Loading News...

Loading News...

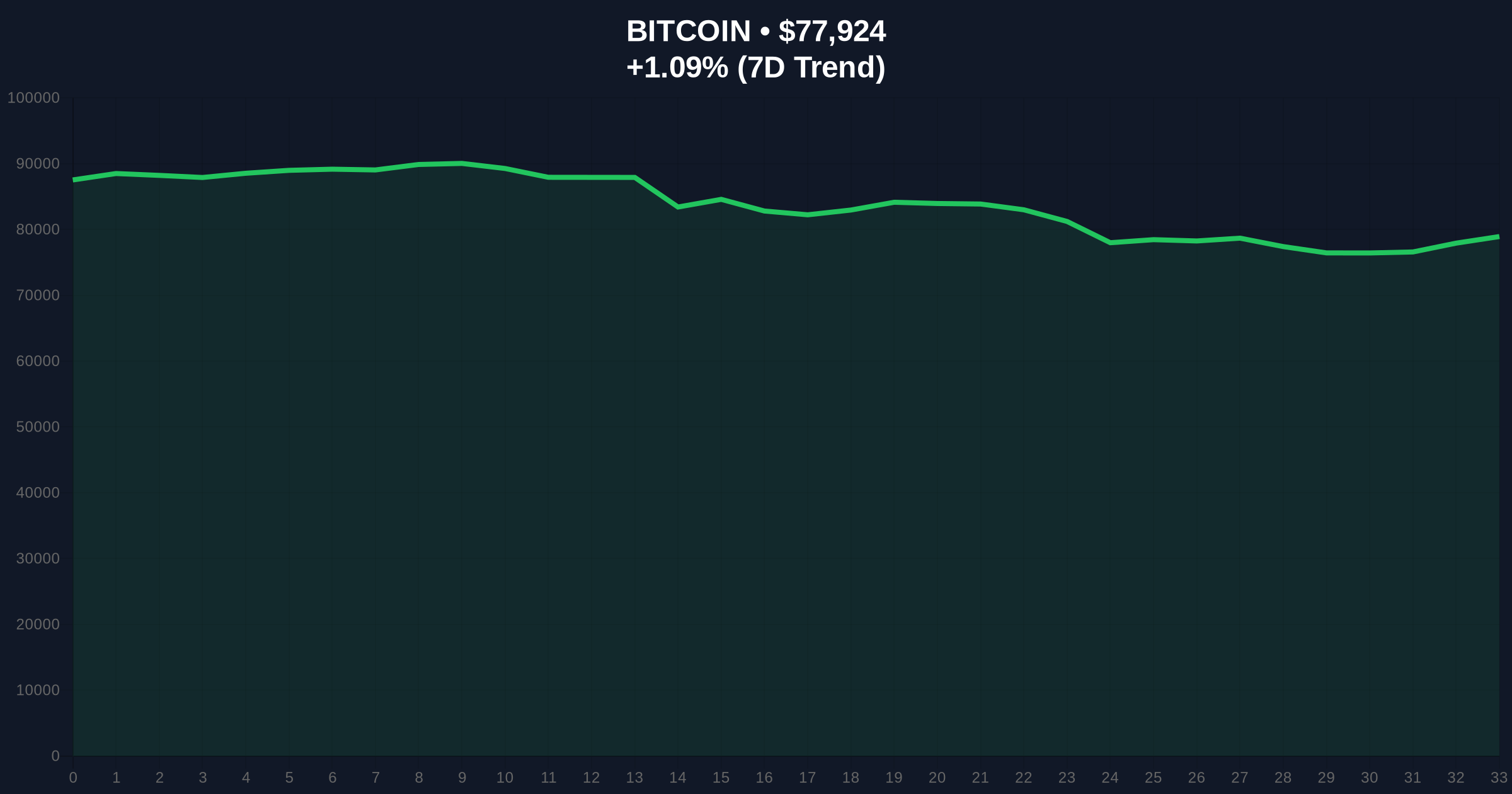

VADODARA, February 2, 2026 — Bitcoin price action turned sharply bearish as BTC broke below the $78,000 psychological level, trading at $77,978 on Binance's USDT market according to CoinNess market monitoring. This move coincides with a Crypto Fear & Greed Index reading of 14, signaling Extreme Fear across digital asset markets. Market structure suggests a liquidity grab below previous consolidation ranges, with historical parallels to the 2021 Q4 correction.

According to CoinNess market monitoring, BTC fell below $78,000 on February 2, 2026. The asset traded at $77,978 on Binance's USDT market at the time of reporting. This represents a 1.16% decline over 24 hours. On-chain data indicates increased selling pressure from short-term holders, similar to distribution patterns observed in previous cycle tops. The breakdown occurred during Asian trading hours, a period often associated with heightened volatility in crypto markets.

Historically, Bitcoin corrections of 15-20% have been common during bull market consolidations. The current pullback from recent highs mirrors the 2021 September correction, where BTC tested the 0.618 Fibonacci retracement level before resuming its uptrend. In contrast, the Extreme Fear sentiment reading of 14 suggests potential capitulation, often a contrarian indicator for institutional accumulation. Underlying this trend, macroeconomic factors including Federal Reserve policy shifts continue to influence risk asset correlations.

Related developments in this sentiment environment include record trading volume at Coinbase and significant position adjustments by major funds.

Market structure suggests the breakdown created a Fair Value Gap (FVG) between $78,500 and $79,200 that may act as immediate resistance. The daily Relative Strength Index (RSI) currently sits at 42, indicating neutral momentum with bearish bias. Critical support resides at the Fibonacci 0.618 level of $75,800, coinciding with the 50-day moving average. Volume profile analysis shows significant liquidity pools between $75,000 and $76,000, making this zone for trend continuation. A break below this cluster would invalidate the current bullish market structure.

| Metric | Value |

|---|---|

| Current BTC Price | $77,976 |

| 24-Hour Change | -1.16% |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

| Market Rank | #1 |

| Key Fibonacci Support | $75,800 |

This price action matters because it tests institutional conviction at critical technical levels. According to Ethereum.org documentation on market cycles, extreme fear periods often precede significant reversals when combined with oversold technical indicators. The breakdown below $78,000 represents a test of the 2025 accumulation range, where numerous institutional buyers established positions. Failure to hold this zone could trigger stop-loss cascades and further downside pressure. Conversely, successful defense could establish a higher low structure, supporting continuation toward previous all-time highs.

"The Extreme Fear reading at 14 typically signals retail capitulation, while on-chain data shows whales accumulating at these levels. Market structure suggests this is a liquidity grab rather than a trend reversal, but the $75,000–$76,000 support cluster must hold to maintain bullish invalidation levels." — CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure. The bullish scenario requires reclaiming the $78,500 FVG and holding above $77,000 as support. The bearish scenario involves breaking the Fibonacci 0.618 support at $75,800, potentially targeting the $72,000 volume node. Historical cycles suggest 12-month outlook remains positive if Bitcoin maintains above the 200-week moving average, currently around $68,000.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.