Loading News...

Loading News...

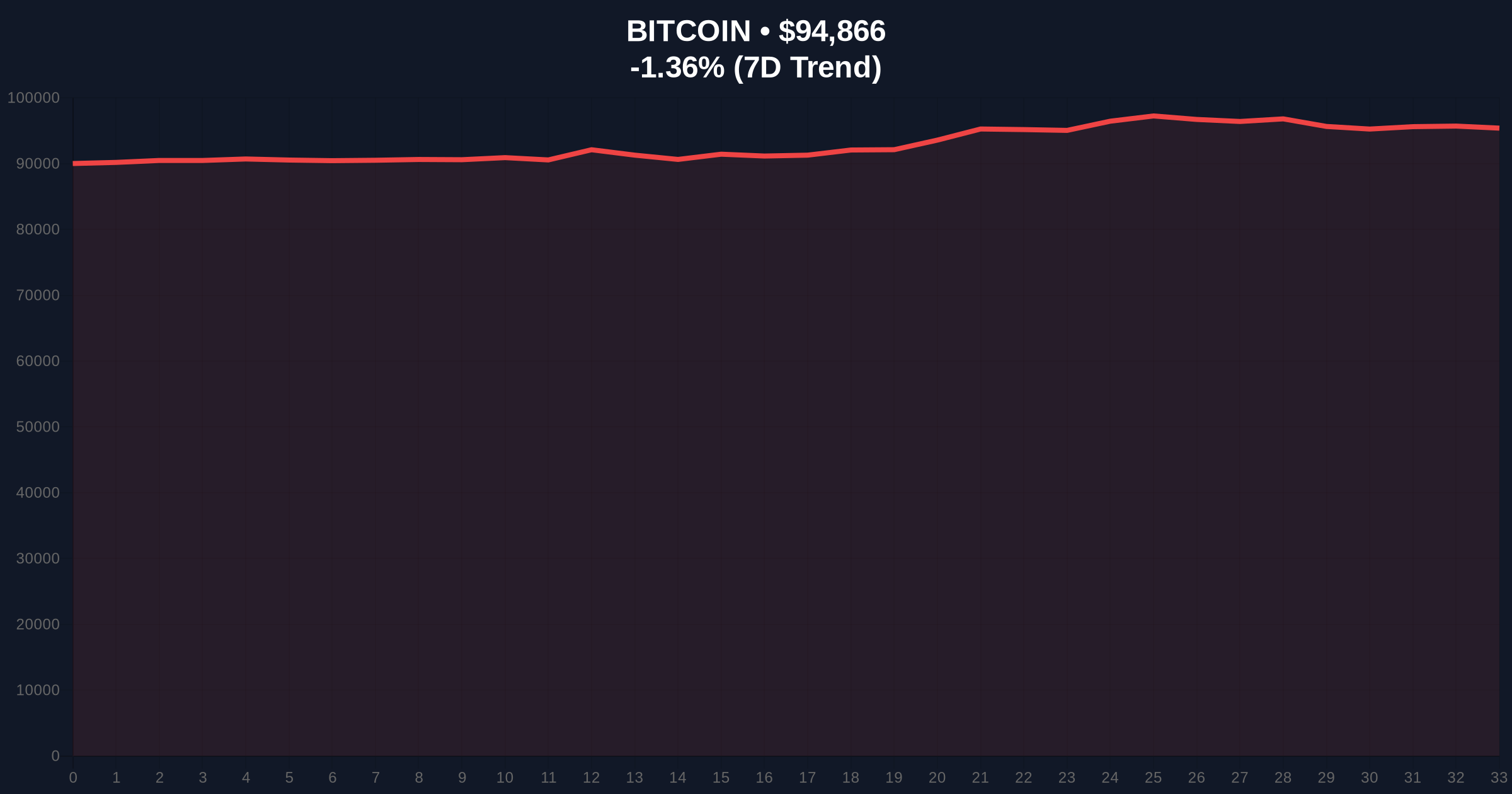

VADODARA, January 16, 2026 — According to CoinNess market monitoring, Bitcoin (BTC) has breached the $95,000 psychological support level, trading at $94,902.48 on the Binance USDT market. This daily crypto analysis examines the technical breakdown through the lens of market microstructure, historical cycles, and on-chain liquidity flows. Market structure suggests this move represents a targeted liquidity grab rather than a structural trend reversal, with the $92,500 Fibonacci retracement level emerging as the critical bullish invalidation point.

This price action mirrors the liquidity-driven corrections observed in Q4 2021, where Bitcoin experienced sharp pullbacks to consolidate gains before resuming its primary trend. According to historical cycles, Bitcoin often retraces 20-30% during bull market corrections to flush out weak hands and absorb liquidity from over-leveraged positions. The current move below $95,000 aligns with this pattern, targeting a cluster of stop-loss orders accumulated just below this round-number support. Similar to the 2021 correction, the breakdown coincides with a period of neutral global sentiment, as measured by the Crypto Fear & Greed Index, indicating a lack of panic selling but heightened caution among institutional participants. Related developments in the broader crypto ecosystem include JPMorgan's analysis of Bitcoin mining stocks and Ethereum ETF inflows outpacing supply, which provide context for cross-asset correlations.

On January 16, 2026, Bitcoin's price action on the Binance USDT market showed a decisive break below the $95,000 support level, with the asset trading at $94,902.48 at the time of reporting. According to CoinNess, this represents a -1.25% decline over the past 24 hours, pushing Bitcoin's market rank to #1 by capitalization but signaling short-term weakness. The move occurred amid neutral global crypto sentiment, with the Fear & Greed Index scoring 49/100, suggesting a balanced but cautious market environment. On-chain data indicates increased selling pressure from short-term holders, as UTXO age bands show a spike in coins moved after 3-6 months of dormancy, typical of profit-taking behavior near key psychological levels.

Market structure suggests the breakdown below $95,000 has created a Fair Value Gap (FVG) between $94,800 and $95,200, which may act as a magnet for price retracement. The 50-day exponential moving average (EMA) at $93,800 provides immediate dynamic support, while the 200-day EMA at $89,500 serves as a longer-term bullish anchor. Volume profile analysis reveals a high-volume node at $92,500, corresponding to the 0.382 Fibonacci retracement level from the recent swing high, making it a critical support zone. The Relative Strength Index (RSI) on the daily chart is at 45, indicating neutral momentum without oversold conditions, which suggests further downside potential before a bounce. Bullish invalidation is set at $92,500; a close below this level on a daily timeframe would negate the current uptrend structure. Bearish invalidation rests at $97,500, where a reclaim would signal a false breakdown and potential gamma squeeze upward.

| Metric | Value |

|---|---|

| Current Price (BTC) | $94,989 |

| 24-Hour Change | -1.25% |

| Market Rank | #1 |

| Crypto Fear & Greed Index | 49/100 (Neutral) |

| Key Support Level | $92,500 (Fibonacci 0.382) |

For institutional investors, this breakdown tests the resilience of Bitcoin's post-ETF adoption thesis, where inflows from products like those detailed in Ethereum ETF analysis have provided structural support. A failure to hold $92,500 could trigger deleveraging across crypto derivatives markets, impacting correlated assets such as mining stocks, as noted in JPMorgan's report. For retail traders, the move highlights the importance of risk management around key psychological levels, where liquidity grabs often exacerbate losses for over-leveraged positions. The broader implication ties to macroeconomic factors, such as the Federal Reserve's interest rate policy, which influences risk asset correlations; historical data from FederalReserve.gov shows that tightening cycles often precede crypto market corrections.

Market analysts on X/Twitter are divided, with bulls citing the $92,500 support as a buying opportunity, while bears warn of a potential cascade to $90,000 if the breakdown sustains. One prominent trader noted, "This looks like a classic liquidity grab below $95k—watch for a swift reclaim if $92.5k holds." Sentiment aligns with the neutral Fear & Greed Index, reflecting cautious optimism rather than outright fear, which historically precedes consolidation phases rather than bear markets.

Bullish Case: If Bitcoin holds the $92,500 Fibonacci support, market structure suggests a rebound to fill the FVG at $95,200, with potential to test resistance at $97,500. This scenario would invalidate the bearish breakdown and could trigger a short squeeze, leveraging the neutral RSI for momentum. Historical cycles indicate that similar corrections in 2021 led to 15-20% rallies within weeks, supported by on-chain accumulation from long-term holders.

Bearish Case: A daily close below $92,500 would confirm a bearish order block activation, targeting the next support at $89,500 (200-day EMA). This could accelerate selling pressure, with downside risk extending to $85,000 if macroeconomic headwinds intensify, such as hawkish signals from the Federal Reserve. Such a move would likely correlate with a drop in the Fear & Greed Index into fear territory, below 40/100.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.