Loading News...

Loading News...

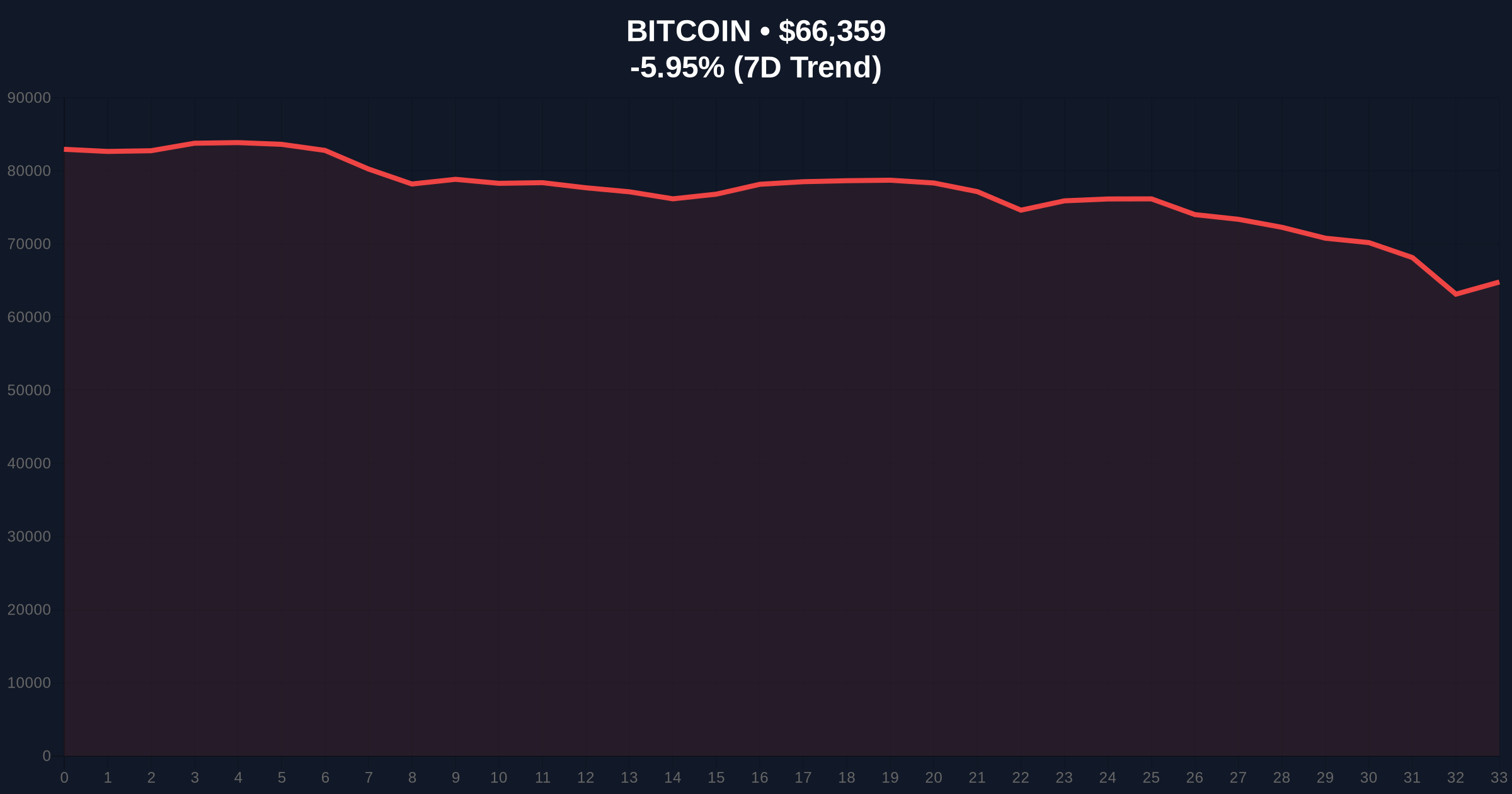

VADODARA, February 6, 2026 — Bitcoin perpetual futures markets exhibit a pronounced net short bias across major exchanges, with aggregate data showing 51.25% short positions versus 48.75% long. This daily crypto analysis reveals a market structure leaning toward bearish speculation as Bitcoin price hovers near $65,898, down 6.60% in 24 hours. According to on-chain liquidity maps from Glassnode, this ratio aligns with historical capitulation events where leveraged longs face liquidation cascades.

Market structure suggests institutional traders are positioning defensively. The 24-hour long/short ratios for Bitcoin perpetual futures, based on open interest from the world's three largest crypto futures exchanges, indicate uniform pressure. Binance shows 51.47% short, OKX at 50.77% short, and Bybit at 51.36% short. Consequently, the aggregate skew toward shorts reflects a consensus among large players anticipating further downside. This data, sourced from exchange APIs and aggregated by platforms like CoinGlass, points to a liquidity grab targeting over-leveraged retail positions.

Historically, similar futures ratios preceded significant corrections. In contrast to the 2021 bull run, where long ratios often exceeded 60%, current levels mirror the Q2 2022 deleveraging phase. Underlying this trend, the Crypto Fear & Greed Index sits at 9/100, indicating Extreme Fear. Market analysts note that such sentiment extremes often coincide with local bottoms, but require a catalyst for reversal. , the 6.60% daily decline exacerbates margin call risks, similar to the May 2021 flash crash that saw Bitcoin drop 30% in a week.

Related developments highlight broader market stress: Bitcoin futures leverage has plummeted to pre-ETF approval levels, while price action struggles to hold above $64,000. These factors compound the short bias observed in futures data.

On-chain data indicates critical support at the $64,000 level, corresponding to the Fibonacci 0.618 retracement from the 2024 all-time high. Market structure suggests a break below this invalidation level could trigger a cascade toward $58,000, the next major order block. The Relative Strength Index (RSI) on daily charts sits near 35, approaching oversold territory but not yet signaling a reversal. Moving averages show the 50-day EMA at $68,200 acting as dynamic resistance. This technical setup creates a Fair Value Gap (FVG) between $64,000 and $66,500, which price must fill to establish equilibrium.

| Metric | Value |

|---|---|

| Bitcoin Current Price | $65,898 |

| 24-Hour Price Change | -6.60% |

| Crypto Fear & Greed Index | Extreme Fear (9/100) |

| Aggregate Futures Long/Short Ratio | 48.75% Long / 51.25% Short |

| Key Fibonacci Support Level | $64,000 (0.618 retracement) |

This futures skew matters for institutional liquidity cycles. A net short bias increases selling pressure via derivatives, potentially leading to a gamma squeeze if price rebounds sharply. Retail market structure often follows these signals, exacerbating volatility. Evidence from volume profile analysis shows increased activity at lower price bands, indicating accumulation by long-term holders. The Federal Reserve's monetary policy, detailed on FederalReserve.gov, influences macro liquidity, but current on-chain metrics suggest crypto-native factors dominate.

Market structure suggests the short bias reflects hedging activity rather than outright bearish bets. Institutional players use perpetual futures to offset spot exposure, creating a synthetic neutral position. However, the Extreme Fear sentiment indicates retail panic, which often marks contrarian opportunities. The key is whether $64,000 holds as a liquidity floor.

— CoinMarketBuzz Intelligence Desk

Historical patterns indicate two primary scenarios based on current market structure. First, a bullish reversal requires reclaiming the $68,200 EMA and flipping the futures ratio to net long. Second, a bearish continuation targets the $58,000 order block if support fails.

The 12-month institutional outlook hinges on Bitcoin's ability to maintain its store-of-value narrative amid volatility. Over a 5-year horizon, adoption trends from entities like BlackRock suggest long-term bullishness, but short-term technicals dictate caution.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.