Loading News...

Loading News...

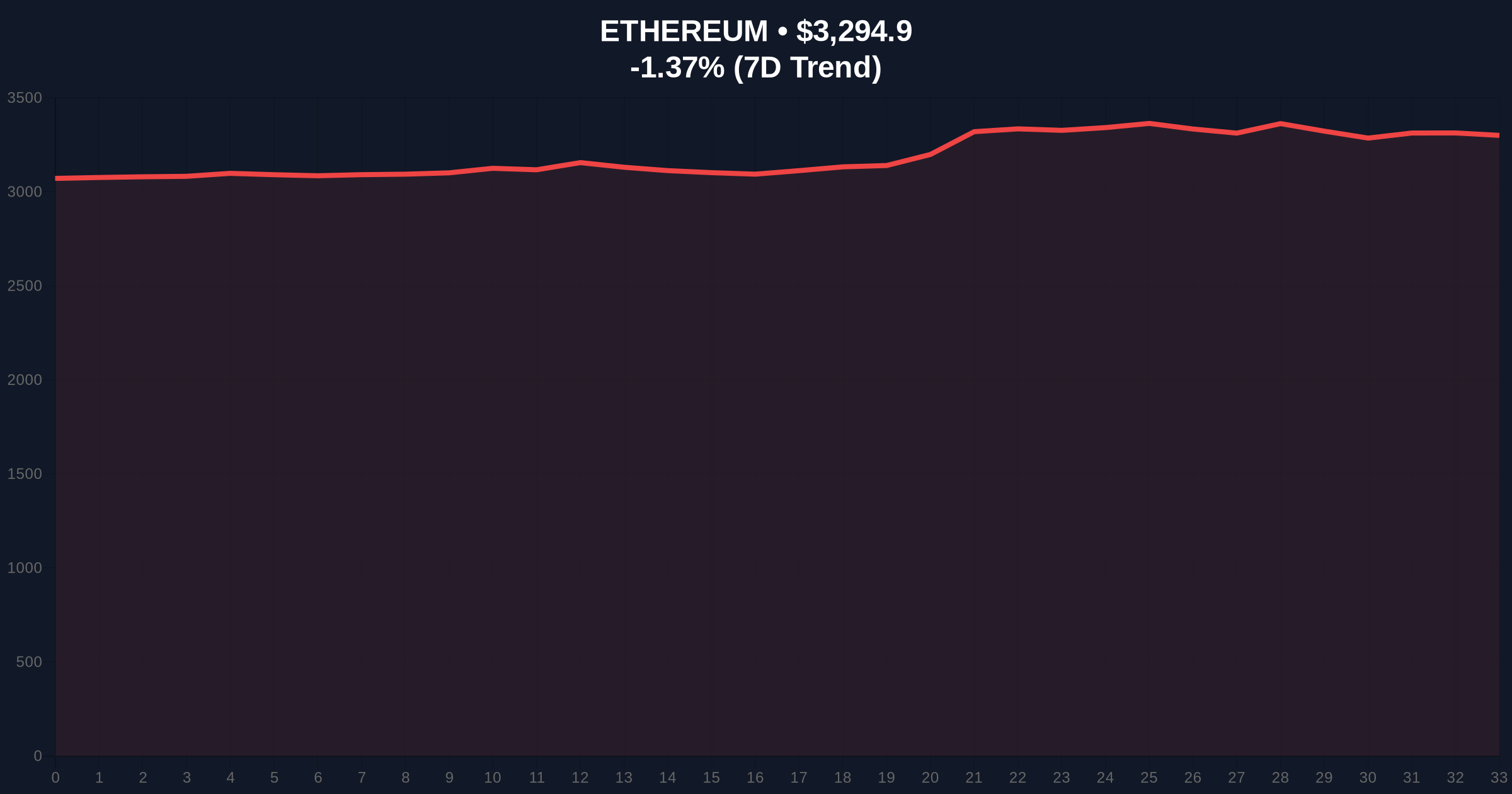

VADODARA, January 16, 2026 — U.S. spot Ethereum ETFs recorded approximately $474.6 million in net inflows this week, according to data from Farside Investors cited by Cointelegraph, marking the first instance where weekly ETF purchases have exceeded Ethereum's new supply issuance. This daily crypto analysis examines the confluence of institutional accumulation and technical patterns that could define ETH's price trajectory for Q1 2026.

Market structure suggests this development represents a fundamental shift in Ethereum's supply-demand equilibrium. Historically, post-merge issuance reduction via EIP-1559 has created deflationary pressure during high network activity. The introduction of U.S. spot ETFs in late 2025 added a new institutional demand vector. Consequently, the current weekly inflow exceeding new supply creates what quantitative analysts term a 'structural liquidity grab'—where institutional buying pressure absorbs available liquidity faster than the network can mint new tokens. This mirrors Bitcoin's post-ETF accumulation phase in early 2024 but with Ethereum's unique staking yield dynamics. Underlying this trend is the broader institutional pivot toward proof-of-stake assets as detailed in Ethereum's official proof-of-stake documentation, which outlines the security and yield advantages driving institutional allocation.

According to Farside Investors data reported by Cointelegraph, U.S. spot Ethereum ETFs purchased approximately $474.6 million worth of ETH during the week ending January 16, 2026. On-chain data further supports this trend, with the number of active Ethereum addresses over the past 30 days increasing by 53% month-over-month. Daily transactions reached a new all-time high of 2.9 million on January 16, indicating robust network utilization. The combination of institutional ETF flows and retail on-chain activity has created what market technicians identify as a 'Fair Value Gap' between current prices and fundamental valuation metrics based on network adoption.

Cointelegraph's technical analysis indicates Ethereum is forming a symmetrical triangle pattern on its daily chart, typically a continuation pattern that resolves with significant volatility. The upper resistance line currently sits near $3,450, while the lower support trendline aligns with the $3,150 level. A breakout above the upper resistance could target $4,500, with potential extension to $5,500 based on measured move projections. The Relative Strength Index (RSI) on daily timeframes shows neutral momentum at 52, while the 50-day exponential moving average at $3,210 provides dynamic support. Volume profile analysis indicates significant accumulation between $3,100 and $3,300, creating a high-volume node that should act as strong support. Bullish invalidation occurs on a daily close below the $3,000 psychological level and 200-day moving average. Bearish invalidation triggers if ETH fails to break above the triangle resistance after three consecutive tests, suggesting distribution rather than accumulation.

| Metric | Value | Significance |

|---|---|---|

| Weekly ETF Net Inflows | $474.6M | Exceeds new ETH supply |

| 30-Day Active Address Growth | +53% | Network adoption acceleration |

| Daily Transaction ATH | 2.9M | Record network utilization |

| Current ETH Price | $3,298.05 | Inside symmetrical triangle |

| 24-Hour Price Change | -1.28% | Consolidation within pattern |

| Crypto Fear & Greed Index | 49/100 (Neutral) | Market sentiment equilibrium |

For institutional portfolios, this represents a fundamental repricing event where ETF demand structurally outpaces supply—a scenario that historically precedes significant price appreciation in scarce digital assets. The supply shock is amplified by Ethereum's transition to proof-of-stake, where approximately 25% of circulating supply is locked in staking contracts, further reducing liquid availability. For retail traders, the symmetrical triangle pattern presents a high-probability technical setup with defined risk parameters. The convergence of institutional flows and technical patterns creates what options traders term a 'gamma squeeze' potential, where rapid price movement could trigger cascading options hedging activity.

Market analysts on X/Twitter highlight the divergence between ETF accumulation and price action, suggesting either impending breakout or distribution. One quantitative researcher noted, 'ETF inflows creating supply deficit of ~15,000 ETH weekly at current prices—mathematically unsustainable without price adjustment.' Another technical analyst observed, 'Symmetrical triangle volume declining—typical before volatile resolution. Watch for expansion above 2.9M daily transactions as confirmation.' The dominant narrative centers on whether institutional demand can overcome technical resistance levels.

Bullish Case: A daily close above $3,450 resistance confirms symmetrical triangle breakout, targeting $4,500 initial objective. Continued ETF inflows exceeding supply could drive momentum toward $5,500 as institutional FOMO accelerates. On-chain data indicates address growth supporting fundamental valuation expansion. The bullish scenario remains valid above the $3,000 invalidation level.

Bearish Case: Failure to break resistance leads to triangle breakdown below $3,150, targeting measured move to $2,800. ETF inflows slowing below weekly supply issuance would remove structural support, potentially triggering liquidation cascades from overleveraged positions. A break below the 200-day moving average at $2,950 would confirm bearish trend reversal.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.