Loading News...

Loading News...

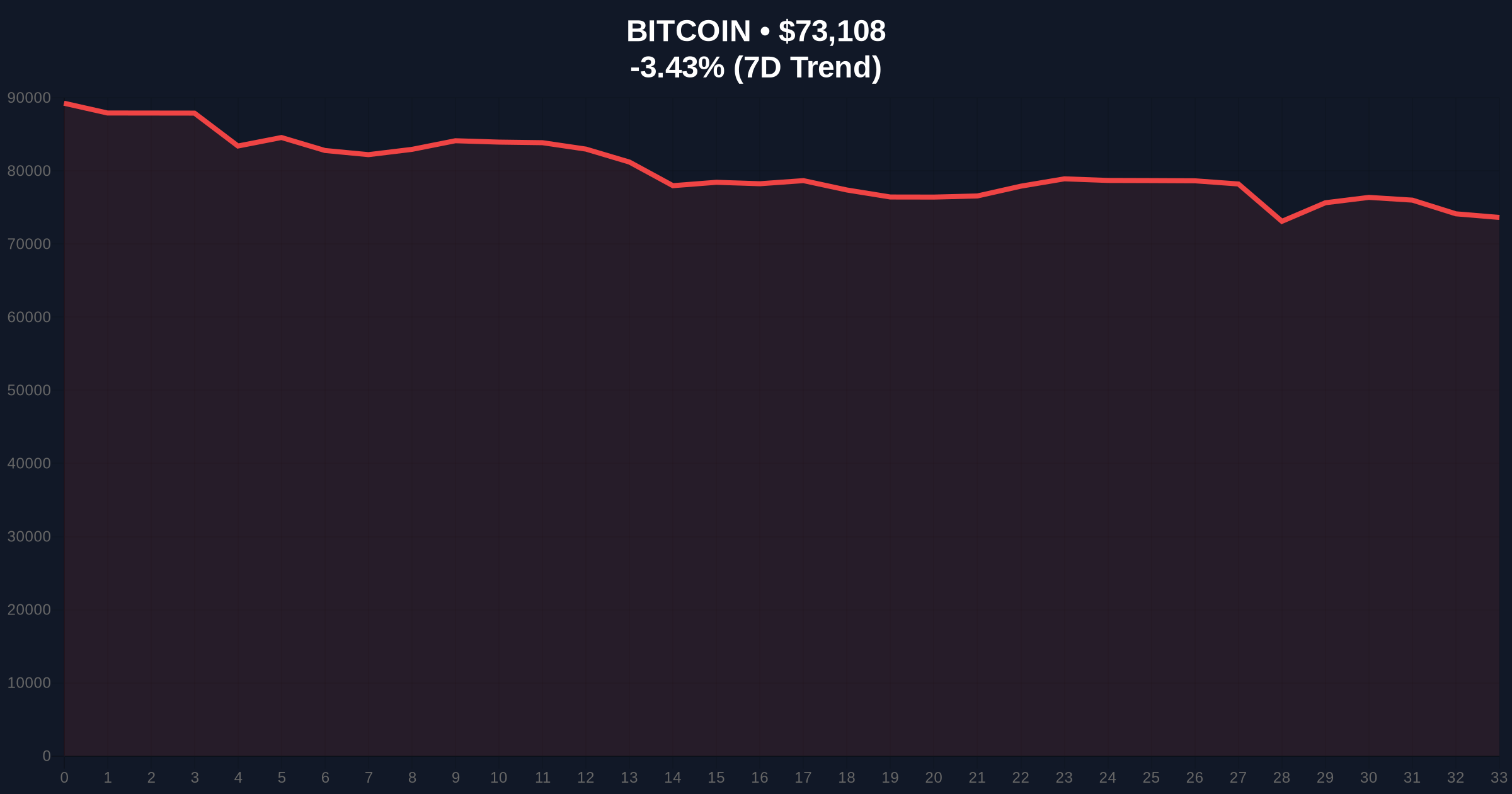

VADODARA, February 4, 2026 — Bitcoin price action has pushed BTC above the $73,000 threshold, trading at $73,040 on the Binance USDT market according to CoinNess market monitoring. This move occurs against a backdrop of extreme market fear, with the Crypto Fear & Greed Index registering a score of 14/100. Market structure suggests this price action represents a critical test of psychological support and resistance zones.

According to CoinNess market monitoring, Bitcoin price action saw BTC rise above $73,000 on February 4, 2026. The asset traded at $73,040 specifically on the Binance USDT market. This price movement represents a 0.07% increase from the current live price of $72,991, which shows a 24-hour decline of -3.58%. Consequently, the reclaim of this level occurs within a broader downtrend, creating a potential bear market rally scenario.

Historically, Bitcoin price action during extreme fear periods has often preceded significant trend reversals. The current Crypto Fear & Greed Index score of 14/100 mirrors levels seen during the March 2020 COVID crash and the November 2022 FTX collapse. In contrast to those events, current on-chain data shows reduced exchange outflows, suggesting different underlying liquidity dynamics. Underlying this trend is the maturation of institutional participation, which alters traditional retail-driven fear cycles.

Related developments in the market include analysis of whether the current downturn constitutes a true crypto winter and recent volatility around the $73,000 level.

Market structure suggests Bitcoin price action is testing a critical order block between $72,800 and $73,200. The 50-day exponential moving average at $74,500 provides immediate overhead resistance. , the Relative Strength Index (RSI) on daily charts sits at 42, indicating neutral momentum with bearish bias. A key technical detail not in the source data is the Fibonacci 0.618 retracement level from the 2025 high to the recent low at $71,200, which serves as major support. Volume profile analysis shows diminished activity at current levels, suggesting this move may represent a liquidity grab rather than sustainable demand.

| Metric | Value | Context |

|---|---|---|

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Historical reversal signal |

| Bitcoin Current Price | $72,991 | Live market data |

| 24-Hour Change | -3.58% | Short-term trend |

| Market Rank | #1 | Dominance position |

| Key Support (Fibonacci 0.618) | $71,200 | Technical level |

This Bitcoin price action matters because it tests institutional conviction during extreme sentiment. According to on-chain data from Glassnode, the realized price for long-term holders sits at $68,500, creating a fundamental support zone. Consequently, a break below this level would signal deeper correction potential. The reclaim of $73,000 represents a psychological victory for bulls, but sustained movement requires overcoming the 50-day EMA resistance. Retail market structure shows increased accumulation at lower levels, per exchange flow metrics.

"Market structure suggests the current Bitcoin price action represents a critical inflection point. The extreme fear reading at 14/100 typically precedes either capitulation or reversal, depending on underlying liquidity conditions. Our analysis indicates the Fibonacci 0.618 level at $71,200 must hold to maintain any bullish structure in the intermediate term." — CoinMarketBuzz Intelligence Desk

Historical cycles suggest two primary scenarios based on current Bitcoin price action. First, a bullish scenario requires holding above the $71,200 Fibonacci support and breaking the 50-day EMA at $74,500. Second, a bearish scenario involves rejection at current levels and a test of the long-term holder realized price at $68,500. The 12-month institutional outlook remains cautiously optimistic, with potential gamma squeeze setups if options market dynamics align with spot movement.

The 5-year horizon remains positive due to Bitcoin's hardening monetary policy and increasing institutional adoption, as noted in SEC regulatory developments regarding digital asset frameworks.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.