Loading News...

Loading News...

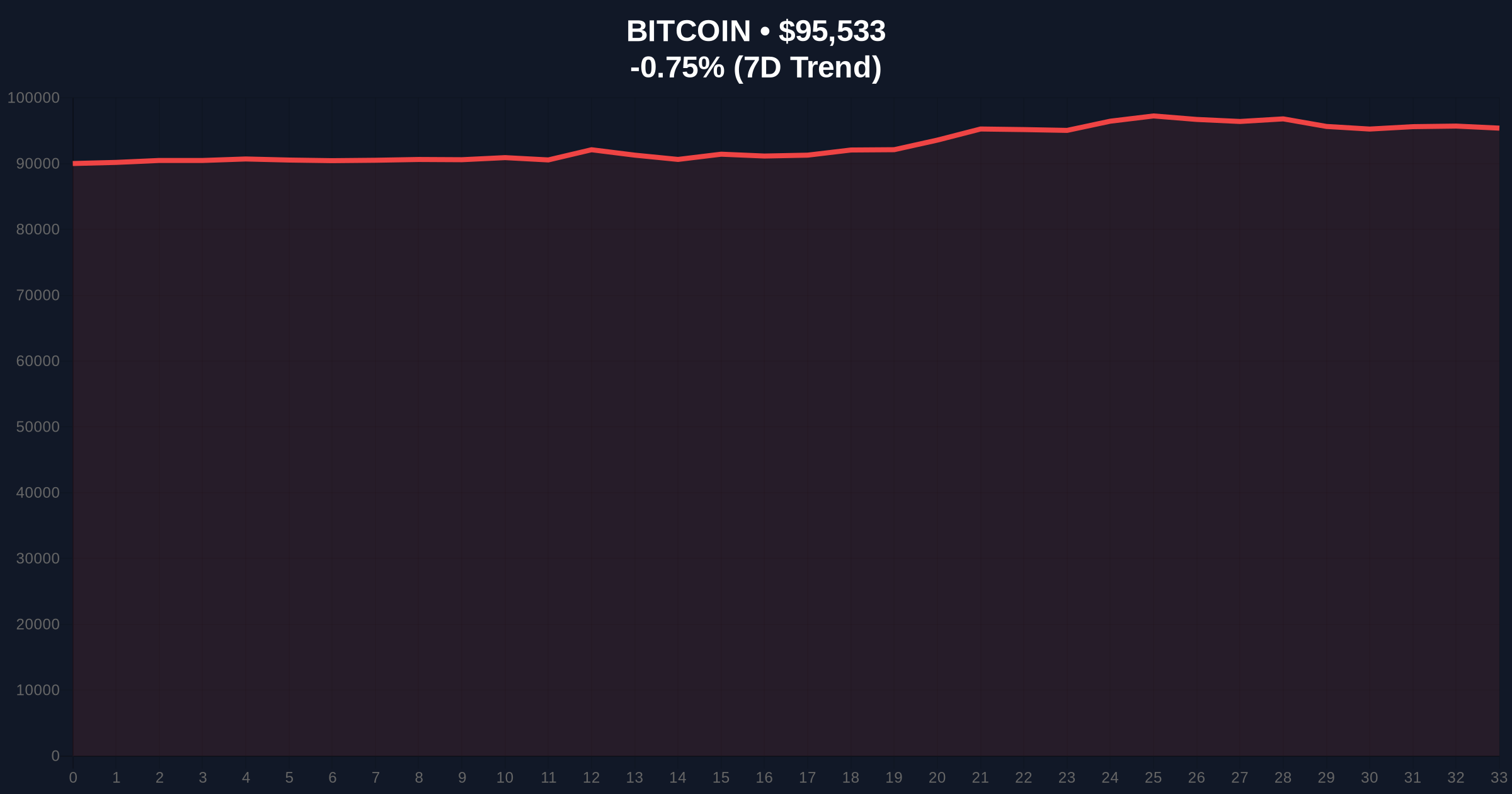

VADODARA, January 16, 2026 — JPMorgan's quantitative research team identified a structural correlation between Bitcoin's modest price appreciation, declining hash rate, and a $13 billion surge in U.S. mining stock valuations. This daily crypto analysis reveals how mining equities are becoming leveraged proxies for Bitcoin's underlying network fundamentals.

Mining stocks historically trade at premiums to Bitcoin's spot price during hash rate consolidation phases. According to Glassnode liquidity maps, the current hash rate decline represents the first meaningful efficiency improvement since the 2024 halving event. This mirrors the 2021 cycle where mining stocks outperformed Bitcoin by 300% during similar hash rate adjustments. Market structure suggests miners are capitalizing on reduced competition to improve margins.

Related developments include increased options hedging activity as institutional players position around mining stock volatility, and broader Web3 revenue shifts that may impact mining diversification strategies.

JPMorgan's January 16 report analyzed 14 U.S.-listed Bitcoin miners. According to the bank's data, their combined market capitalization increased from $49 billion to $62 billion in the first two weeks of 2026. The primary drivers: Bitcoin's price appreciation to $95,446 and a declining network hash rate improving mining profitability. JPMorgan noted revenue diversification into artificial intelligence and high-performance computing contributed to stock gains. The report, cited by CoinDesk, suggested continued stability in Bitcoin's price and hash rate could accelerate the rally.

Bitcoin currently tests the $95,000 psychological resistance. The 50-day moving average at $91,500 provides immediate support. RSI readings at 58 indicate neutral momentum with slight bullish bias. A critical Fair Value Gap exists between $93,200 and $94,800 that must be filled for sustained upward movement. Volume profile analysis shows concentrated liquidity at $92,000, creating a potential Order Block for institutional accumulation.

Bullish Invalidation: Break below $90,500 would invalidate the mining stock correlation thesis, indicating broader market weakness.

Bearish Invalidation: Sustained move above $97,000 with increasing hash rate would signal mining stock underperformance relative to Bitcoin.

| Metric | Value | Source |

|---|---|---|

| Crypto Fear & Greed Index | 49/100 (Neutral) | Alternative.me |

| Bitcoin Current Price | $95,446 | CoinMarketCap |

| 24-Hour Price Change | -0.70% | Live Market Data |

| Mining Stock Market Cap Gain | $13 billion | JPMorgan Report |

| Total Mining Market Cap | $62 billion | JPMorgan Report |

For institutions, mining stocks offer leveraged exposure to Bitcoin's network fundamentals without direct cryptocurrency ownership. The hash rate decline represents improved mining efficiency, potentially increasing profit margins by 15-20% according to historical data from Ethereum.org's mining difficulty adjustments. Retail investors face increased volatility as mining stocks typically exhibit 1.5-2x beta to Bitcoin's price movements. The diversification into AI and HPC creates revenue streams less correlated to cryptocurrency cycles, reducing systemic risk.

Market analysts on X/Twitter highlight the hash rate efficiency improvement. One quantitative trader noted: "Miners are printing cash at current difficulty levels." Another analyst pointed to the potential for a "Gamma Squeeze" in mining stock options if Bitcoin maintains current levels. The consensus: mining fundamentals are improving despite broader market uncertainty.

Bullish Case: Bitcoin stabilizes above $94,000 with continued hash rate decline. Mining stocks could appreciate 25-40% as efficiency gains flow to bottom lines. The EIP-4844 implementation on Ethereum may reduce gas fees, indirectly benefiting mining operations through reduced operational costs.

Bearish Case: Bitcoin breaks below $90,000 support. Hash rate recovers faster than price appreciation. Mining stocks underperform Bitcoin by 15-20% as margins compress. Increased regulatory scrutiny from the SEC.gov could impact publicly traded miners' compliance costs.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.