Loading News...

Loading News...

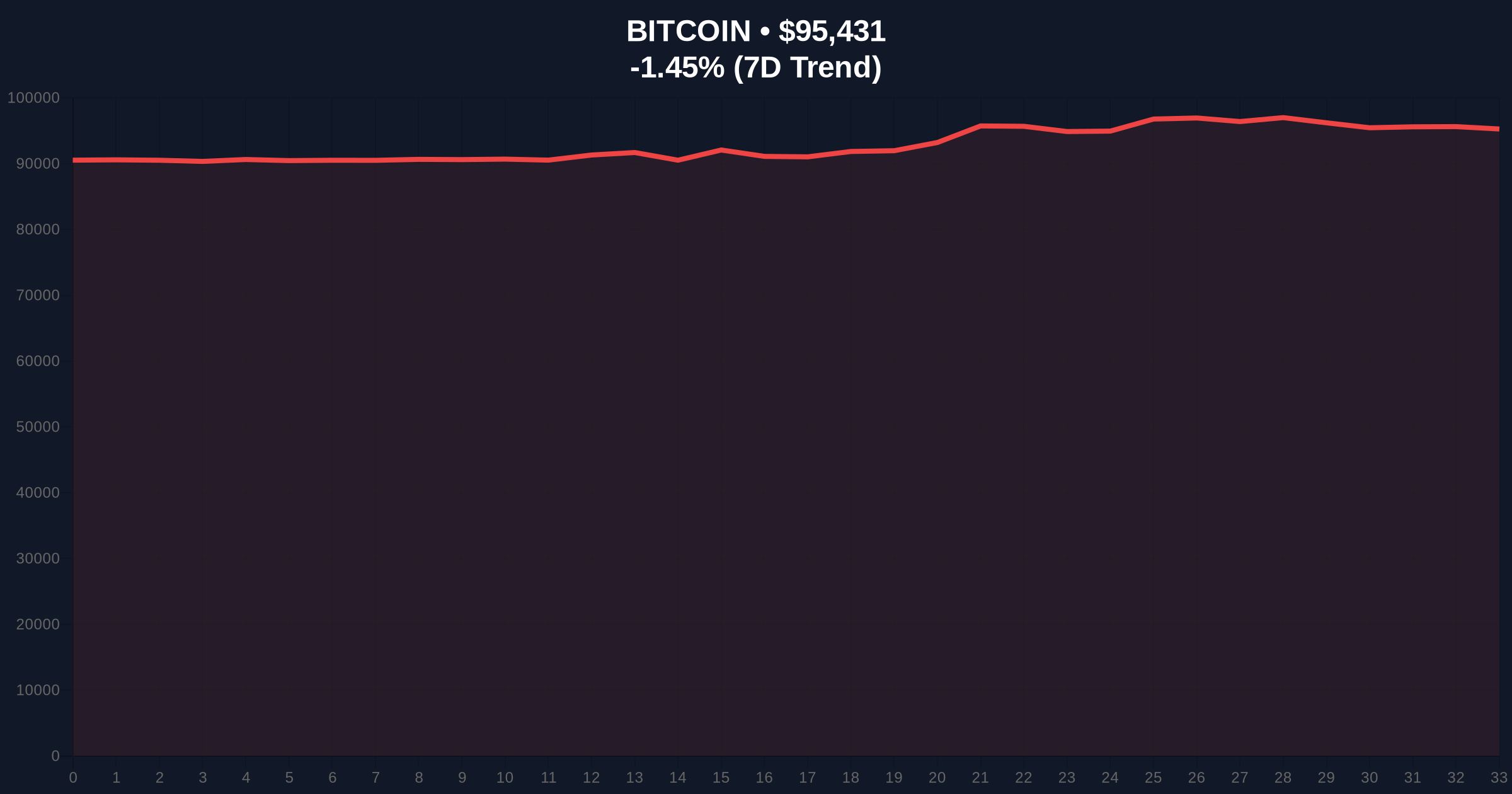

VADODARA, January 16, 2026 — Bitcoin options traders maintain defensive positioning despite spot price action breaking above $95,000. According to on-chain analytics firm Glassnode, implied volatility contraction and mixed skew signals reveal persistent downside hedging. This daily crypto analysis examines the structural fragility beneath recent gains.

Current options behavior mirrors Q4 2024 patterns. Back then, volatility compression preceded a 22% correction. Market structure suggests traders learned from that liquidity grab. The Federal Reserve's latest minutes show continued quantitative tightening, creating macro headwinds for risk assets. Related developments include concerns about Bitcoin's long-term security budget and institutional adoption amid market neutrality.

Glassnode's January 16 report reveals critical data points. Implied volatility across all maturities is contracting. This indicates declining demand for price movement hedges. Short-term volatility reacts to spot but gets suppressed during rallies. The 25-delta skew still favors put options. However, long-term skew tilts bullish. Trend-following behavior emerged when BTC surpassed $95,000. Traders concentrated call option purchases at that level. Yet overall sentiment remains fragile. Put option selling reluctance confirms persistent downside caution.

Bitcoin currently trades at $95,406, down 1.48% in 24 hours. The daily chart shows a fair value gap between $93,800 and $94,500. This zone must hold for continuation. RSI sits at 58, indicating neutral momentum. The 50-day EMA provides dynamic support at $91,200. Volume profile analysis reveals high-volume nodes at $89,200 and $96,800. Bullish invalidation: A close below the $92,500 order block invalidates the uptrend. Bearish invalidation: A sustained break above $97,200 triggers gamma squeeze potential.

| Metric | Value | Interpretation |

|---|---|---|

| Current Bitcoin Price | $95,406 | -1.48% 24h change |

| Crypto Fear & Greed Index | 49/100 (Neutral) | Underlying caution persists |

| 25-Delta Skew | Favors puts | Downside hedging dominant |

| Implied Volatility Trend | Contracting | Hedge demand slowing |

| Key Support Level | $92,500 | Bullish invalidation point |

Institutional impact is significant. Options market fragility suggests smart money anticipates volatility. Retail traders face asymmetric risk. Leveraged long positions could get liquidated if support fails. The mixed signals create a dangerous environment for momentum chasing. Historical cycles show similar volatility compression often precedes directional breaks.

Market analysts express concern. "The skew divergence between short and long-term maturities is unusual," noted one derivatives trader. Bulls point to the $95,000 breakout as technically significant. Bears highlight the put option dominance as a warning sign. Overall, X sentiment remains divided, mirroring the options data.

Bullish Case: Bitcoin holds the $92,500 order block. Long-term skew bullishness validates. Price targets the $96,800 volume node, then $100,000 psychological resistance. EIP-4844 implementation could boost Ethereum correlation, lifting entire market.

Bearish Case: Support at $92,500 fails. Downside hedging intensifies. Price retraces to fill the fair value gap at $89,200. Continued volatility compression leads to breakdown toward $85,000. Macro headwinds from Federal Reserve policy exacerbate sell pressure.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.