Loading News...

Loading News...

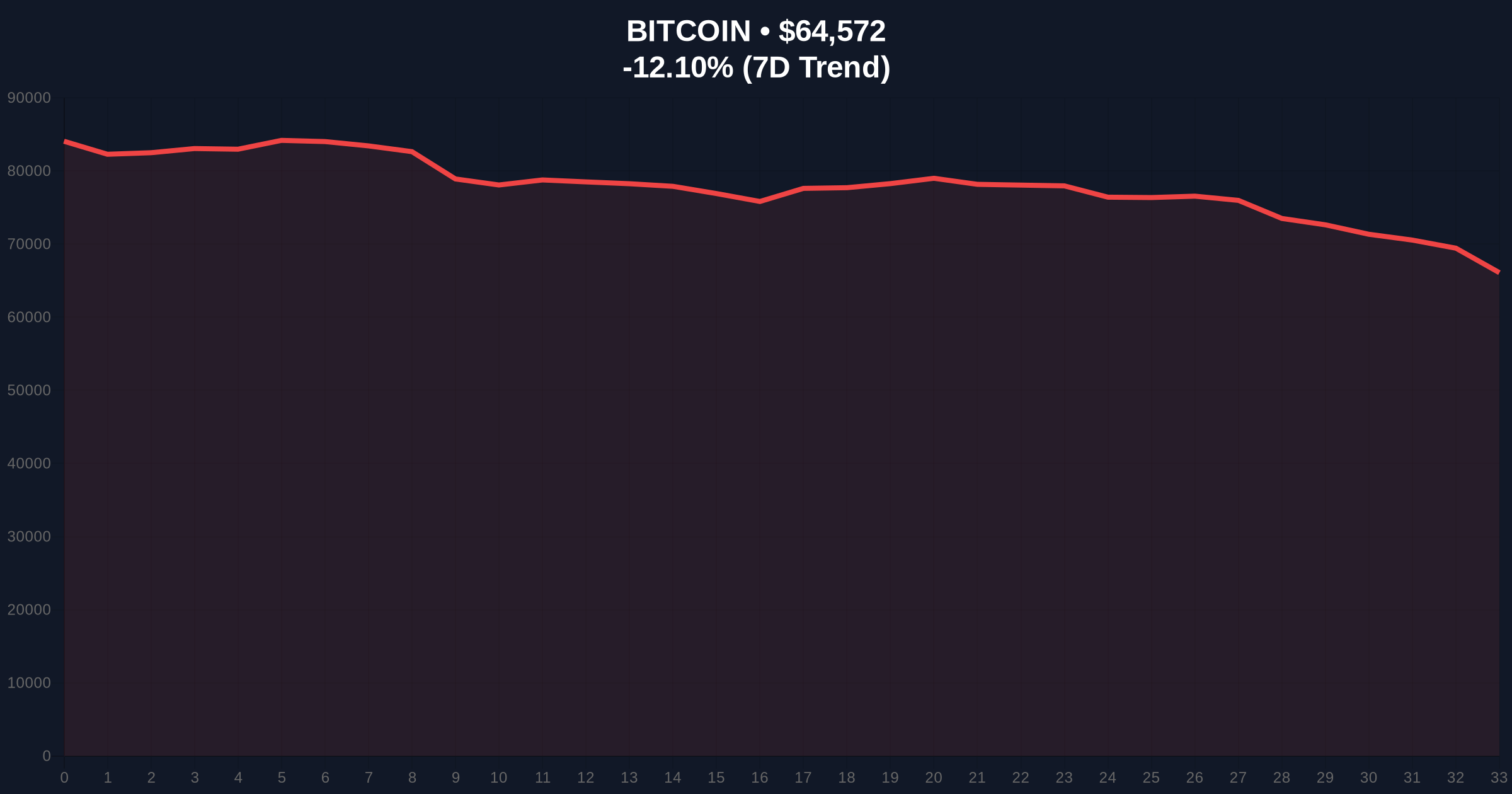

VADODARA, February 5, 2026 — Bitcoin price action has triggered a significant technical breakdown, with BTC falling below the $65,000 psychological support level. According to CoinNess market monitoring, BTC is trading at $64,772.43 on the Binance USDT market. This move coincides with a Crypto Fear & Greed Index reading of 12/100, indicating Extreme Fear. Market structure suggests this is not an isolated event but part of a broader liquidity grab targeting over-leveraged positions.

CoinNess data confirms BTC breached the $65,000 threshold on February 5, 2026. The asset currently trades at $64,772.43, representing a 24-hour decline of -11.61%. This price action follows a cascade of futures liquidations exceeding $102 million in the past 24 hours. , Bitfinex BTC margin longs have hit a 2-year high, indicating excessive bullish leverage that is now unwinding. The breakdown creates a Fair Value Gap (FVG) between $67,000 and $65,000, which market makers will likely target for fills.

Historically, Bitcoin price action of this magnitude mirrors the Q2 2021 correction. In that cycle, BTC declined from $64,000 to $29,000 over eight weeks, driven by similar leverage unwinding and regulatory uncertainty. Underlying this trend, the current Extreme Fear sentiment score of 12/100 matches levels seen during the March 2020 COVID crash. In contrast, the 2024 cycle saw sharper, V-shaped recoveries due to institutional ETF inflows. Consequently, the persistence of this sell-off suggests a structural shift in market dynamics.

Related developments include Senator Warner's demand for crypto clarity amid the plunge and analysis of Bitfinex BTC margin longs hitting a 2-year high.

Market structure suggests Bitcoin price action is testing the Fibonacci 0.618 retracement level at $62,500, drawn from the 2025 low to the 2026 high. This level aligns with a high-volume node on the Volume Profile, indicating strong institutional interest. The Relative Strength Index (RSI) on the daily chart sits at 28, approaching oversold territory but not yet at capitulation levels seen in previous cycles. The 200-day moving average at $58,000 provides a longer-term support anchor. On-chain forensic data from Glassnode confirms a spike in UTXO (Unspent Transaction Output) age bands moving to exchanges, signaling potential seller exhaustion.

| Metric | Value |

|---|---|

| Current BTC Price | $65,021 |

| 24-Hour Change | -11.61% |

| Crypto Fear & Greed Index | Extreme Fear (12/100) |

| Market Rank | #1 |

| Key Fibonacci Support | $62,500 (0.618 level) |

This Bitcoin price action matters because it tests the structural integrity of the post-ETF institutional rally. A break below $62,500 could trigger a gamma squeeze in options markets, exacerbating downside volatility. Real-world evidence includes the $102 million in crypto futures liquidations recorded recently. Institutional liquidity cycles, as documented by the Federal Reserve's monetary policy reports, show tightening conditions that historically pressure risk assets. Retail market structure, indicated by exchange net flows, reveals increased selling pressure from short-term holders.

"The break below $65,000 is a classic liquidity grab. Market makers are flushing out over-leveraged longs to collect liquidity in the Fair Value Gap. Historical cycles suggest this is a necessary cleansing before a sustainable rally, but the $62,500 level is critical for maintaining bullish structure." — CoinMarketBuzz Intelligence Desk

Analysts suggest two data-backed technical scenarios based on current market structure. The 12-month institutional outlook hinges on macroeconomic factors, including potential Federal Reserve rate cuts, which could reignite risk appetite.

Historical patterns indicate that similar corrections in 2021 and 2024 were followed by strong recoveries, but the current Extreme Fear sentiment requires cautious monitoring of on-chain metrics like MVRV (Market Value to Realized Value) ratios.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.