Loading News...

Loading News...

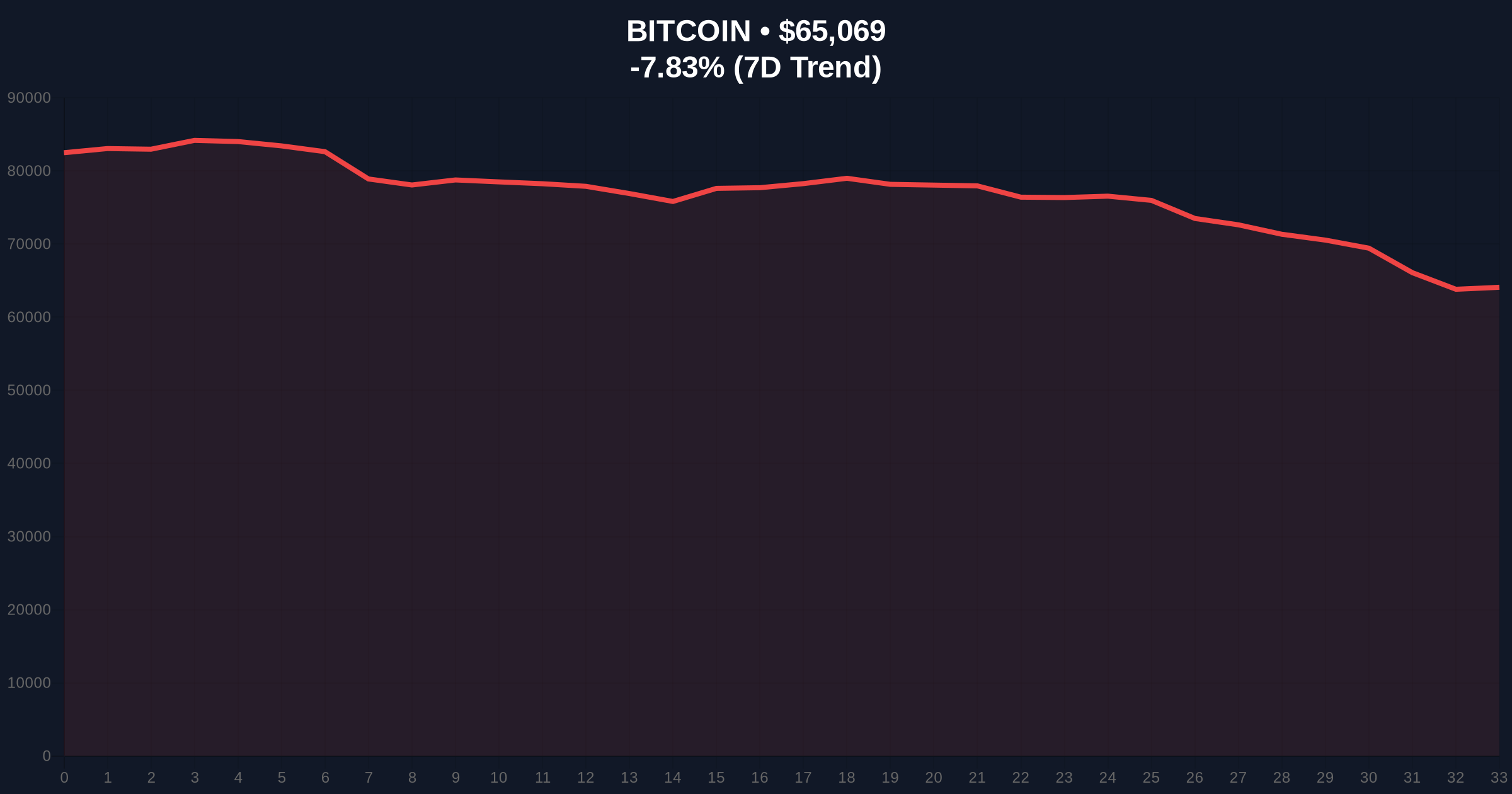

VADODARA, February 6, 2026 — Bitcoin price action has triggered a critical technical breakdown, with BTC falling below the $65,000 support level. According to CoinNess market monitoring, BTC is trading at $64,990.01 on the Binance USDT market. This move coincides with a Global Crypto Fear & Greed Index reading of 9/100, indicating Extreme Fear. Market structure suggests this is not an isolated event but part of a broader liquidity cycle.

On-chain data from CoinNess confirms the breakdown. BTC breached the $65,000 level during Asian trading hours. The price currently hovers at $64,990.01. This represents a 24-hour decline of approximately 7.82%. The Binance USDT market, a primary liquidity pool, shows significant selling pressure. Consequently, the market has invalidated a key weekly order block that previously acted as support. This price action creates a new Fair Value Gap (FVG) between $65,500 and $66,200.

Historically, Bitcoin has experienced similar sharp corrections during bull market consolidations. For instance, the 2021 cycle saw multiple 20-30% pullbacks before reaching new all-time highs. In contrast, the current decline occurs amid macro-economic uncertainty, including potential shifts in the Federal Reserve's interest rate policy. Underlying this trend is a decrease in network activity, as measured by daily active addresses. This suggests weakening retail participation. Related developments include recent breaks below the $62,000 support and plunges below $63,000, indicating a cascading support failure.

The technical reveals several critical levels. The immediate resistance now sits at the $65,000 breakdown point. Support is found at the Fibonacci 0.618 retracement level of $62,500, drawn from the 2025 low to the recent high. The 200-day moving average provides dynamic support near $60,000. Volume profile analysis shows high volume nodes around $63,000, indicating a potential battleground. The Relative Strength Index (RSI) on the daily chart is approaching oversold territory at 32. This often precedes a short-term bounce. However, the breakdown invalidates the bullish structure above $65,000.

| Metric | Value | Source |

|---|---|---|

| Current BTC Price | $65,077 | Live Market Data |

| 24-Hour Change | -7.82% | Live Market Data |

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) | Live Market Data |

| Market Rank | #1 | Live Market Data |

| Key Fibonacci Support | $62,500 | Technical Analysis |

This breakdown matters for institutional liquidity cycles. A hold below $65,000 could trigger stop-loss orders from leveraged positions. This creates a liquidity grab, where large players absorb sell-side volume. Retail market structure is fragile during Extreme Fear periods. Consequently, weak hands may capitulate, transferring coins to stronger holders. The 5-year horizon depends on whether this is a healthy correction or a trend reversal. On-chain metrics like UTXO age bands will reveal if long-term holders are distributing.

Market structure suggests the $65,000 level was a critical psychological and technical support. Its breach indicates a shift in supply-demand dynamics. We are now watching the $62,500 Fibonacci level as the next major test. If that fails, the 200-day moving average becomes the final line of defense for the bull market. Historical cycles show that Extreme Fear readings often mark local bottoms, but confirmation requires a reclaim of $68,000 resistance.

— CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook hinges on macro factors. According to the Federal Reserve's latest statements, interest rate decisions could impact risk assets. If Bitcoin holds above $60,000, institutions may view this as a buying opportunity. The 5-year horizon remains bullish if network fundamentals like hash rate continue to grow.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.