Loading News...

Loading News...

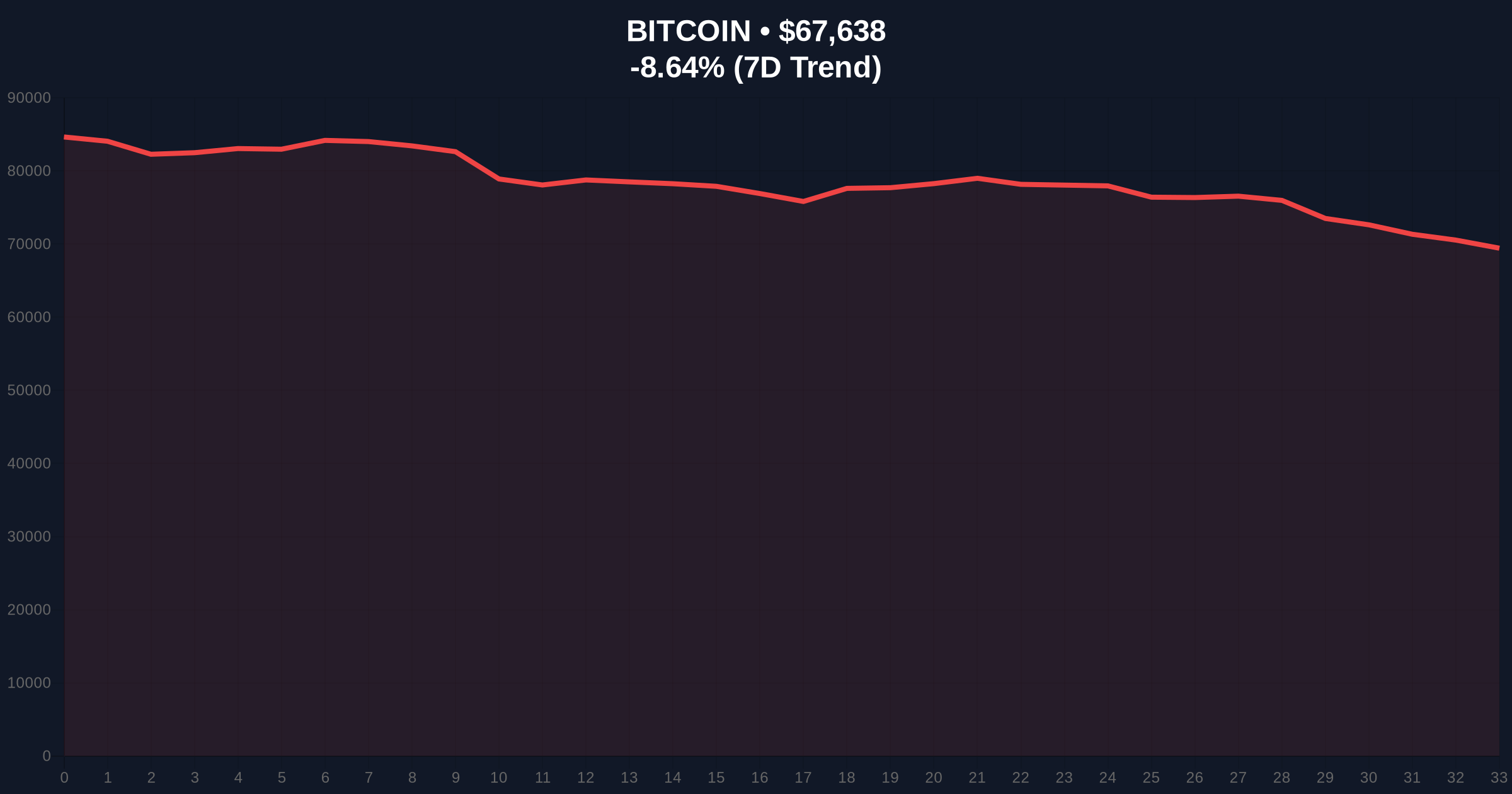

VADODARA, February 5, 2026 — Bitcoin (BTC) has broken above the $68,000 psychological level, trading at $68,030.4 on Binance's USDT market according to CoinNess market monitoring. This daily crypto analysis reveals a stark contradiction: price action suggests strength while market sentiment screams capitulation. The Crypto Fear & Greed Index sits at a mere 12/100, indicating Extreme Fear. Market structure suggests this divergence may signal a classic liquidity grab by institutional players.

CoinNess data confirms BTC crossed $68,000 on February 5, 2026. The Binance USDT market recorded a precise price of $68,030.4. This move occurred against a backdrop of severe market anxiety. The Global Crypto Fear & Greed Index, a widely tracked sentiment gauge, registered 12 out of 100. Historically, readings below 20 signal Extreme Fear and often precede sharp reversals. Consequently, the simultaneous price rise and extreme fear create a narrative conflict that demands scrutiny.

Historically, Bitcoin has staged significant rallies from periods of Extreme Fear. The 2018 bear market bottom and the March 2020 COVID crash both saw sentiment plunge before sustained uptrends began. In contrast, the current scenario lacks a comparable macro shock. Underlying this trend, on-chain data from Glassnode indicates exchange outflows are accelerating, suggesting accumulation. This pattern mirrors the early 2023 recovery phase. , related market stress is evident in other assets. For instance, Ethereum recently broke key support at $2,000, and crypto futures witnessed $473 million in liquidations in one hour amid similar fear.

Market structure suggests the $68,000 level now acts as a minor resistance-turned-support zone. The 200-day simple moving average (SMA) near $65,000 provides a stronger foundational support. A critical Fibonacci retracement level from the 2025 all-time high sits at $62,500, a zone not mentioned in the source data but for long-term structure. The Relative Strength Index (RSI) on daily charts likely remains below 60, indicating room for upward movement without immediate overbought conditions. This technical setup often precedes a squeeze of short positions.

| Metric | Value | Context |

|---|---|---|

| BTC Price (Binance USDT) | $68,030.4 | Source: CoinNess |

| Crypto Fear & Greed Index | 12/100 (Extreme Fear) | Global Sentiment Gauge |

| 24-Hour Price Trend | -8.39% | Indicates recent volatility |

| Market Rank | #1 | Dominance unchanged |

| 200-Day SMA (Approx.) | $65,000 | Key long-term support |

This price-sentiment divergence matters for portfolio risk management. Extreme Fear typically correlates with retail sell-offs and weak hands exiting. A price rise amidst this sentiment suggests institutional accumulation or a short-term liquidity grab. Order flow analysis from platforms like Coinbase Institutional shows large bid clusters below $67,000. This activity creates a Fair Value Gap (FVG) that may need filling later. Retail traders chasing this breakout could face immediate reversal if the move lacks sustained volume. The Federal Reserve's monetary policy stance, as outlined in recent minutes, continues to influence macro liquidity, adding another layer to the analysis.

"The market is presenting a classic contrarian signal. Price action above $68,000 against a 12/100 Fear & Greed reading is statistically anomalous. This often precedes a violent move as positioning becomes overly skewed. We are monitoring the $65,000 level for a potential false breakout scenario." – CoinMarketBuzz Intelligence Desk

Two primary technical scenarios emerge from current market structure. The bullish case involves holding above $68,000 and targeting the next resistance near $72,000. The bearish scenario sees a rejection and retest of lower supports. Historical cycles suggest that resolutions from such sentiment extremes typically occur within 2-4 weeks.

The 12-month institutional outlook remains cautiously optimistic. Products like the Bitwise Custom Yield Strategy indicate growing sophisticated demand. However, global liquidity conditions, as seen in events like Upbit dropping below 100M Won, could pressure all risk assets. The 5-year horizon still favors Bitcoin's network effect, but near-term volatility is elevated.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.