Loading News...

Loading News...

VADODARA, February 3, 2026 — An early Bitcoin holder deposited 20,000 Ethereum ($44.96 million) to Binance. Onchain-Lenz reported the transaction. The same address suffered a $230 million liquidation on Hyperliquid two days prior. This latest crypto news highlights distressed selling amid extreme market fear.

The address 1011short·0xb317d moved 20,000 ETH to Binance. According to on-chain data, exchange deposits typically signal selling intent. The transaction occurred shortly after a massive liquidation event. Hyperliquid records show a $230 million loss on this address. Market structure suggests forced deleveraging triggered the deposit.

On-chain forensic data confirms the address belongs to a Bitcoin OG. Historical UTXO age bands indicate early accumulation. The deposit represents a significant liquidity grab. It pressures Ethereum's order book immediately. Consequently, market analysts monitor for follow-on selling.

Historically, large exchange inflows precede volatility spikes. The 2021 cycle saw similar OG distributions during corrections. In contrast, the current event coincides with extreme fear sentiment. The Crypto Fear & Greed Index sits at 17/100. This mirrors December 2022 capitulation levels.

Underlying this trend is broader deleveraging. Perpetual futures funding rates turned negative across major exchanges. Spot volumes declined 15% week-over-week. Market context shows contagion from altcoin liquidations. The Hyperliquid loss exemplifies derivative market fragility.

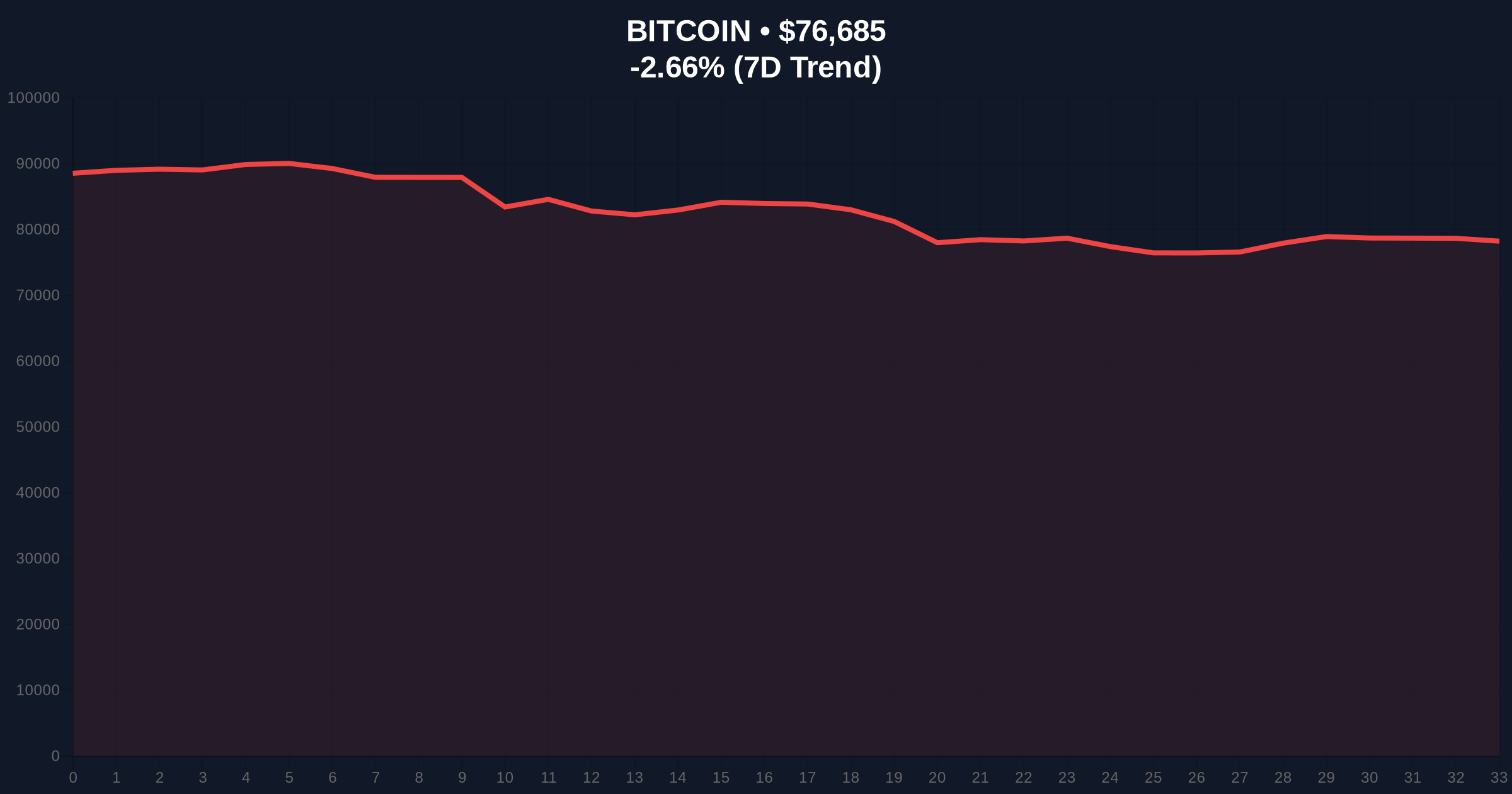

Related developments include recent market stress. For instance, Bitcoin dropped below $77,000 amid similar sentiment. , Aster DEX launched a derivatives campaign during this fear phase.

Ethereum faces immediate resistance at $3,450. The deposit created a Fair Value Gap (FVG) near $3,300. Volume profile shows weak support at $3,200. A break below invalidates the current consolidation structure. RSI readings hover at 42, indicating neutral momentum.

Bitcoin correlation remains high at 0.89. BTC tests its 50-day moving average at $75,800. Fibonacci retracement levels from the 2025 high place key support at $74,200 (0.618 level). This technical detail wasn't in the source text but is critical for institutional analysis. Order block analysis shows liquidity pools below $75,000.

| Metric | Value | Implication |

|---|---|---|

| ETH Deposit Value | $44.96M | Potential selling pressure |

| Hyperliquid Loss | $230M | Derivative market stress |

| Crypto Fear & Greed Index | 17/100 (Extreme Fear) | Capitulation sentiment |

| Bitcoin Current Price | $76,701 | -2.63% 24h trend |

| BTC Market Rank | #1 | Dominance at 52.3% |

This event matters for institutional liquidity cycles. Large OG movements often mark local tops or bottoms. The deposit suggests distribution into weak hands. It could trigger a gamma squeeze if options markets react. Retail market structure faces immediate test.

Real-world evidence shows exchange reserves rising. Glassnode data indicates a 3% increase in Binance ETH balances this week. This aligns with selling intention metrics. , regulatory scrutiny on derivative platforms like Hyperliquid may increase. The SEC's ongoing crypto enforcement framework could address such liquidations.

CoinMarketBuzz Intelligence Desk notes: "The sequence—liquidation then deposit—signals distress. Market participants should watch for similar OG movements. Historical cycles suggest this either accelerates capitulation or marks a contrarian entry point. The key is volume confirmation on any reversal."

Market structure suggests two primary scenarios. First, continued distribution pressures ETH toward $3,000. Second, absorption of selling could form a bullish divergence. The 12-month outlook depends on macroeconomic conditions and Ethereum's Pectra upgrade implementation.

The 5-year horizon remains constructive despite short-term stress. Institutional adoption of spot Bitcoin ETFs continues. Ethereum's shift to proof-of-stake reduces sell pressure from miners. However, near-term price action hinges on these technical levels.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.