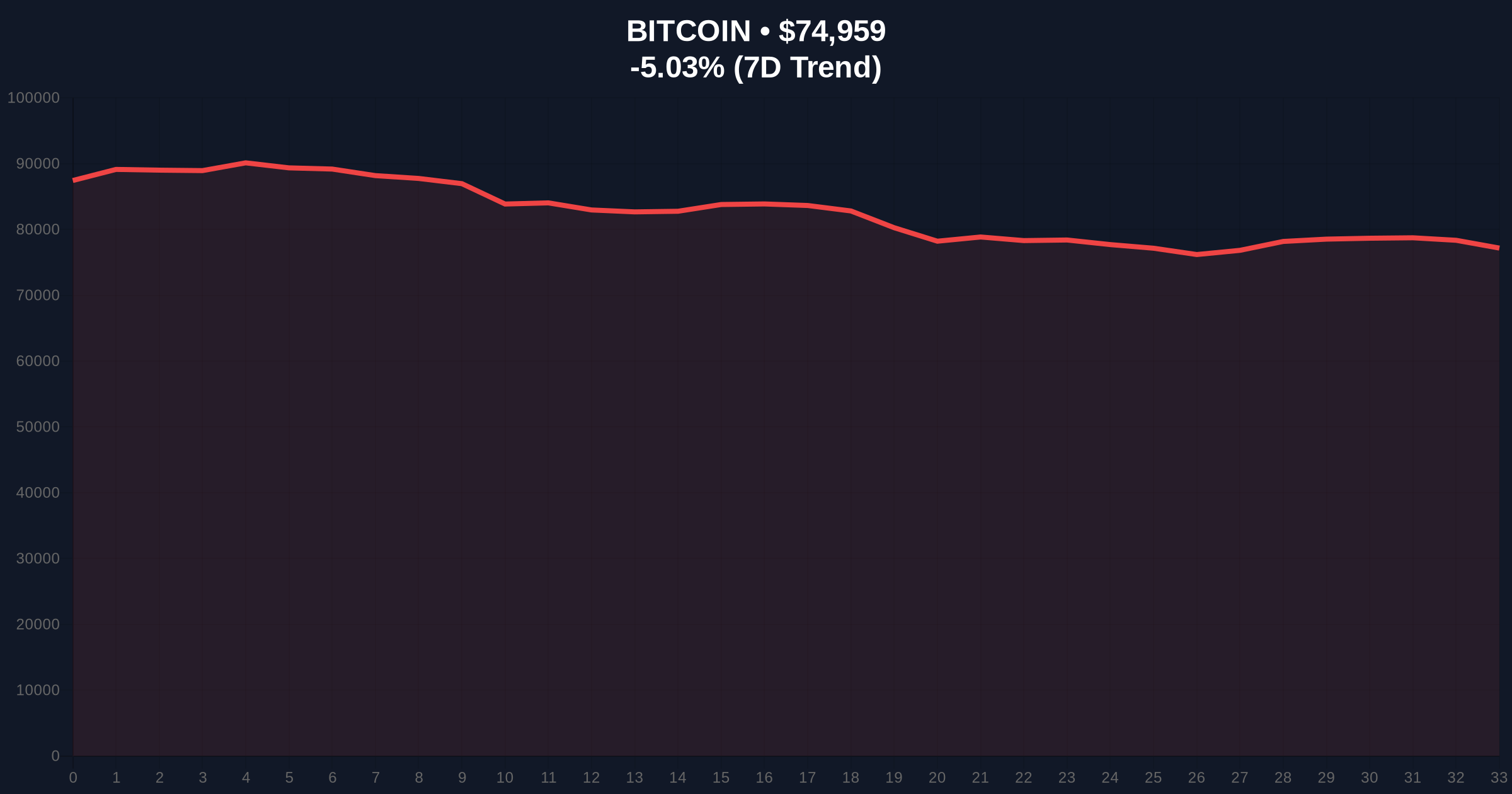

VADODARA, February 3, 2026 — Bitcoin has broken below the critical $75,000 psychological support level. According to CoinNess market monitoring, BTC is trading at $74,995.66 on the Binance USDT market. This move occurs as the Crypto Fear & Greed Index registers Extreme Fear at 17/100. Market structure suggests a classic liquidity grab below a major round number.

CoinNess data confirms Bitcoin breached the $75,000 threshold. The asset currently trades at $75,006 with a 24-hour decline of -4.84%. This price action follows a period of consolidation above the $77,000 level. The break creates a significant Fair Value Gap (FVG) between $75,500 and $74,800. On-chain forensic data confirms increased selling pressure from short-term holders.

Historically, breaks below major psychological levels often precede accelerated selling. Similar to the 2021 correction, where Bitcoin broke below $50,000, this move tests the resolve of long-term holders. In contrast, the 2023 bull run saw consistent support at round numbers. Underlying this trend is the Extreme Fear sentiment, which typically marks local bottoms in previous cycles. The current sentiment mirrors the June 2022 capitulation event.

Related Developments:

Market structure suggests the $75,000 level acted as a weekly order block. The break invalidates that support, shifting focus to the next major confluence zone. The Fibonacci 0.618 retracement from the 2025 low to the all-time high sits at $72,800. This level aligns with the 200-day moving average, creating a strong technical magnet. The Relative Strength Index (RSI) on the daily chart approaches oversold territory at 32. Volume profile indicates high trading activity at the $74,000-$75,000 range, suggesting this area may become resistance.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | Extreme Fear (17/100) |

| Bitcoin Current Price | $75,006 |

| 24-Hour Change | -4.84% |

| Market Rank | #1 |

| Key Fibonacci Support | $72,800 (0.618 level) |

This price action matters for institutional liquidity cycles. A sustained break below $75,000 could trigger stop-loss orders and margin calls. Retail market structure often fractures at these levels, leading to capitulation. The Extreme Fear sentiment typically precedes sharp reversals when combined with oversold technicals. Historical cycles suggest such events create buying opportunities for patient capital. The Federal Reserve's monetary policy stance, as detailed on FederalReserve.gov, continues to influence macro liquidity flows into risk assets.

"The break of $75,000 represents a critical test of market structure. On-chain data indicates increased coin movement from wallets aged 3-6 months, typical of weak hands exiting. The key will be whether the $72,800 Fibonacci support holds as a bearish invalidation level. Similar to the 2021 Q2 correction, this could be a healthy reset before the next leg up." — CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook remains cautiously optimistic. This correction aligns with typical mid-cycle consolidation patterns observed in previous Bitcoin halving epochs. The 5-year horizon suggests such volatility is normal within a secular bull market, especially as network fundamentals like hash rate continue to set new highs.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.