Loading News...

Loading News...

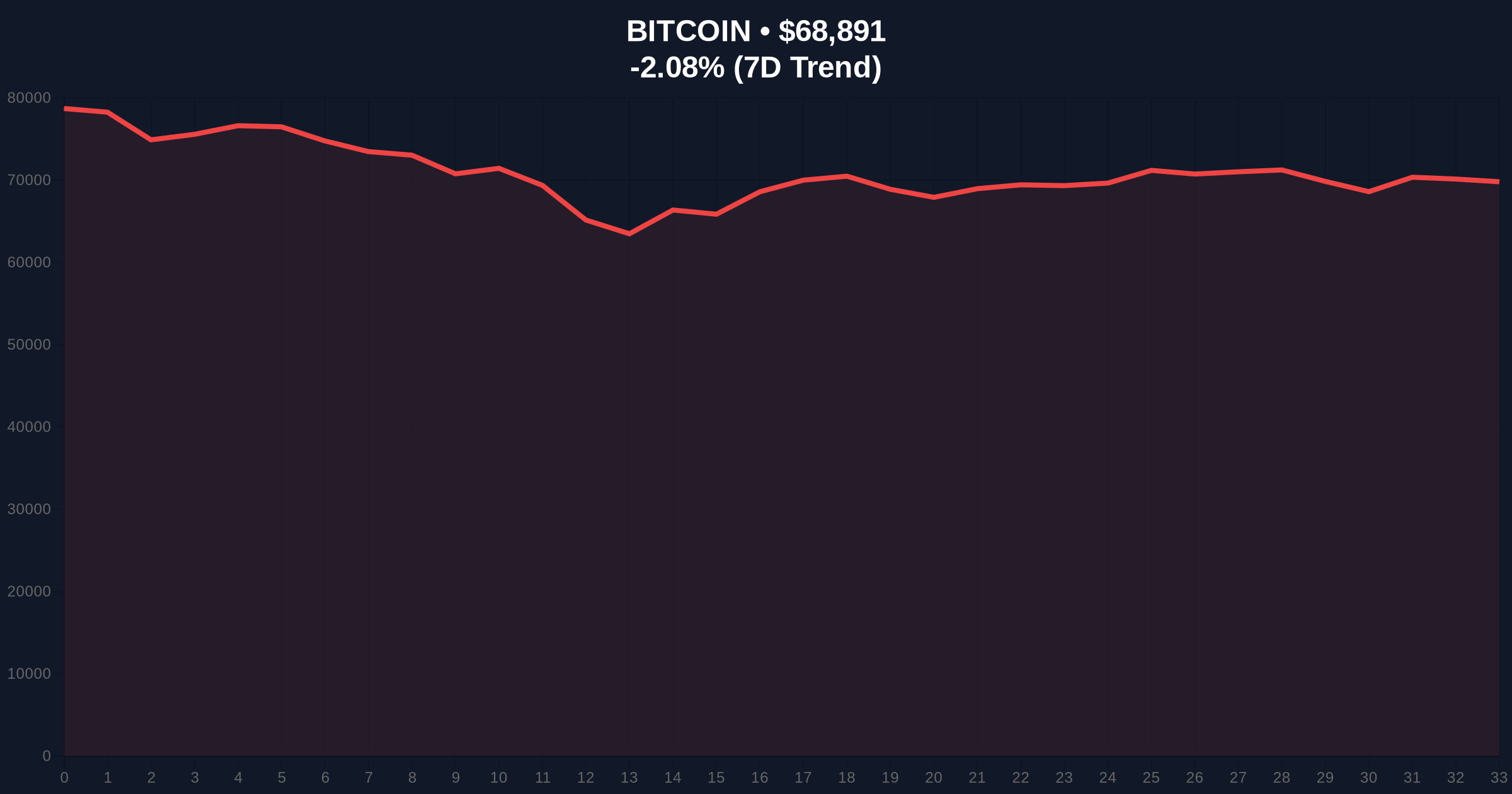

VADODARA, February 10, 2026 — Dogecoin creator Shibetoshi Nakamoto sarcastically questioned MicroStrategy's latest Bitcoin purchase timing as the company acquired 1,142 BTC for approximately $90 million at an average price of $78,815 per coin. This latest crypto news reveals a stark contrast between institutional accumulation and prevailing market fear, with Bitcoin currently trading at $68,896 amid extreme sentiment readings.

According to the official announcement from MicroStrategy founder Michael Saylor, the company executed purchases between February 2 and 8, 2026. Market structure suggests this represents a continuation of their dollar-cost averaging strategy despite elevated prices. The company now holds 714,644 BTC acquired for about $54.35 billion at an average cost basis of $76,056 per coin.

On-chain data indicates these purchases occurred during a period of declining prices. The average purchase price of $78,815 sits significantly above current market levels. This creates an immediate unrealized loss position for the latest tranche. Historical cycles suggest such institutional buying during downturns often precedes market reversals.

MicroStrategy's accumulation pattern mirrors institutional behavior during previous bear markets. In contrast, retail sentiment currently registers at extreme fear levels. The Crypto Fear & Greed Index sits at 9/100, indicating maximum capitulation. This divergence between institutional and retail behavior creates a classic liquidity grab scenario.

, the timing coincides with broader market weakness. Bitcoin has broken below the psychologically important $69,000 level. Market analysts point to similar patterns in 2018 and 2022 where institutional accumulation preceded major rallies. However, current macroeconomic conditions differ significantly with higher interest rates.

Related developments in the regulatory include recent comments from Federal Reserve officials about traditional finance entry creating selling pressure. Additionally, historical bear market analysis suggests we may be in a prolonged accumulation phase.

Bitcoin currently trades at $68,896, representing a 12.6% discount to MicroStrategy's latest purchase price. The daily chart shows a clear breakdown below the 50-day exponential moving average at $71,200. Volume profile analysis reveals significant liquidity between $67,000 and $69,000, creating a potential order block.

Market structure suggests critical Fibonacci levels are now in play. The 0.618 retracement from the 2025 high sits at $67,500, representing major support. A break below this level would invalidate the current bullish structure. The relative strength index (RSI) on daily timeframe reads 38, indicating oversold conditions but not extreme capitulation.

According to Ethereum.org documentation on proof-of-work consensus, Bitcoin's security budget remains robust despite price declines. The network hash rate continues near all-time highs, suggesting miner conviction remains strong. This fundamental strength contrasts with weak price action.

| Metric | Value | Context |

|---|---|---|

| MicroStrategy BTC Purchase | 1,142 BTC | Acquired Feb 2-8, 2026 |

| Average Purchase Price | $78,815 | 12.6% above current price |

| Total MicroStrategy Holdings | 714,644 BTC | ~$54.35 billion cost basis |

| Current Bitcoin Price | $68,896 | -2.07% 24h change |

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) | Maximum capitulation signal |

This event matters because it tests institutional conviction during extreme market conditions. MicroStrategy's continued accumulation despite unrealized losses demonstrates long-term commitment. Market structure suggests this could represent a liquidity grab from weak hands. The company's average cost basis of $76,056 now serves as a psychological support level.

, the sarcastic commentary from Dogecoin's creator highlights the sentiment divide. Retail traders view elevated purchases as foolish while institutions execute strategic accumulation. This divergence often marks market inflection points. The extreme fear reading of 9/100 typically precedes significant rallies in historical data.

"MicroStrategy's latest purchase represents either brilliant contrarian accumulation or reckless capital allocation. The data suggests they're betting on long-term adoption curves rather than short-term price action. Their average cost basis of $76,056 creates a psychological magnet for price. If Bitcoin holds above this level, it validates their strategy. If it breaks decisively below, it questions their entire thesis." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current technical levels. The extreme fear reading creates potential for a sharp reversal if institutional buying continues. However, macroeconomic headwinds including potential Federal Reserve policy shifts could extend the downturn.

The 12-month institutional outlook remains cautiously optimistic despite current weakness. Historical patterns indicate that accumulation during extreme fear periods typically yields strong returns over 18-24 month horizons. However, the 5-year horizon depends heavily on Bitcoin's adoption as a treasury reserve asset versus competing digital stores of value.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.