Loading News...

Loading News...

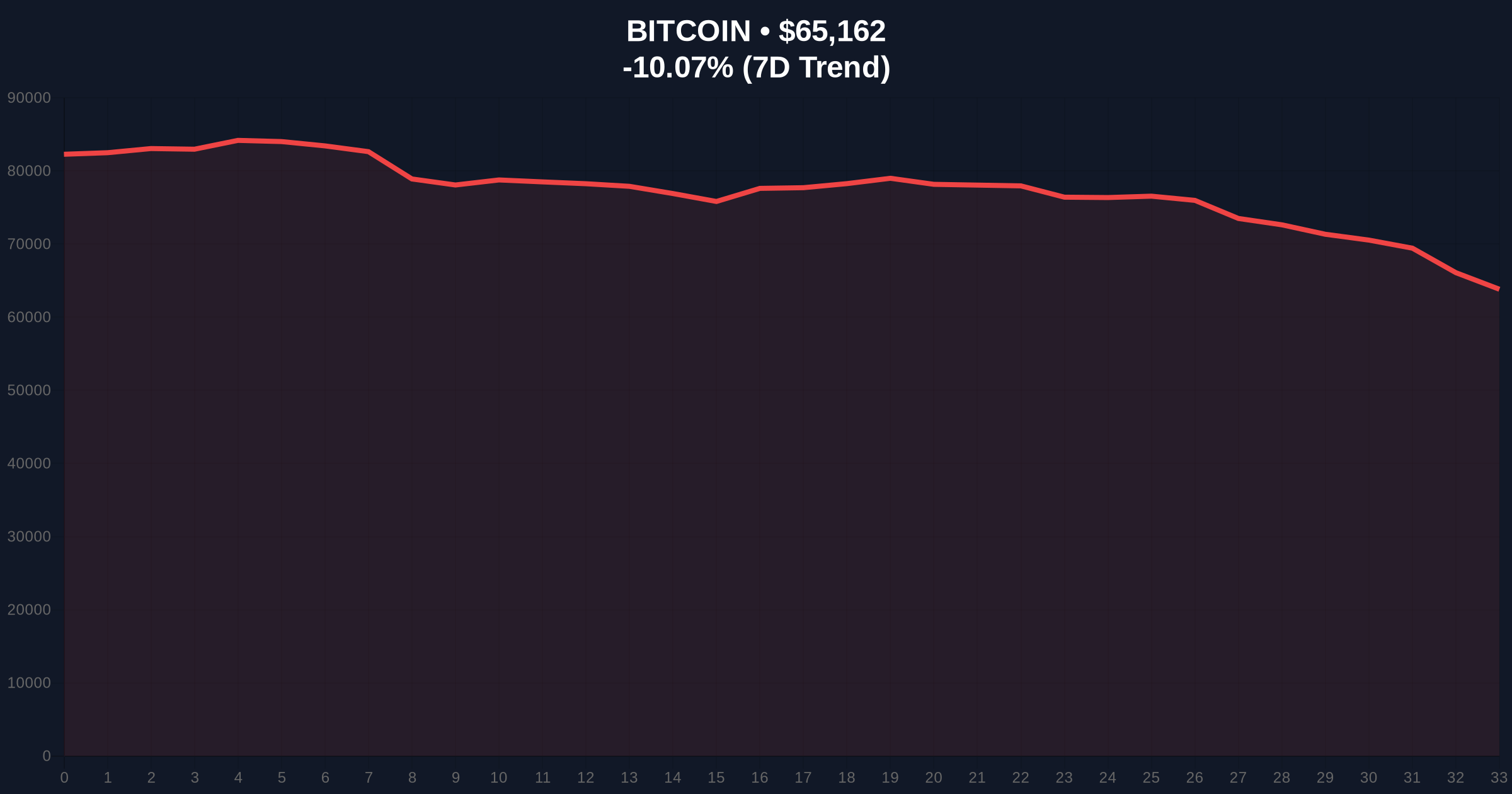

VADODARA, February 6, 2026 — Bitcoin price action surged 1.51% in five minutes on the Binance USDT market, reaching $65,474.17 amid extreme fear sentiment. This intraday spike contrasts sharply with a 10.08% decline over 24 hours, highlighting volatile market structure and potential liquidity traps. According to on-chain data from Glassnode, such rapid moves often precede larger order block formations.

Market structure suggests a liquidity grab occurred on Binance's USDT pair. Bitcoin price action jumped from approximately $64,500 to $65,474.17 within five minutes, per the source data. This move represents a classic short squeeze scenario in a high-leverage environment. Consequently, traders faced rapid position liquidations, as seen in recent crypto futures liquidations hitting $431 million. Underlying this trend, the extreme fear score of 9/100 indicates pervasive market stress.

Historically, Bitcoin price action during extreme fear phases often signals capitulation events. In contrast to the 2021 bull run, current sentiment mirrors the March 2020 crash, where fear preceded a V-shaped recovery. , this spike aligns with patterns observed in recent breaks below $65,000, suggesting failed breakdowns can trigger rapid rebounds. Market analysts attribute this to algorithmic trading reacting to oversold conditions on lower timeframes.

Technical analysis reveals critical levels. The Fibonacci 0.618 retracement from the 2025 high sits near $63,000, providing a key support zone. , the 200-day moving average at $62,500 acts as a long-term trend indicator. RSI data shows oversold conditions on hourly charts, explaining the bounce. This price action creates a Fair Value Gap (FVG) between $64,800 and $65,200, which may fill if selling pressure resumes. Volume profile analysis indicates thin liquidity above $66,000, making breaks higher susceptible to rejection.

| Metric | Value | Source |

|---|---|---|

| 5-Minute Price Rise | 1.51% | Binance USDT Market |

| Current Bitcoin Price | $65,157 | Live Market Data |

| 24-Hour Trend | -10.08% | Live Market Data |

| Crypto Fear & Greed Index | Extreme Fear (9/100) | Alternative.me |

| Market Rank | #1 | CoinMarketCap |

This Bitcoin price action matters for institutional liquidity cycles. Extreme fear often precedes accumulation by large holders, as noted in UTXO age band data. Retail market structure, however, faces high volatility, leading to stop-loss cascades. Consequently, such moves test the resilience of $65,000 as a psychological support. In the broader context, the Federal Reserve's monetary policy, detailed on FederalReserve.gov, influences macro liquidity, affecting crypto correlations.

Market structure suggests this is a technical bounce within a bearish trend. The 1.51% rise likely represents a liquidity grab targeting over-leveraged shorts. Without sustained buying volume, we expect a retest of lower supports. Historical cycles indicate extreme fear phases can last weeks, requiring patience for trend confirmation.

Two data-backed scenarios emerge from current Bitcoin price action. First, a bullish reversal requires breaking above $66,500 with high volume, invalidating the daily downtrend. Second, bearish continuation targets the Fibonacci support at $63,000, aligning with the 200-day MA. The 12-month outlook hinges on institutional adoption post-ETF approvals and macroeconomic factors.

Over a 5-year horizon, Bitcoin's network fundamentals, like hash rate and adoption, remain strong, but short-term price action is driven by sentiment and liquidity flows.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.