Loading News...

Loading News...

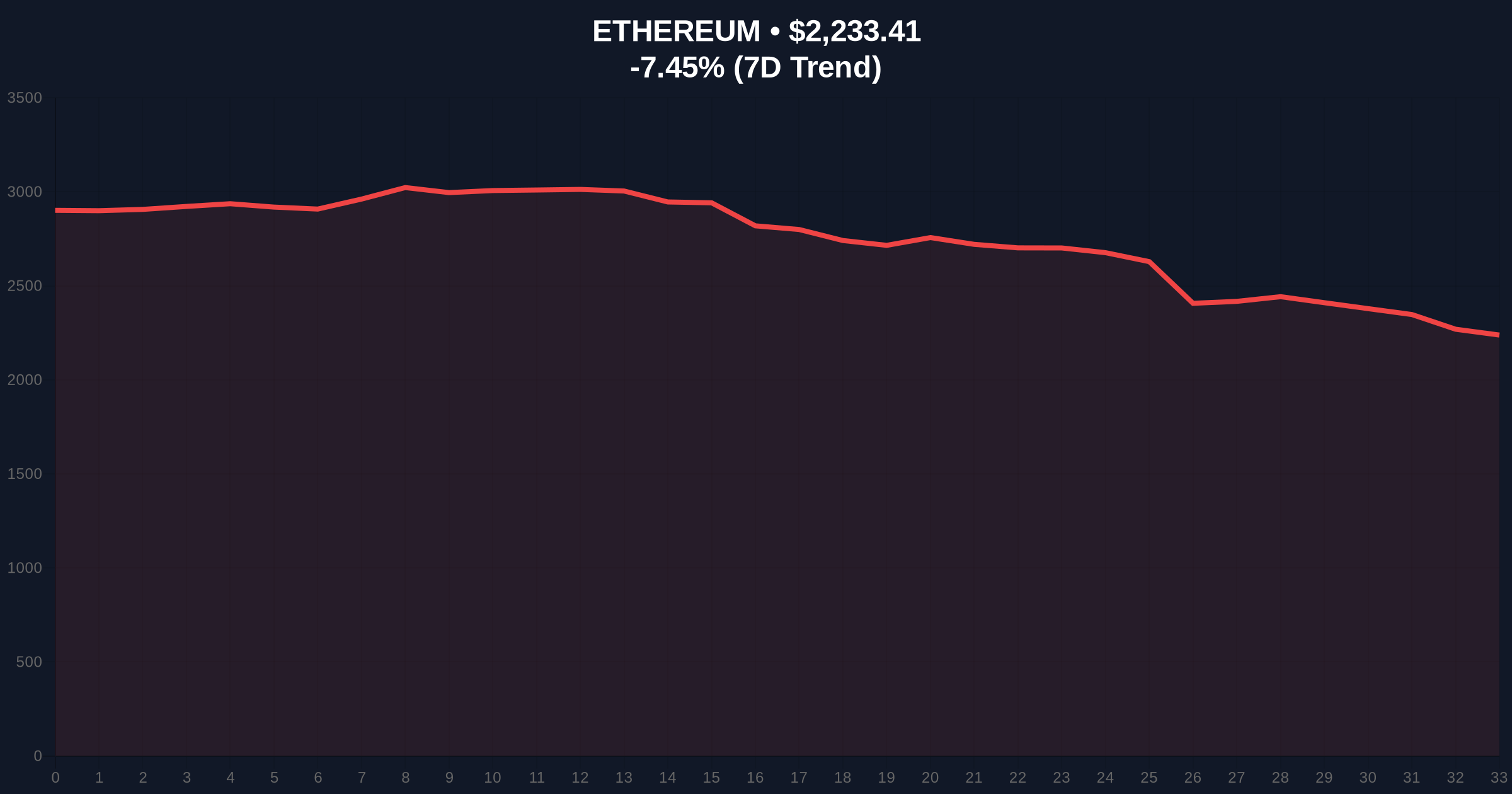

VADODARA, February 2, 2026 — LD Capital has executed a significant Ethereum position reduction. The firm sold approximately 40,000 ETH over the weekend. This move follows a public admission of a strategic misjudgment. Founder JackYi stated the firm re-entered near $3,000 expecting a rally. That bet failed. Market structure suggests this is a classic liquidity grab event.

According to on-chain data and public statements, LD Capital's affiliate TrendResearch held roughly 650,000 ETH until January's end. The firm then sold 40,000 ETH. It simultaneously repaid loans on protocols like Aave. Current holdings now stand at approximately 608,251 ETH. JackYi explained the rationale on social media platform X. He cited a premature bet on an Ethereum uptrend. "We are now managing risk by closing some positions," he said. This daily crypto analysis reveals a controlled institutional de-risking.

Historically, large single-entity sell-offs create immediate Fair Value Gaps (FVGs). The 2021 cycle saw similar moves during consolidation phases. In contrast, the current market faces Extreme Fear sentiment. This amplifies the impact of liquidations. Underlying this trend is a broader macro liquidity shortage. Recent Bitcoin price action also reflects this pressure. Consequently, Ethereum's price broke below key psychological support at $2,200. Related developments include ongoing tests of Ethereum's price resilience amid similar sentiment.

Ethereum currently trades at $2,230.93. It is down 7.56% in 24 hours. The sell-off breached the 50-day moving average. Volume profile indicates concentrated selling near the $2,300 order block. A critical Fibonacci 0.618 retracement level sits at $2,150. This aligns with high-volume nodes from Q4 2025. RSI readings are deep in oversold territory at 28. Market structure suggests a potential bear trap if this level holds. The EIP-4844 upgrade's impact on fee markets remains a longer-term bullish factor not reflected in current price action.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

| Ethereum Current Price | $2,230.93 |

| 24-Hour Price Change | -7.56% |

| ETH Sold by LD Capital | ~40,000 ETH |

| Remaining LD Capital Holdings | ~608,251 ETH |

This event matters for portfolio risk models. Institutional de-risking often precedes retail capitulation. On-chain data indicates rising exchange inflows. That signals potential further selling pressure. The repayment of Aave loans reduces systemic leverage in DeFi. This is a healthy long-term reset. However, it creates short-term liquidity vacuums. Market analysts watch for a gamma squeeze setup if volatility spikes. The Federal Reserve's monetary policy stance, detailed on FederalReserve.gov, continues to influence global liquidity conditions impacting crypto assets.

"Position trimming at this scale reflects a recalibration of institutional delta. It's not a full exit. The firm retains over 600k ETH. This suggests a tactical risk management move, not a fundamental bearish turn. The key is whether this selling exhausts near the $2,150 volume node." – CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook remains cautiously optimistic. Ethereum's roadmap, including the Pectra upgrade, aims to enhance scalability. This fundamental progress contrasts with short-term price action. The 5-year horizon still favors network adoption over cyclical volatility.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.