Loading News...

Loading News...

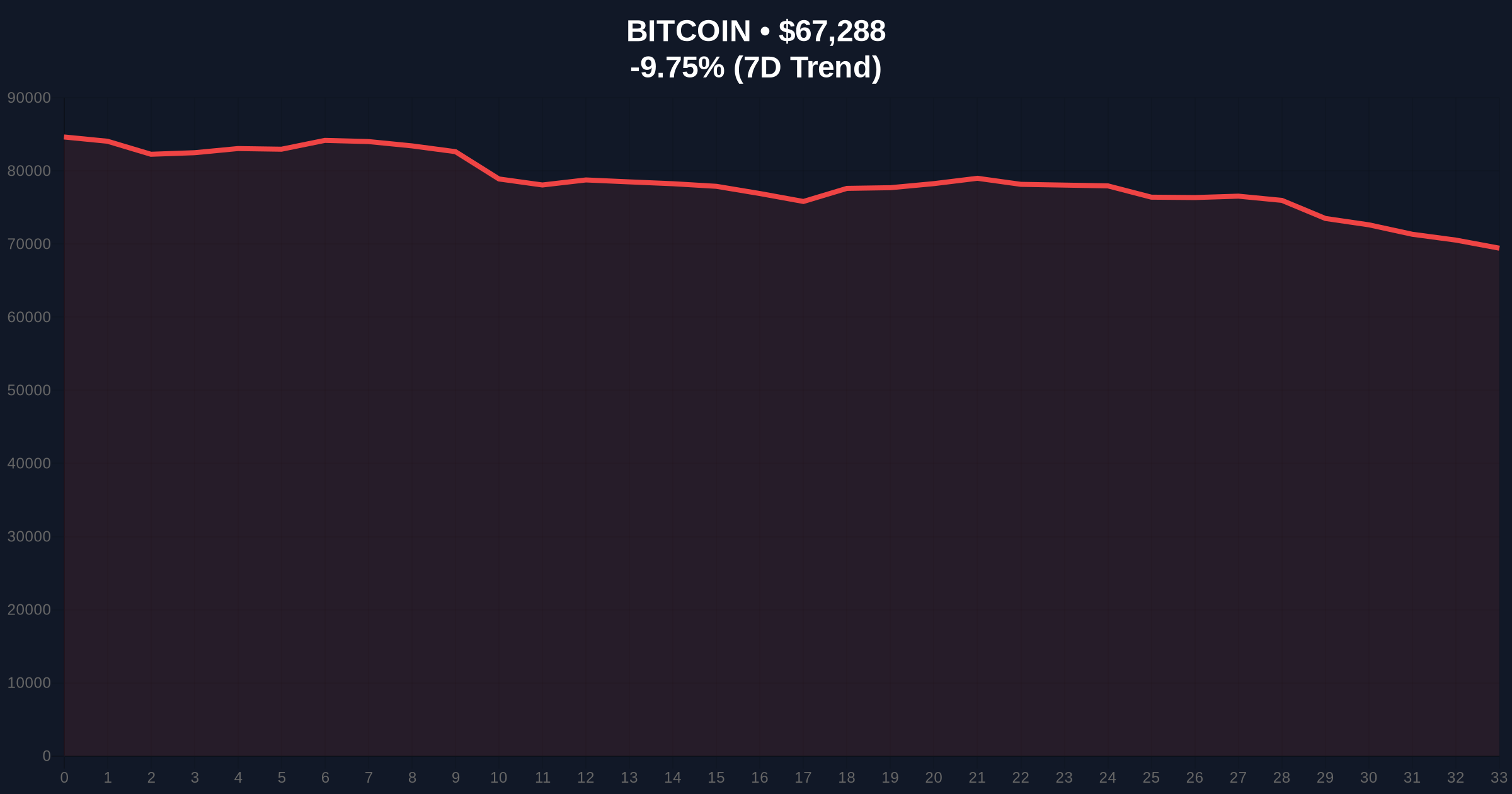

VADODARA, February 5, 2026 — Bitcoin has breached the critical 100 million won psychological support level on South Korea's Upbit exchange for the first time since November 6, 2024. According to CoinNess market monitoring, the asset is currently trading at 99,777,000 won on the exchange's KRW market, marking a 7.50% decline. This Bitcoin price action represents a significant technical breakdown in one of Asia's most influential liquidity pools, occurring against a backdrop of global market stress.

Market structure suggests a deliberate liquidity grab below the 100 million won threshold. The last recorded price below this level was on November 6, 2024, establishing a 15-month support zone that has now been invalidated. According to CoinNess data, the 7.50% intraday drop created a substantial Fair Value Gap (FVG) between 100 million won and the current trading price. Consequently, this move has triggered stop-loss orders and margin calls across the Korean retail sector, exacerbating the sell pressure.

Historically, Korean exchanges like Upbit have exhibited premium pricing relative to global benchmarks, often acting as a sentiment bellwether for Asian retail markets. The breach of this long-held support mirrors patterns observed during the 2018 bear market capitulation, where Kimchi premium collapses preceded broader liquidity crises. Underlying this trend is a global shift toward risk-off assets, as evidenced by rising U.S. Treasury yields and a strengthening dollar index. In contrast to the 2021 cycle, current on-chain data indicates weaker HODLer conviction among short-term holders.

Related Developments: This liquidity stress coincides with other institutional maneuvers, such as Gemini's operational retreat in key markets and Tether's strategic investment in Anchorage Digital, highlighting a bifurcation in market strategies.

The breakdown on Upbit's KRW market invalidates a major Order Block that had formed between November 2024 and February 2026. Market structure suggests the next significant support cluster lies at the Fibonacci 0.618 retracement level of the 2024-2025 bull run, approximately at 85 million won. , the Relative Strength Index (RSI) on the daily chart has plunged into oversold territory below 30, indicating potential for a short-term relief rally. However, the 50-day and 200-day moving averages have now crossed bearishly, confirming a medium-term downtrend. Volume profile analysis shows elevated selling volume at the breakdown point, confirming institutional distribution.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 12/100 (Extreme Fear) |

| Bitcoin Current Price (USD) | $67,637 |

| Bitcoin 24h Trend | -9.28% |

| Upbit KRW Price | 99,777,000 won |

| Time Below 100M Won | First since Nov 6, 2024 |

This event matters because it tests the structural integrity of Bitcoin's global market architecture. The Korean won market represents a significant liquidity pool, and its breakdown can create arbitrage opportunities that pressure prices on other exchanges like Coinbase and Binance. On-chain data indicates a surge in exchange inflows from Korean addresses, suggesting local capitulation. Consequently, this could lead to a cascade of liquidations in leveraged derivatives markets, potentially triggering a broader gamma squeeze to the downside. Institutional players are monitoring this for signs of a liquidity crisis similar to the 2020 March crash.

The breach of 100 million won on Upbit is not an isolated event but a symptom of global macro tightening. Market structure suggests we are witnessing a coordinated liquidity withdrawal from risk assets, with crypto acting as the canary in the coal mine. The key will be whether this level can be reclaimed swiftly or if it establishes a new resistance zone.

— CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on the Upbit breakdown. First, a relief rally could occur if the Fear & Greed Index reaches historic oversold levels, potentially pushing price back to test 100 million won as new resistance. Second, continued selling pressure could target the next major support at the 85 million won Fibonacci level, aligning with the 2024 cycle low.

The 12-month institutional outlook remains cautious. Historical cycles suggest that breaks of major psychological levels often lead to extended consolidation periods, typically 6-12 months. However, the long-term horizon remains positive if Bitcoin can maintain its network security and hash rate, as outlined in Bitcoin's original whitepaper regarding its deflationary monetary policy.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.