Loading News...

Loading News...

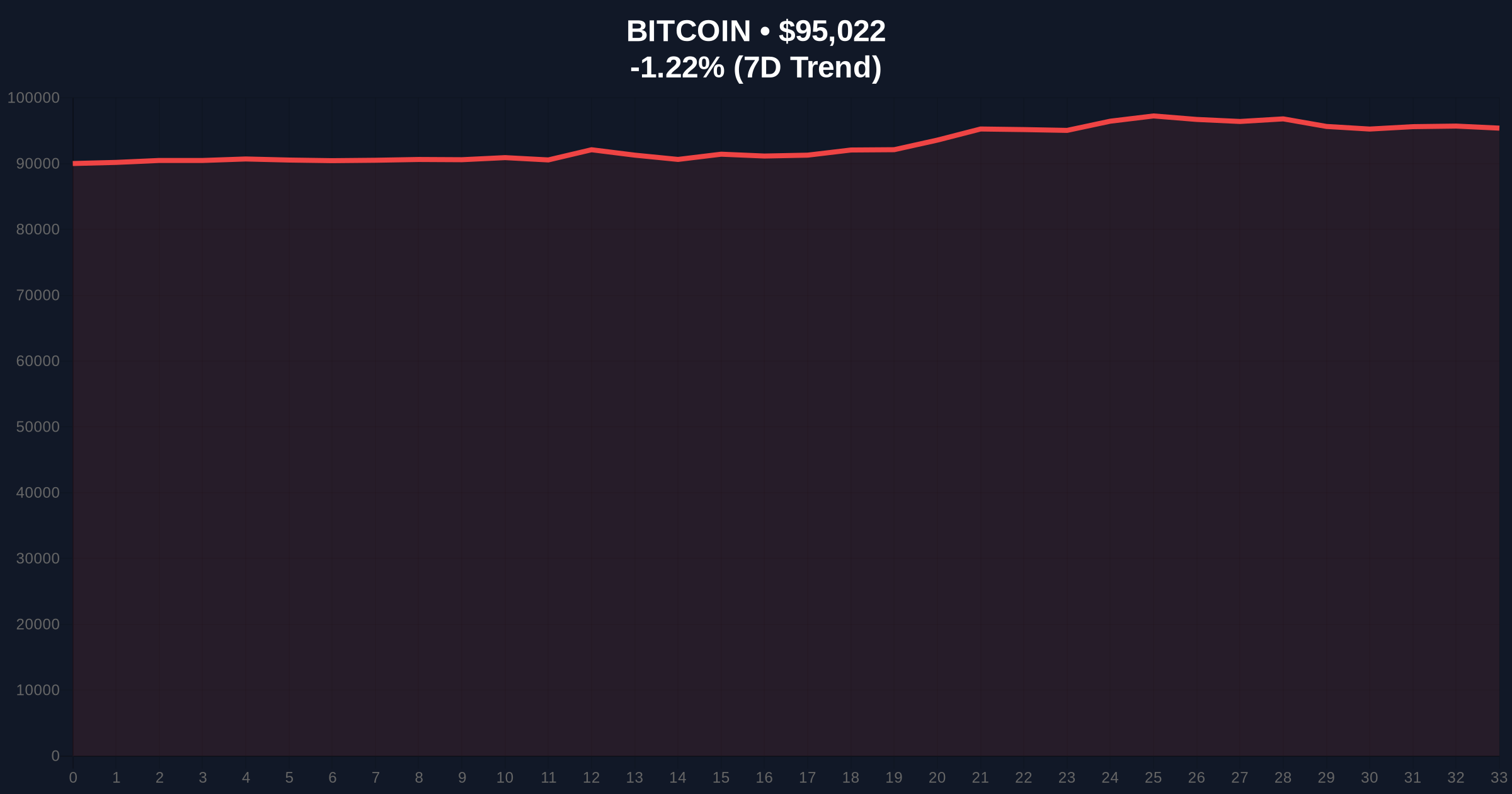

VADODARA, January 16, 2026 — Bitcoin's daily crypto analysis reveals a critical divergence. Price approaches $95,412 while on-chain metrics flash bearish signals. According to CryptoQuant's X post, investor sentiment has turned enthusiastic, but multiple indicators still point to a bear market. Market structure suggests this rally is a liquidity grab within a larger downtrend.

This mirrors the 2022 bear market cycle. Bitcoin broke below its 365-day moving average after a peak, triggering a prolonged decline. The current chart pattern shows similar characteristics. Historical cycles suggest moving averages act as dynamic resistance during bear markets. The 2022 precedent involved a symmetrical triangle breakdown that preceded a 40% correction. Related developments include Bitcoin options traders hedging downside risk despite recent price strength, indicating institutional caution.

On-chain data platform CryptoQuant published analysis on January 16, 2026. The firm noted Bitcoin has rallied this year, approaching its 365-day moving average on the daily chart. This level previously halted rallies during the 2022 bear market. CryptoQuant highlighted decreasing on-chain spot demand. ETF-driven fund inflows remain largely unchanged compared to the same period last year. BTC inflows to major exchanges have increased, suggesting rising selling pressure. The analysis concluded the year-to-date rally is likely a rebound within a broader bear market.

Bitcoin currently trades at $95,412, down 0.81% in 24 hours. The 365-day moving average sits near $96,500, creating a Fair Value Gap (FVG) between current price and this resistance. RSI on daily charts shows bearish divergence—price makes higher highs while momentum weakens. Volume profile indicates thinning liquidity above $96k. The 200-day EMA at $89,200 provides immediate support. Bullish invalidation level: A sustained break above $97,000 with increasing spot demand. Bearish invalidation level: A close below $88,500 would confirm the bear market structure.

| Metric | Value | Implication |

|---|---|---|

| Current Bitcoin Price | $95,412 | Approaching key resistance |

| 24-Hour Change | -0.81% | Short-term weakness |

| 365-Day Moving Average | ~$96,500 | Critical bear market resistance |

| Crypto Fear & Greed Index | 49/100 (Neutral) | Sentiment divergence from price |

| Market Rank | #1 | Dominance remains intact |

Institutional impact is significant. Unchanged ETF inflows suggest professional money remains cautious despite retail enthusiasm. According to the Federal Reserve's monetary policy documentation, interest rate environments influence crypto correlations. Retail impact could be severe if the bear market thesis plays out. Decreasing spot demand indicates weakening organic buying pressure. Increased exchange inflows create overhead supply that must be absorbed for further rallies.

Market analysts express concern about the divergence. "The chart pattern resembles 2022," noted CryptoQuant in their post. Bulls point to technical strength near $95k, but bears highlight the order block forming at the 365-day MA. On-chain forensic data confirms rising UTXO age bands among long-term holders, suggesting distribution.

Bullish Case: Bitcoin breaks above the 365-day moving average with conviction. Spot demand accelerates, and exchange inflows reverse. This would target $105,000 as the next liquidity zone. Gamma squeeze potential exists if options dealers are forced to hedge upward moves.Bearish Case: Resistance holds at $96,500. Selling pressure increases as exchange inflows continue. A breakdown below $88,500 could trigger a move toward $82,000, where Fibonacci support converges with the 0.618 retracement level from the 2025 high.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.