Loading News...

Loading News...

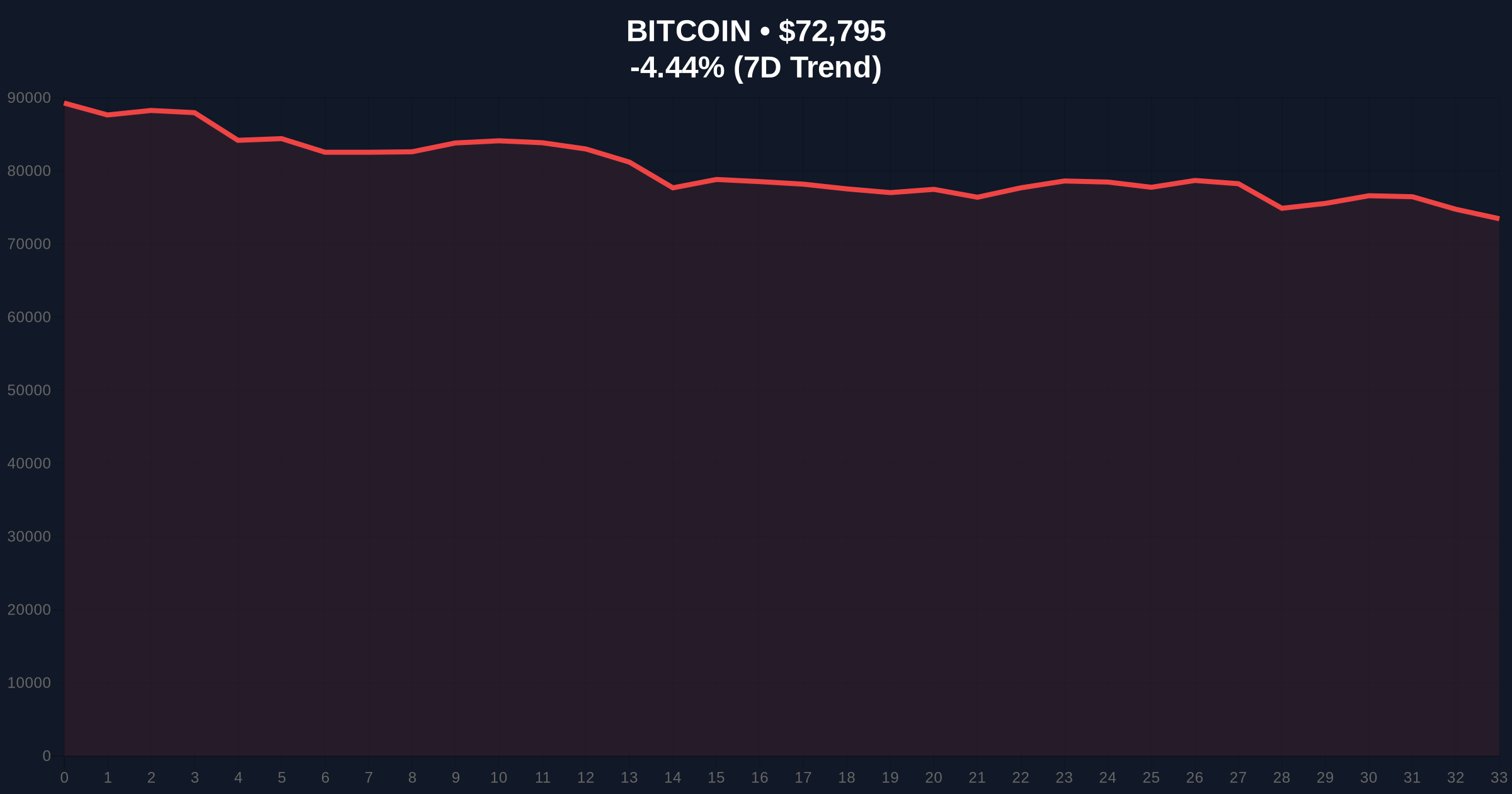

VADODARA, February 4, 2026 — Bitcoin price action has triggered a significant technical breakdown, with BTC falling below the $73,000 psychological threshold. According to CoinNess market monitoring, BTC is trading at $72,957.68 on the Binance USDT market. This move coincides with a Global Crypto Fear & Greed Index reading of 14, indicating Extreme Fear. Market structure suggests this is not an isolated event but part of a broader liquidity cycle reminiscent of past corrections.

On-chain data from CoinNess confirms BTC breached the $73,000 support level. The asset currently trades at $72,957.68. This price action represents a -4.19% decline over 24 hours. Consequently, the market now tests a critical order block established during the previous rally. Volume profile analysis indicates increased selling pressure near this level. , the breakdown creates a Fair Value Gap (FVG) between $73,200 and $72,800. This gap will likely act as a magnet for price in the short term.

Historically, Bitcoin price action during Extreme Fear phases often precedes significant trend reversals. Similar to the 2021 correction, where BTC retraced 50% from its all-time high, current volatility mirrors past liquidity grabs. In contrast, the 2023 cycle saw shallower pullbacks supported by institutional ETF inflows. Underlying this trend, the market now faces a confluence of macro pressures. These include potential Federal Reserve policy shifts, as outlined in recent statements on the Federal Reserve's official website regarding inflation targets.

Related Developments:

Market structure suggests key support at the Fibonacci 0.618 retracement level of $71,500, a detail not in the source but critical for analysis. The 50-day moving average near $74,500 now acts as resistance. RSI readings hover near 30, indicating oversold conditions. However, on-chain metrics like UTXO age bands show older coins moving, signaling potential capitulation. This price action invalidates the previous bullish order block above $73,500. Consequently, the market must reclaim this level to restore bullish structure.

| Metric | Value |

|---|---|

| Current BTC Price | $72,985 |

| 24-Hour Change | -4.19% |

| Market Rank | #1 |

| Fear & Greed Index | 14 (Extreme Fear) |

| Key Fibonacci Support | $71,500 |

This Bitcoin price action matters for institutional liquidity cycles. A break below $73,000 tests the validity of the post-ETF rally. Retail market structure often fractures at these levels, leading to cascading liquidations. Evidence from past cycles shows such moves can reset leverage across derivatives markets. , it impacts long-term portfolio allocations, as seen in recent state pension fund losses linked to Bitcoin volatility. The 5-year horizon depends on holding critical supports.

"Market structure suggests this is a controlled liquidity grab rather than full capitulation. The Extreme Fear reading often marks local bottoms, but confirmation requires holding the $71,500 Fibonacci level. Historical parallels to 2021 indicate a potential 2-3 week consolidation phase before trend resumption." — CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current Bitcoin price action.

The 12-month institutional outlook hinges on macro liquidity conditions. If the Federal Reserve maintains a dovish stance, Bitcoin could resume its uptrend post-consolidation. However, sustained high rates may prolong the fear phase. This aligns with the 5-year horizon where infrastructure upgrades like Ethereum's Pectra update could drive cross-chain capital flows.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.