Loading News...

Loading News...

VADODARA, February 10, 2026 — Chainlink founder Sergey Nazarov declares the current cryptocurrency market correction fundamentally distinct from historical bear cycles. This latest crypto news reveals an industry evolution toward structural stability. According to Cointelegraph, Nazarov frames the downturn as a maturity case study rather than a systemic setback.

Sergey Nazarov presented his analysis through official channels this week. He emphasized recurring market cycles as inherent phenomena. The critical distinction lies in industry response mechanisms. Nazarov specifically noted the absence of 2022-style catastrophic failures.

No FTX-scale collapses have emerged during this correction. Crypto lending platforms show no bankruptcy chains. Widespread risk management failures remain unobserved. Systemic risks appear contained according to his assessment. This suggests enhanced volatility absorption capacity.

Historically, bear markets triggered cascading liquidations. The 2018 cycle saw multiple exchange failures. Consequently, the 2022 collapse created a $2 trillion market cap destruction. In contrast, current on-chain data indicates controlled deleveraging.

Underlying this trend is improved institutional infrastructure. Regulated custody solutions now dominate. , traditional finance integration provides shock absorbers. Market structure suggests this correction mirrors 2015's consolidation phase more than 2018's capitulation.

Related Developments: This stability narrative emerges alongside other market stress tests. Recent events include Binance's TRX wallet maintenance and Tether's 3.5 billion USDT burn. Additionally, Upbit's delisting watchlist actions and Binance's new margin pairs reflect exchange-level adjustments amid extreme fear conditions.

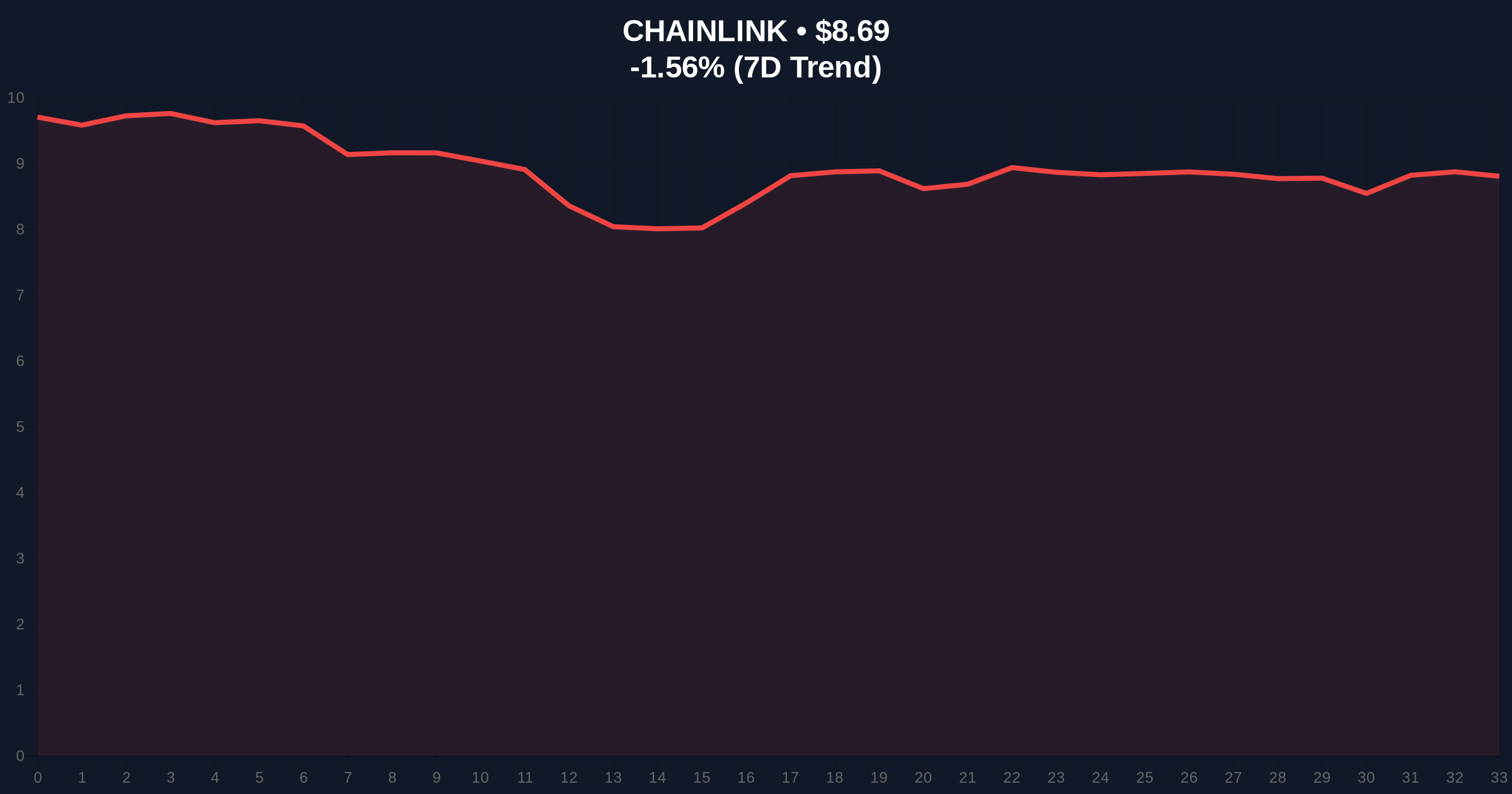

Chainlink's current price sits at $8.69. The 24-hour trend shows a -1.54% decline. Market structure reveals critical Fibonacci levels. The 0.618 retracement at $7.85 represents major historical support.

Volume profile analysis indicates accumulation near current levels. Order blocks between $8.20 and $8.80 show institutional interest. Relative Strength Index (RSI) reads 42 on daily timeframes. This suggests neutral momentum rather than oversold conditions.

Fair Value Gaps (FVGs) exist above $9.50. These gaps likely attract liquidity grabs during rallies. The 200-day moving average provides dynamic resistance at $9.20. Technical architecture aligns with Nazarov's stability thesis through orderly price discovery.

| Metric | Value | Context |

|---|---|---|

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) | Contrasts with stability narrative |

| Chainlink (LINK) Price | $8.69 | -1.54% 24h change |

| LINK Market Rank | #20 | Among all cryptocurrencies |

| Fibonacci 0.618 Support | $7.85 | Critical technical level |

| 200-Day Moving Average | $9.20 | Key resistance zone |

This analysis carries profound implications for market structure. Institutional liquidity cycles now dominate price action. Retail participation shows decreased leverage ratios. On-chain data confirms reduced exchange outflows compared to 2022.

The absence of systemic failures validates regulatory progress. Banking partnerships provide traditional liquidity backstops. Smart contract adoption continues expanding despite price volatility. Real-world asset tokenization represents a fundamental shift in value proposition.

Market structure suggests we've transitioned from speculative frenzy to utility-driven growth. The current correction lacks the hallmarks of previous capitulation events. Institutional adoption creates natural volatility dampeners through diversified entry points.

— CoinMarketBuzz Intelligence Desk

Two data-backed scenarios emerge from current market structure.

The 12-month institutional outlook remains cautiously optimistic. Traditional finance integration continues accelerating. According to Ethereum's official Pectra upgrade documentation, blockchain scalability improvements will further enhance DeFi stability. This supports Nazarov's maturity argument for the 5-year horizon.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.