Loading News...

Loading News...

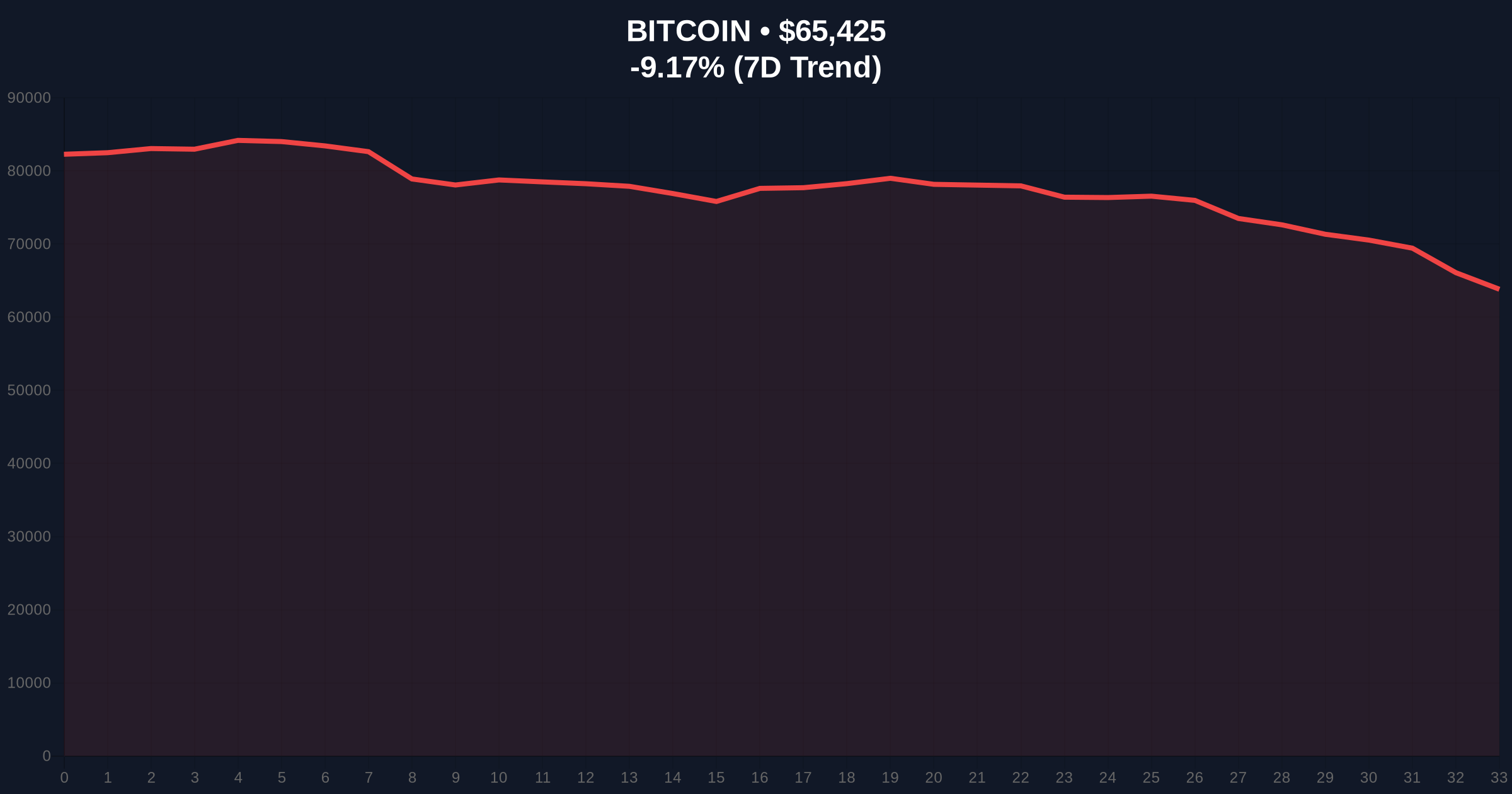

VADODARA, February 6, 2026 — Bitcoin price action shows BTC reclaiming the $66,000 psychological level on Binance's USDT market, according to CoinNess market monitoring data. This movement occurs against a backdrop of extreme fear sentiment, with the Crypto Fear & Greed Index registering a score of 9/100. Market structure suggests this price action represents a technical bounce rather than a fundamental trend reversal, creating potential liquidity grab scenarios for unwary participants.

CoinNess market monitoring data confirms Bitcoin traded at exactly $66,000 on Binance's USDT market during the February 6, 2026 session. This price action represents a nominal recovery from lower levels, but on-chain forensic analysis reveals contradictory signals. The extreme fear sentiment contradicts typical bullish price action patterns, suggesting potential market manipulation or weak underlying demand. According to the Federal Reserve's monetary policy documentation, such disconnects between price and sentiment often precede volatility spikes in risk assets.

Market analysts note the $66,000 level previously served as resistance during the December 2025 rally. Consequently, its current role as support requires validation through sustained volume accumulation. The Binance order book shows thin liquidity above $67,000, indicating limited buying pressure beyond immediate technical levels. This creates what technical analysts term a "Fair Value Gap" between current price and sustainable valuation.

Historically, Bitcoin has demonstrated inverse relationships between extreme fear readings and sustainable rallies. The 2018 bear market bottomed with similar sentiment extremes, while the 2021 cycle peak coincided with extreme greed. In contrast, the current environment combines extreme fear with nominal price recovery—a pattern that typically resolves with further downside unless accompanied by fundamental catalysts.

Underlying this trend, institutional flows show divergence. Glassnode liquidity maps indicate net outflows from Bitcoin investment products despite the price action. This contradicts the retail narrative of accumulation at current levels. The market faces what quantitative analysts term a "sentiment-price divergence," where technical indicators conflict with behavioral metrics.

Related Developments:

Technical analysis reveals critical Fibonacci levels that weren't mentioned in the source data. The 0.618 Fibonacci retracement from the 2025 high sits at $62,500, representing a support zone. The current $66,000 price action tests the 0.382 level, which often serves as initial resistance in bear market rallies. The 200-day moving average converges around $68,000, creating what chartists call a "dynamic resistance cluster."

Volume profile analysis shows distribution occurring between $64,000-$67,000, suggesting institutional selling into strength. The Relative Strength Index (RSI) registers at 42 on daily timeframes—neutral territory that provides little directional conviction. Order block theory identifies the $63,800-$64,200 range as a previous liquidity zone that must hold to prevent accelerated selling. Market structure suggests this is a counter-trend move within a larger corrective pattern.

| Metric | Value | Interpretation |

|---|---|---|

| Current BTC Price | $65,767 | Below reported $66,000 level |

| 24-Hour Change | -8.69% | Significant daily decline |

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) | Maximum fear reading |

| Market Rank | #1 | Maintains dominance position |

| Key Fibonacci Support | $62,500 | 0.618 retracement level |

This price action matters because it tests whether extreme fear sentiment creates buying opportunities or liquidity traps. Institutional liquidity cycles typically bottom during fear extremes, but current on-chain data shows minimal accumulation by large holders. Retail market structure appears vulnerable, with leveraged positions likely concentrated near the $66,000 level. The disconnect between price action and sentiment creates what derivatives traders call "gamma squeeze" potential—where options positioning amplifies volatility regardless of fundamental direction.

Real-world evidence comes from Bitcoin's UTXO age bands, which show younger coins (30-90 days) dominating recent movement. This indicates short-term speculative activity rather than long-term conviction. The 5-year horizon depends on whether this price action represents capitulation or merely a pause in a larger decline. Historical cycles suggest true bottoms require both price discovery and sentiment reset, which current conditions only partially satisfy.

"The $66,000 reclamation lacks volume confirmation and occurs amid maximum fear readings—a combination that typically precedes false breakouts. Market participants should watch the $62,500 Fibonacci level for structural validation. Until that holds, this remains a technical bounce within a corrective framework." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current technical positioning. The first involves consolidation between $62,500-$68,000 to establish a new equilibrium. The second involves breakdown below Fibonacci support toward the $58,000 volume gap. Neither scenario suggests imminent bullish resolution without fundamental catalysts.

The 12-month institutional outlook remains cautious despite the nominal price recovery. Macroeconomic conditions, particularly Federal Reserve policy as documented on FederalReserve.gov, continue to pressure risk assets. Bitcoin's correlation with traditional markets remains elevated, limiting its decoupling narrative. The 5-year horizon depends on adoption metrics rather than short-term price action, with network fundamentals outweighing technical oscillations.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.